Management's Discussion & Analysis

advertisement

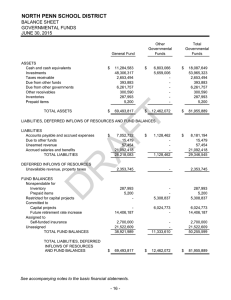

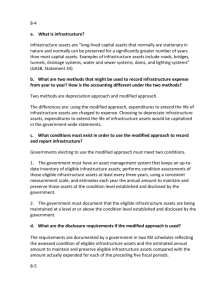

MANAGEMENT’S DISCUSSION & ANALYSIS NMASBO Fall Conference 2012 Taos, New Mexico Presented by Leslie Smith, Retired Business Manager GASB 34 – Financial Reporting Standards In June 1999, the Governmental Accounting Standards Board (GASB) established new financial reporting standards that for state and local governments to report their financial results. Public Schools are required to follow these standards. Overview of the Financial Statements This report consists of three parts Management’s Discussion & Analysis Basic Financial Statements Government-wide financial statements which provide long and short term information about the school’s overall financial status Fund financial statements that focus on individual parts of the school district operations in more detail Required Supplementary Information & Notes What Is the M D & A? The MD&A is a nontechnical presentation of information contained the district’s audited Financial Statements. This portion is unaudited. The discussion Offers insights on the district’s overall financial standing Explains the reasons for significant change in financial position relative to the last reporting period, and Identifies current factors with the potential to influence the district’s future financial position May contain other relevant information regarding the district Consider These Topics for Discussion Mission and Organizational Structure Discussion and Analysis of the Financial Statements Financial Results Budgetary Integrity Current Demands Risks, Uncertainties, Events, Conditions, and Trends Future Effects of Current Demands, Risks, Uncertainties, Events, Conditions and Trends Understanding Financial Reporting Discussion and Analysis of Systems, Controls and Legal Compliance Discussion and Analysis of Performance Model MD & A Template in this presentation is from a school district in South Dakota Overview of Financial Statements Financial Analysis Explanation of Significant Differences Governmental & Business-Type Activities Governmental Activities Financial Analysis of the School District’s Funds General Fund Budgetary Highlights Capital Asset Administration Long-term Debt Economic Factors Preparation Process The preparation of MD&A requires significant coordination among district personnel to Analyze, identify and disclose the reasons for changes in the financial statements, Analyze relevant global and local economic issues, and discuss future financial plans with district management. Use charts, graphs, and tables to enhance the understandability of the information presented. Government-wide Financial Statements The government-wide statements include a statement of net assets and a statement of activities. These statements focus on the school district as a whole and report all assets (including infrastructure), liabilities, revenues, and expenses of the school district. These statements follow the flow of economic resources method using full accrual basis accounting. Accrual accounting means that transactions are recorded when they occur, rather than when cash is disbursed or received. Statement of Net Assets The statement of net assets includes the district’s assets and liabilities at a given point in time. Net assets are simply the difference between assets and liabilities. All financial and capital resources are reported. Capital assets that are being or have been depreciated are reported at historical cost (or estimated historical cost, at transition), less accumulated depreciation. Statement of Activities The statement of activities reports school district operating revenues and expenses. Expenses are reported by function and program, such as transportation, administration, regular & special education and any revenue (except taxes) attributable to that function or program is reported with the function or program and net expense or revenue presented. A review of this statement will indicate which programs contribute to and which draw from general revenues. Annual depreciation expense is generally reported with each program or function. Fund Financial Statements Fund financial statements provide more detailed information about the school district’s most significant funds – not the district as a whole. Funds are used only in governmental accounting to keep track of certain sources of funding and spending for a particular purpose. Measurement focus, and basis of accounting of funds did not change with GASB 34. Fund accounting continues alongside the governmentwide statements. Reconciliation of the fund statements with the government-wide statements is required. Fund Financial Statements The school district’s basic activities are reported in the “governmental fund” statements. These fund statements are prepared using the current financial resources measurement focus and a modified, as opposed to full, accrual basis of accounting. Governmental funds do not report capital assets, and therefore do not have depreciation expense. Further, they do not show long-term debt. Analysis of Fund Financial Statements An analysis of balances and transactions of individual funds - The analysis should address the reasons for significant changes in fund balances or fund net assets and whether restriction, commitments, or other limitations significantly affect the availability of fund resources for future use. An analysis of significant variations between original and final budget amounts and between final budget amounts and actual budget results for the general fund (or its equivalent) - The analysis should include any currently known reasons for those variations that are expected to have a significant effect on future services or liquidity. Comprehensive Variance Analysis In order to facilitate the identification of significant changes and determining the reasons for such changes, the comprehensive variance analysis must include the following information: Statement of Net Assets: Current year vs. prior year balances – dollar and percent changes Balances for the current year and two preceding years – comparison of balances as a percentage of total assets (for assets) and as a percentage of total net assets (for liabilities and net assets) for each year. Comprehensive Variance Analysis Statement of Revenues, Expenses, and Changes in Net Assets: Current year vs. prior year balances – dollar and percent changes Current year vs. prior year balances – dollar and percent changes for expenses by natural classification General Fund Budgetary Highlights Any significant budget adjustments made during the year Change in Unit Value Change in T & E Index Increase or Decrease in Student Membership Reduction in force Hiring freeze Other Topics Capital Asset Administration Long Term Debt Economic Factors and Next Year’s Budgets Contacting the District’s Financial Management Questions?? Thank you for your attendance! Contact Information Leslie Smith dba gFund Solutions 575 420-6269