Principles of Accounting MBA 1st_2011-13

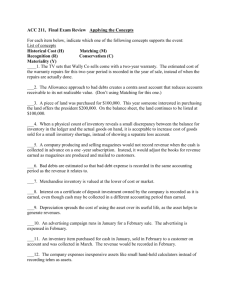

advertisement

INSTITUTE OF BUSINESS & MANAGEMENT SCIENCE/CS KPK AGRICULTURAL UNIVERSITY PESHAWAR Programme Course Name Course Code Course Hours Total Weeks Total Hours : : : : : : MBA-I Principles of Accounting MBA-702 03 16 48 Course Objectives Today everyone needs a basic understanding of accounting information especially those students who are planning careers in business. The students will work with accounting information and will use it in managing their personal financial activities. Using accounting information is simply a part of everybody life. This course introduces students to actual accounting practices techniques. The real focus of the course is uncovering the meaning of accounting information. A major goal of the course is to develop the students abilities to understand accounting information and to use this information in making economic decisions. Week 1: Basic Structure of Accounting Various Accounting Term Career Opportunities in Accounting/Branches of Accounting User/Objectives of Accounting Information. Forms of Business Organization Week 2: Generally Accepted Accounting Principles Specialized Accounting Services Accounting Information and Types of Accounting Information Accounting Systems and Function of Accounting Systems. Week 3: Basic Financial Statement Financial Statement the Starting Point in the Study of Accounting Balance Sheet and its Contents Effect of Business Transaction Upon Accounting Equation & Balance Sheet Week 4: Accounting Cycle Capturing Economic Event Account and Its Classification Rules for Debit & Credit, Accounting Cycles Week 5: Recording and Classification of Business Transactions (Journalizing and Posting Business Transactions to Ledger) Week 6: Running Balance Form Account Trial Balance Week 7: Accounting Cycle Capturing Economic Event Nature of Net Income and Net Loss, Revenue, Expenses & with Draw. Income Statement & Statement of Owner Equity, Balance Sheet. Realization and Matching Principles in Revenue Expense Records Week 8: Accounting Cycle: Preparing An Annual Report Adjustment and Its Types & Need. Unearned Revenue, Unrecorded Expenses & Revenue Un Expired Cost and Closing Entries Week 9: Financial Assets. Bank Statement Reconciling the Bank Statement Account Receivable & Interest Revenue Week 10: Form of Business Organization Characteristics of Sole Proprietorship, Partnership and Corporation Allocate Partnership Net Income or Loss Among the Partner. Accounts for Issue of Shares Accounts for Dividend and Statement of Retained Earning. Week 11: Plant Assets and Depreciation Categories of Plant Asset, Acquisition of Plant Asset Natural Resources & Disposal of Asset, Depreciation and Its Methods and Causes. Week 12: Unit of Output Method Straight Line Methods Declining Balance Method Week 13: Double Declining Balance Method 150% Declining Balance Method MACRS Method Week 14: Inventory and Cost of Goods Sold Specific Identification Cost Flow Assumption, Gross Profit and Retail Method, Inventory Turnover Rate. Week 15: Perpetual & Periodical Inventory System Cost of Good Sold Using Specific Identification Average Cost FIFO & LIFO. Methods Week 16: Measuring The Cash Flow Statement Statement of Cash Flow Classification of Cash Flow Statement Recommended Books 1. 1. ACCOUNTING THE BASIS FOR BUSINESS DECISION --- Meig & Meigs 11th Edition. The McGraw-Hill. Companies years 1996. FINANCIAL ACCOUNTING BELVERD ENEEDLESS --- J.R. 5th Edition, Mifflin Company 1995.