Essentials of Accounting for

Governmental and

Not-for-Profit Organizations

Chapter 3

Budgetary Accounting for the

General and Special Revenue

Funds

McGraw-Hill/Irwin

Copyright © 2008 by The McGraw-Hill Companies, Inc. All rights reserved.

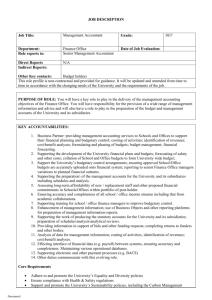

Overview of Chapter 3

Importance of budgets in government

accounting

Recording the budget in the accounts

Overview of property taxes

Interfund transactions and other financing

sources

3-2

Importance of Budgets

Net income is NOT a good measure of

government effectiveness

Excess of revenue over expenditure does NOT

mean success, but indicates whether the funds

received are in excess of the funds expended

Since the funds received are often the result of

nonexchange transactions, Tax Revenues are not

equivalent to Sales as a measure of success in the

marketplace

3-3

What Is the Budget?

A budget is a financial plan submitted

to the appropriate body for approval

Once approved, budgets carry the

status of law

When voted upon, an appropriation act

gives the legal authority to spend and

generally sets the maximum limit for

spending

3-4

Importance of Budget Reporting

The primary means of financial control by

the government is the budget

The financial report should answer the question,

“Did the government use its funds as promised?”

Budget amounts are incorporated in accounting

records of the General Fund and special revenue

funds to provide information that will keep the

spending within the legal limits

3-5

Uses of Budgets

Governments must adopt an annual budget

General funds and Special Revenue funds will

have separate budgets. Separate budgets are

optional for other governmental funds and are

not used for proprietary and fiduciary funds.

Budgetary accounting principles are the same

for any governmental type fund which adopts

an annual budget

3-6

The General Process of Putting

Together a Budget

Plan the expected inflows

Plan the expected outflows

Project revenues based on past history, economic models,

etc

Ask departments for their projected needs

Balance the inflows and the outflows

Look for places to increase revenues or to cut spending

Governments may also borrow or use accumulated

surpluses to balance inflows and outflows

3-7

Budgetary Accounting –

New Account Titles

Estimated Revenues

Appropriations

Budgeted spending -- credit balance

Encumbrances

Budgeted inflows -- debit balance

Commitments (e.g. purchase orders) outstanding -debit balance

Reserve for Encumbrances

Restriction on fund balance -- credit balance

3-8

Recording the Budget

Assume $1,000,000 of revenues are budget along

with $950,000 of estimated expenditures

The budget entry would be

Estimated Revenues 1,000,000

Appropriations

Budgetary Fund Balance

950,000

50,000

Alternatively, estimated revenues and appropriations could

be recorded in separate entries

3-9

Incorporating Other Financing Sources

and Uses in Budget Entry

Assume a city budgets property tax revenues of $2,000,000;

bond proceeds of $1,000,000; expenditures of $2,800,000;

and a transfer to another fund of $100,000

The budget entry would be

Estimated Revenues

2,000,000

Estimated Other Financing Sources 1,000,000

Appropriations

Estimated Other Financing Uses

Budgetary Fund Balance

2,800,000

100,000

100,000

3-10

Why Record Encumbrances?

In business accounting, orders are not

entered into the general ledger

Governments recognize that an

outstanding order will turn into an

expenditure and a liability when the goods

arrive

To prevent over-spending outstanding

orders are entered into the books

3-11

Recording Outstanding Orders

Place an order for $150,000 which consists of three

mini-buses costing $50,000 each. Recorded as:

Encumbrances

150,000

Reserve for Encumbrances

150,000

Assume two of the buses arrive, but with freight, they

cost $102,000 instead of $100,000.

First, reverse a part of the encumbrances:

Reserve for Encumbrances

Encumbrances

100,000

100,000

Second, record the actual amount of expenditure:

Expenditure

Accounts Payable

102,000

102,000

3-12

Budget Revisions

Budget revisions may be

necessary during the year

due to changes in revenue

projections or operating

conditions … for example,

electricity price increases,

decrease in sales taxes

due to low consumer

spending

Budget revisions usually

are taken back to the

appropriate legislative

body for approval,

although some

jurisdictions may allow

some percentage of the

budget to be transferred

between accounts

3-13

Budgetary Comparison Schedule

Both the original and the final adjusted

budget is shown

The revised appropriations are compared to

the Actual Expenditures for the current

period plus Outstanding Encumbrances

A variance column is typically shown, but is

optional

3-14

Budgetary Comparison Schedule

The actual column

should use the basis of

accounting assumed in

the budget. This may

be different than

GAAP basis

Another schedule will

reconcile the ‘actual’

figures on the

budgetary vs. GAAP

basis

3-15

Classification of Inflows and

Outflows on Budget Schedule

Revenues are classified by source

Where the money came from: taxes, licenses and

permits, charges for service, etc

May be subdivided further such as by type of tax,

sometimes shown in separate schedule

Expenditures and Encumbrances may be

classified by

function, program, department, activity, character, or

object

3-16

Outflow Classifications

Character groupings are always: CURRENT,

CAPITAL OUTLAY, and DEBT SERVICE

Current may be classified by function: General

government, public safety, streets and highways

Public safety could be subdivided by department: Police

and fire

Police could be subdivided further by activity: Traffic and

drug enforcement

Activities in the traffic area could be divided into objects of

expenditure: Policeman’s salary, gas for automobiles

3-17

Property/ad valorem Taxes

Ad valorem taxes are based on the

assessed value of an underlying asset and

are a major type of tax, particularly at the

local government level

All real property bought and sold is typically

registered at the county courthouse and

subject to property tax

The tax is based on the tax rate, often

expressed as a millage rate, times the

assessed value

3-18

Millage and Assessed Value

A mill is

Appraised value

1/1000 of a dollar, or 1/10 of a penny

In other words, $.001 times some amount

Is calculated based on size of home, lot, etc.

Ideally, should approximate market value

Assessed value is usually less than

appraised value … often around 20-30% of

appraised value

3-19

Property Tax Calculation

Assume a home has an appraised

value of $100,000; 20% assessed

value rate; tax rate is 45 mills

Assessed value:

$100,000 X .20 = $20,000

Tax amount would be:

45 mills X 20 thousands = $900

Or, $20,000 X .045 = $900

3-20

How Is the Millage Rate Set?

In some areas all property taxes are

subject to a direct vote

In other areas the property tax is adjusted

each year (subject to possible maximum

amounts) to meet expenditure needs

Illustration 3-5 presents a calculation to

determine the property taxes needed to

balance the budget

3-21