the presentation

advertisement

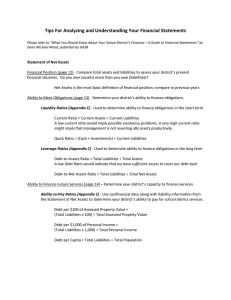

Financial Management A basic guide to creating and analyzing financial statements By: Husain AlQaseer February 1, 2014 What should you know about financial statements? There are two basic concepts you need to focus on with regards to financial statements: How to create your financial statements: Creating your financial statements helps you record your company’s performance over time. How to analyze your financial statements: Analyzing your financial statements helps you better understand your company’s dynamics, how to improve it, and how to compare it to other similar businesses Creating your financial statements There are three basic statements in a set of financial statements: Income (profit and loss) statement – shows your revenues and expenses over a period of time Balance sheet – shows a snapshot of the business as at a specific point in time Cash flow statement – shows the movement of cash over a period of time Income statement An income statement, also known as a profit and loss statement, has two basic sections: Revenues: Consist of all the income you make from you main operations during a period of time Expenses: All expenses contributing to creating your revenues during a period of time Profits = Revenues – Expenses Income statement Balance sheet A balance sheet presents a snapshot of the business at a specific point in time There are three main parts in a balance sheet Assets: Consist of all assets owned by the business. This will include items such as cash and fixed assets (cars, machines, etc). Liabilities: All liabilities or debts owed by the business. This will include items such as bank loans Shareholders’ Equity: This is what the shareholders own in the business. The basic balance sheet formula is: Assets = Liabilities + Shareholders’ Equity Balance sheet Cash flow statement A cash flow statement shows the flow of cash through a business during a period of time There are three main area of cash movement: Cash flow from operations: This shows the movement of cash from/to the main operations of a business Cash flow from investing: This shows the movement of cash from/to investments Cash flow from financing: This shows the movement of cash from/to the capital of the business Cash flow statement Analyzing your financial statements One of the most important aspects of financial management is using your financial statements to better understand your business Below are some examples of useful analysis equations: Net profit margin: This shows you the percentage of your revenues that turn into profits Debt to assets: This shows you what percentage of your assets is financed by debt Let’s have a look at the financial statements to better understand how you can analyze your business Income statement Balance sheet Cash flow statement Questions?