4. Accounting for Fixed Assets (AS 10).

advertisement

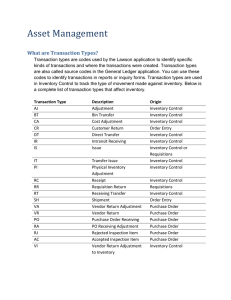

Auditing of Fixed Assets A perspective for beginners Vinod Reddy, SDUCA During the initial days of your articleship, you will be asked to handle different assignments with wide range of areas in each assignment. I want to share my experiences along with guidance from my team members and seniors to equip beginners with minimum knowledge and information required to handle the work you are assigned with. One common area of any audit is fixed assets. Fixed assets normally constitute a significant portion of the total assets, particularly in a manufacturing enterprise. Audit of fixed assets, therefore, assumes considerable importance. Usually this will be the first thing that you will learn. In this article we will be discussing about the checks you should perform and steps to be followed during checking fixed assets. Before moving to what is to be done, let us note down the basics about fixed assets, their nature, features and their impact on audit procedures. By their very nature, fixed assets are turned over much slower than current assets. Normally, fixed assets are carried over from year to year. Since fixed assets are high value items, their acquisition is more effectively controlled. The control aspect assumes special significance where fixed assets are self-constructed. In an inflationary situation, normally, the book values of fixed assets are considerably lower than their replacement values. Internal Controls As an auditor we should review the system of internal controls in place for fixed assets. Particularly regarding the following: Control over expenditure incurred on fixed assets acquired or self-constructed. Budgeting and reviewing periodically with actual expenditure and authorization are effective methods of implementing these controls. Accountability and utilization controls Records like who is using and responsible a particular asset should be maintained to establish custodianship/ownership. Information and documentation controls Controls that ensure the relevant information and details of the assets available for calculating depreciation, tax calculations, for establishing insurance amount etc., should be kept in place. Understanding the processes In order to verify the physical presence, accounting and documentation of fixed assets, we must understand the policies and processes that were documented and followed in the organization. This is a crucial step in auditing fixed assets as it helps us to get acquainted with the environment and the procedures that the organization follow. Based on this we can plan the type of audit procedures and the depth of checks to be performed. Consult the managers responsible for procuring, accounting and managing the fixed assets. Meet the process owners (if any) for FA. These processes differ from organization to organization. In general, understand the following: The approval matrix; The purchase process and; Accounting process However If we go more detailed, for an ideal organization processes regarding the following steps needs to be understood. Raising the purchase requisition (PR) PR approval Authorized vendors list, their selection and approval process. PO generation PO approval Receipt of invoice Raising GRN GRN approval Invoice approval. Revaluation policy Asset Disposal policy. After the discussion, the process understanding must get approved or accepted from the concerned person from whom we understood. E-mail is a preferred option for this. This is for the purpose of evidence. Physical verification of fixed assets The physical existence of the asset needs to be examined with the relevant records. We should try to reconcile both. Tagging of assets is done in different ways in different organizations. Some large organizations may use barcode technology for tagging of their assets. Some organizations simply paste asset code on the asset. But the ultimate goal of physical verification is: To know whether the assets are really present; Assets were not misappropriated; Assets are tracked; Fixed asset register is maintained properly. We may not verify the existence of few assets due to many reasons like, the assets are continuously in use or they might be in such a place where we cannot go and verify. Some assets may be inside other assets which we cannot verify through naked eye. In such situations, an auditor should apply professional skepticism and judgement to come on a conclusion. Any differences and discrepancies between the recorded quantity and the actual quantity should be brought to the knowledge of management. If any previous incidents were recorded, we should check how they were dealt with. Verification of records The opening balances of the fixed assets should be verified from the financial statements or the FA register. Acquisition of new assets or any improvements to existing assets must be checked with supporting documents. Following details must be captured from the documents for the ease of checking: Invoice details such as amount, date, quantity, invoice received date, approval etc. PO date, amount, quantity, vendor, approval etc. Respective PR to the PO. GRN date, quantity approval and accounting date. Capitalization date. We should verify whether the process in the fixed asset policy of followed or not. Any deviations from the policy and process specified must be noted and evidences for them must be obtained. Ensure that the assets are procured from approved vendors and through approved process. Any exceptions must have been authorized by the appropriate personnel. Quantity recorded in the invoice, quantity recorded in GRN and the quantity accounted must be verified. Capitalization date must be verified. We should examine how the value of the asset has been arrived at. The provisions stated in AS 10 must have been followed. “The cost of an item of fixed asset comprises its purchase price, including import duties and other non-refundable taxes or levies and any directly attributable cost of bringing the asset to its working condition for its intended use; any trade discounts and rebates are deducted in arriving at the purchase price. Examples of directly attributable costs are: (i) site preparation; (ii) initial delivery and handling costs; (iii) installation cost, such as special foundations for plant; and (iv) professional fees, for example fees of architects and engineers” Depreciation must be checked. It is better if we calculate depreciation again according to the statute and reconcile with the depreciation already provided. In the wake of new laws like Companies act, 2013 and IndAS, one must ensure that the transitional provisions are followed correctly to avoid any non-compliance. In respect of fixed assets retired, i.e., destroyed, scrapped or sold, we should examine (a) Whether the retirements have been properly authorized and appropriate procedures for invitation of quotations have been followed wherever applicable; (b) Whether the assets and depreciation accounts have been properly adjusted; (c) Whether the sale proceeds, if any, have been fully accounted for; and (d) Whether the resulting gains or losses, if material, have been properly adjusted and disclosed in the Profit and Loss Account. Few important points to ponder: Documentation is the most important aspect of any audit. Work not documented is work not done. Ensure that the completeness, accuracy and validity of any transaction or an item is verified. Concentrate on such issues which may affect the interests of the organization and financial statements substantially. Try to frequently communicate with team members and create a rapport with them in order to get you guided and finish the assignment in time. List of publications issued by the Institute of Chartered Accountants of India, which indicate the generally accepted bases of accounting of fixed assets. A. Accounting Standards 1. Disclosure of Accounting Policies (AS 1). 2. Prior Period and Extraordinary Items and Changes in Accounting Policies (AS 5)4. 3. Depreciation Accounting (AS 6). 4. Accounting for Fixed Assets (AS 10). B. Companies act, 2013 1. Schedule II C. Other Publications 1. Guidance Note on Treatment of Expenditure during Construction Period. 2. Statement on Accounting for Foreign Currency Translation 5. 3. Guidance Note on Accounting Treatment of Interest on Deferred Payments. 4. Guidance Note on Accounting for Capital Based Grants 6. 5. Guidance Note on Treatment of Reserves Created on Revaluation of Fixed Assets. 6. Guidance Notes on Provision for Depreciation 7. Guidance Note on Mode of Valuation of Fixed Assets.