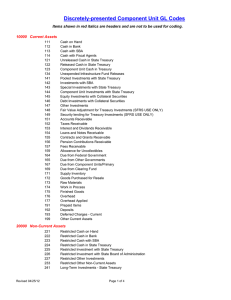

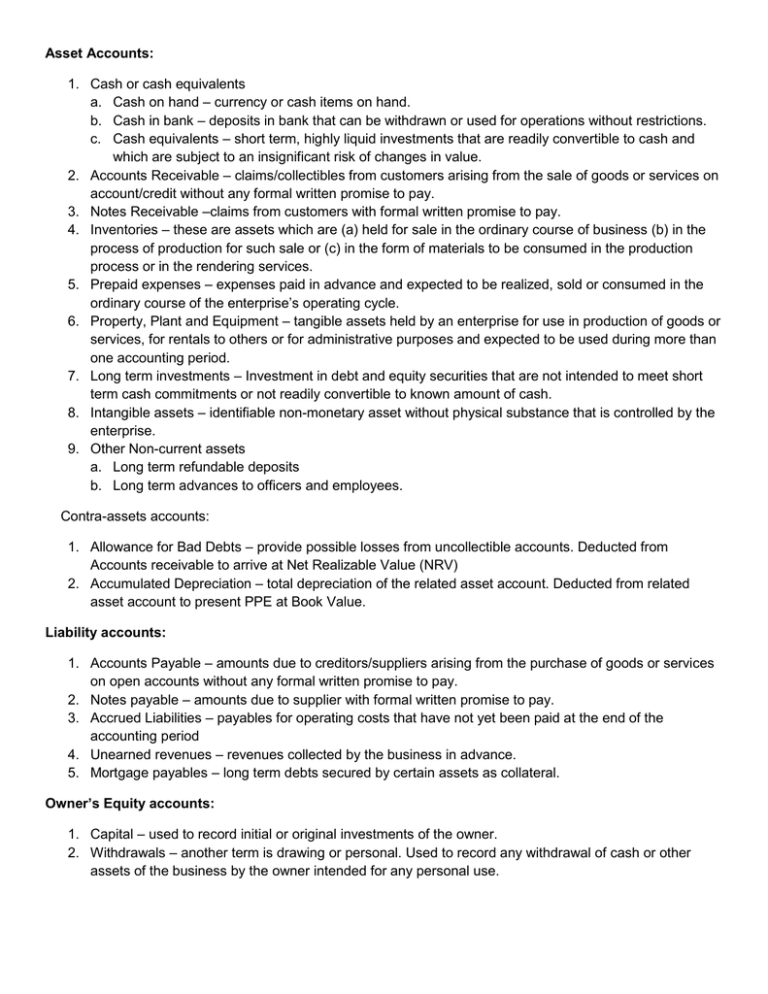

Example of accounts

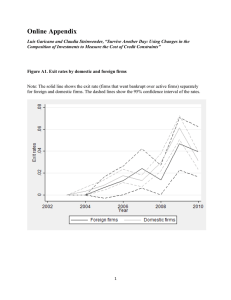

advertisement

Asset Accounts: 1. Cash or cash equivalents a. Cash on hand – currency or cash items on hand. b. Cash in bank – deposits in bank that can be withdrawn or used for operations without restrictions. c. Cash equivalents – short term, highly liquid investments that are readily convertible to cash and which are subject to an insignificant risk of changes in value. 2. Accounts Receivable – claims/collectibles from customers arising from the sale of goods or services on account/credit without any formal written promise to pay. 3. Notes Receivable –claims from customers with formal written promise to pay. 4. Inventories – these are assets which are (a) held for sale in the ordinary course of business (b) in the process of production for such sale or (c) in the form of materials to be consumed in the production process or in the rendering services. 5. Prepaid expenses – expenses paid in advance and expected to be realized, sold or consumed in the ordinary course of the enterprise’s operating cycle. 6. Property, Plant and Equipment – tangible assets held by an enterprise for use in production of goods or services, for rentals to others or for administrative purposes and expected to be used during more than one accounting period. 7. Long term investments – Investment in debt and equity securities that are not intended to meet short term cash commitments or not readily convertible to known amount of cash. 8. Intangible assets – identifiable non-monetary asset without physical substance that is controlled by the enterprise. 9. Other Non-current assets a. Long term refundable deposits b. Long term advances to officers and employees. Contra-assets accounts: 1. Allowance for Bad Debts – provide possible losses from uncollectible accounts. Deducted from Accounts receivable to arrive at Net Realizable Value (NRV) 2. Accumulated Depreciation – total depreciation of the related asset account. Deducted from related asset account to present PPE at Book Value. Liability accounts: 1. Accounts Payable – amounts due to creditors/suppliers arising from the purchase of goods or services on open accounts without any formal written promise to pay. 2. Notes payable – amounts due to supplier with formal written promise to pay. 3. Accrued Liabilities – payables for operating costs that have not yet been paid at the end of the accounting period 4. Unearned revenues – revenues collected by the business in advance. 5. Mortgage payables – long term debts secured by certain assets as collateral. Owner’s Equity accounts: 1. Capital – used to record initial or original investments of the owner. 2. Withdrawals – another term is drawing or personal. Used to record any withdrawal of cash or other assets of the business by the owner intended for any personal use. Income accounts: 1. Sales or Revenue from Sales – selling goods or merchandise 2. Service income, Professional fees – rendering services Expense accounts: 1. Selling Expenses – incurred with connection with selling function a. Sales, salaries and commissions b. Store supplies c. Depreciation of store equipment d. Advertising e. Freight out 2. General Administrative expense – incurred in connection with administrative function a. Office salaries b. Telephone c. Depreciation of Office Equipment, Furniture and Fixtures