Sample Quiz #7 Questions – based on Chapter 14

advertisement

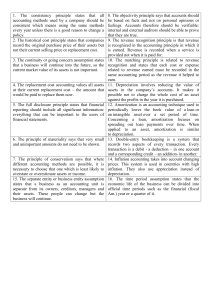

Sample Quiz #7 Questions – based on Chapter 14 1. If the tax rate is 32%, what is the after tax impact on income of a short term business transaction with cash inflows of $35,000 and cash outflows of $26,000. All cash flows are taxation relevant. A. B. C. D. $2,880 $9,000 $35,000 $6,120 2. If A. B. C. D. $2,500 $1,780 $3,750 $2,670 the tax rate is 40%, what is the present value of the tax savings from the depreciation tax shield in the third year of the life of an asset being depreciated using the straight-line method with no deduction for salvage value as is typical of tax depreciation? The cost of the asset is $50,000. The asset has an economic life of 8 years. The time value of money rate is 12%. A present value table is provided for use in answering this question. === Present value factors for 12 % rate: time point 0 1 2 3 4 5 6 7 8 9 10 Q# Answer 5/29/2016 1. D single amount discount 1.000 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 2. B page 1 of 1