2-3 A. The three major sections are the introductory, financial, and

advertisement

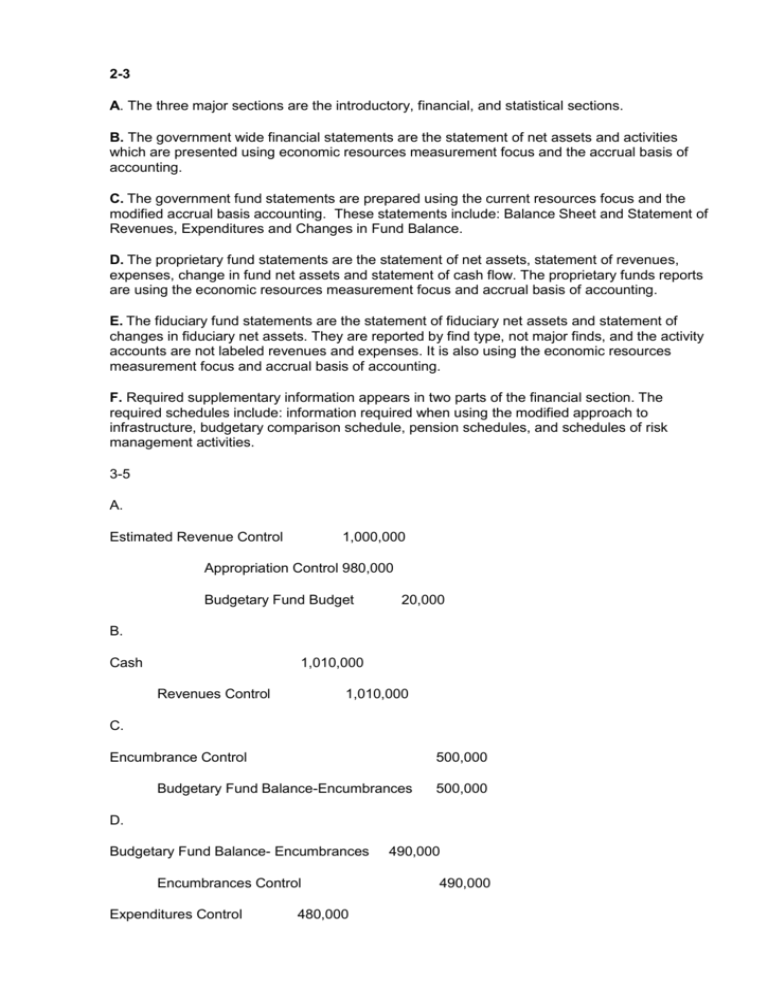

2-3 A. The three major sections are the introductory, financial, and statistical sections. B. The government wide financial statements are the statement of net assets and activities which are presented using economic resources measurement focus and the accrual basis of accounting. C. The government fund statements are prepared using the current resources focus and the modified accrual basis accounting. These statements include: Balance Sheet and Statement of Revenues, Expenditures and Changes in Fund Balance. D. The proprietary fund statements are the statement of net assets, statement of revenues, expenses, change in fund net assets and statement of cash flow. The proprietary funds reports are using the economic resources measurement focus and accrual basis of accounting. E. The fiduciary fund statements are the statement of fiduciary net assets and statement of changes in fiduciary net assets. They are reported by find type, not major finds, and the activity accounts are not labeled revenues and expenses. It is also using the economic resources measurement focus and accrual basis of accounting. F. Required supplementary information appears in two parts of the financial section. The required schedules include: information required when using the modified approach to infrastructure, budgetary comparison schedule, pension schedules, and schedules of risk management activities. 3-5 A. Estimated Revenue Control 1,000,000 Appropriation Control 980,000 Budgetary Fund Budget 20,000 B. Cash 1,010,000 Revenues Control 1,010,000 C. Encumbrance Control 500,000 Budgetary Fund Balance-Encumbrances 500,000 D. Budgetary Fund Balance- Encumbrances Encumbrances Control Expenditures Control 480,000 490,000 490,000 Account Payable 480,000 E. Expenditures Control 460,000 Account Payable 460,000 F. Account Payable 940,000 Cash 940,000 3-10-(A) CITY OF VIENNA Budgetary comparison schedule General Fund for the year ended December 31, 2012 Budgetary Amounts actual amounts variance with final budget ( Budgetary Basis) positive/ (negative) original final 3,200,000 3,300,000 3,400,000 100,000 licenses 900,000 900,000 898,000 (2,000) intergovernmental 500,000 500,000 500,000 0 miscellaneous 100,000 104,000 105,000 1,000 total revenues 4,700,000 4,804,000 4,903,000 99,000 950,000 940,000 925,000 15,000 parks 2,500,000 2,500,000 2,400,000 100,000 health & welfare 1,200,000 1,204,000 1,150,000 54,000 total expenditures & Encumbrances 4,650,000 4,644,000 4,475,000 169,000 50,000 160,000 428,000 268,000 Fund balance- beginning 332,000 350,000 350,000 0 Fund balance- ending 382,000 510,000 778,000 268,000 Revenues: taxes Expenditures & Encumbrances general government Net change in fund balance 3-10-(B) General Ledger Debits Budgetary Fund Balance Estimated Revenues Control Appropriations Control Credits 104,000 6,000 110,000 subsidiary ledger Debits credits Revenues Ledger: Tax revenues Miscellaneous Revenues 100,000 4,000 Appropriation Ledger: General Government Health & Welfare 10,000 4,000 Reference: Copley, P.A. (2011). Essentials of Accounting for Governmental and Not-for-Profit Organizations. (10th ed.). Boston: McGraw-Hill Irwin. ISBN: 9780073527055