Government in America Chapter 13 Notes The Budget: The Politics

advertisement

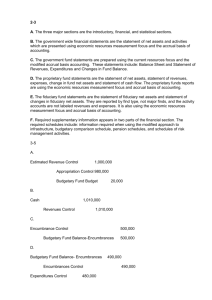

Government in America Chapter 13 Notes The Budget: The Politics of Taxing and Spending 1. Define Budget 2. Define Deficit 3. Define Expenditures 4. Define Revenues 5. What was the deficit run in the US for 2013? 6. How does the government pay for the spending that it does not collect in taxes? _________________________________________________________________________________________________________________________ 13.1 – Federal Revenue and Borrowing 1. Define Income Tax 2. Define Sixteenth Amendment 3. What does it mean to say that the American income tax system is progressive? 4. What is the range of income taxes that Americans pay? 5. What percentage of individuals in 2009 paid no income tax? 6. What percentage of total tax revenues did the richest 10% of Americans pay? 7. What percentage of total tax revenues did the poorest 50% of Americans pay? 8. What are the arguments for the progressive tax? 9. What are the arguments against the progressive tax? 10. What percentage of tax revenues came from corporate taxes in 2012? 11. What are social insurance taxes? 12. How is social insurance tax revenue different than general income tax revenue? 13. What percentage of tax revenues does social insurance tax make up today? 14 How does the government raise the money it needs to cover the deficit? 15 Define National Debt 16 What are some of the concerns about a high national debt? 17. What is the debt ceiling? 18 How is the idea of a balanced budget for the federal government an incorrect comparison to individual’s having a balanced budget? 19 How is the idea of a balanced budget for the federal government an incorrect comparison to business’s having a balanced budget? 20. Define Tax Expenditures 21. What purpose do many tax expenditures serve? 22. Without tax exemptions, by how much would the federal governments’ total tax receipts have increased by in 2013? 23 Some argue that cutting taxes is good for controlling the size and growth of government. What actually happens to government spending following tax cuts? 24. How does the American tax burden compare to the rest of the world? _________________________________________________________________________________________________________________________ 13.2 – Federal Expenditures 1. What has happened, almost without fail, every year to the amount of federal expenditures? 2. What might be some reasons as to why this has happened? 3. What is the military-industrial complex? 4. How has the percentage of the federal budge allocated to national security changed over time? 5. What set of programs make up the largest percentage of the federal budget today? 6. What is income security? 7. Define Social Security Act 8. Define Medicare 9. How does Social Security get its money? 10. How many workers were supporting each Social Security beneficiary when the program was first put into place? 11. How may today? 12. Define Incrementalism 13. Define Uncontrollable Expenditures 14. Define Entitlements _________________________________________________________________________________________________________________________ 13.3 – The Budgetary Process 1. What makes the budgetary process so convoluted? 2. Who are the different “players involved in the budgetary process? 3. Define House Ways and Means Committee 4. Define Senate Finance Committee 5. Define Congressional Budget Office 6. To whom do agencies submit their proposed budgets to, in the hopes of getting the most funding possible? 7. By when does the president need to have submitted a proposed budget to Congress? 8. What is the “power of the purse”? 9. Define Budget Resolution 10. Define Reconciliation 11. Define Authorization Bill 12. Define Appropriations Bill 13. Define Continuing Resolutions _________________________________________________________________________________________________________________________ 13.4 – Understanding the Budget 1. How does equality of suffrage lead to increased government spending (and an increased size of government)? 2. How do wealthy individuals and large corporations encourage a large government? 3. How do American taxes and government spending compare to almost all other democracies with developed economies? 4. Ultimately, what is it that results in an unbalanced budget? 5. How has the budgetary process acted as a limit on the size of government?