Handout 3

advertisement

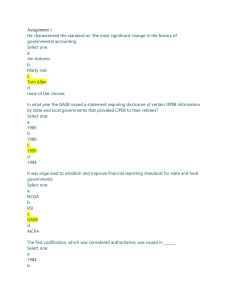

Governmental Accounting Handout 3 Accrual: basis of accounting under which revenues are recorded when earned and expenditures (or expenses) are recorded as soon as they result in liabilities for benefits received, notwithstanding that the receipt of cash or the payment of cash may take place, in whole or in part, in another accounting period. Capital assets: Term used by GASB to include land, improvements to land, easements, buildings, building improvements, vehicles, machinery, equipment, works of art and historical treasures, infrastructure, and all other tangible or intangible assets that are used in operations that have initial useful lives extending beyond a single reporting period. Comprehensive Annual Financial Report (CAFR): A governmental unit’s official annual report prepared and published as a matter of public record. In addition to the basic financial statements (q.v.) and required supplementary information, the CAFR should contain introductory material, schedules to demonstrate compliance, and statistical tables specified in the GASB Codification. Current: term that, applied to budgeting and accounting, designates the operations of the present fiscal period as opposed to past or future periods. One of the Character classifications of expenditures. Financial Accounting Standards Board (FASB): Independent seven-member body designated to set accounting and financial reporting standards for commercial entities and nongovernmental not-for-profit entities. fund accounting: Accounting system organized on the basis of funds, each of which is considered a separate accounting entity. The operations of each fund are accounted for with a separate set of self-balancing accounts that comprise its assets, liabilities, fund equity, revenues, and expenditures, or expenses, as appropriate. Generally Accepted Accounting Principles (GAAP): Body of accounting and financial reporting standards as defined by Rule 203 of the American Institute of Certified Public Accountants (AICPA). “Level A” GAAP is set by the FASB, the GASB, and the FASAB. Governmental Accounting Standards Board (GASB): Independent agency established under the Financial Accounting Foundation in 1984 to set accounting and financial reporting standards for state and local governments and for governmentally related not-for-profit organizations. Liquidity: A measure of the extent to which a person or organization has cash to meet immediate and short-term obligations, or assets that can be quickly converted to do this. Modified accrual: basis of accounting required for use by governmental funds (q.v.) in which revenues are recognized in the period in which they become available and measurable, and expenditures are recognized at the time a liability is incurred except for principal and interest on long-term debt, which are recorded when due.