silo.tips chapter-9-financial-reporting-of-state-and-local-governments

advertisement

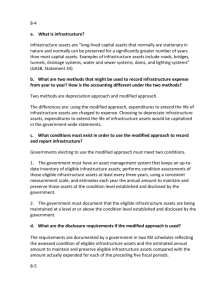

Chapter 9 Financial Reporting of State and Local Governments Dr. Chula King The University of West Florida Student Learning Outcomes Describe the GASBS 34 reporting model. Explain the key concepts and terms used in describing the governmental reporting entity. Apply the GASB criteria used to determine whether a potential component unit should be included in the reporting entity, and the manner of reporting component units. 2 1 Student Learning Outcomes Identify and describe the contents of a Comprehensive Annual Financial Report (CAFR). Identify and explain contemporary financial reporting issues. 3 Reporting Entity The reporting entity consists of the primary government and all component units for which the primary government is financially accountable Most component units are reported by discrete (separate column) presentation, rather than “blending” the component unit’s financial information in the same fund columns of the primary government. 4 2 Reporting Entity A primary government is financially accountable for another organization if it appoints a voting majority of the organization’s governing board and it can either • impose its will on that organization or • potentially provide specific financial benefits to or impose a financial burden on the other organization. 5 Reporting Entity Even if it does not appoint a majority of an organization’s governing board, the primary government (PG) is financially accountable for another organization if either: • The other organization is fiscally dependent on the PG, or • It holds economic resources entirely or almost entirely for the PG, the PG is entitled to or has the ability to access a majority of the economic resources being held by the other organization, and the resources being held are significant to the PG 6 3 Financial Reports Citizens and others (e.g., creditors and legislators) have a need for periodic reports on where the government got its money and how it was spent Interim financial reports are needed as well as annual reports. 7 Comprehensive Annual Financial Report Introductory section Financial section Statistical section 8 4 Comprehensive Annual Financial Report Introductory Section • Title page • Contents page • Letter of transmittal • Other (as desired by management) 9 Comprehensive Annual Financial Report Financial Section • Auditor’s report • MD&A • Basic Financial Statements • Required Supplementary Information (RSI) other than MD&A • Combining and individual fund financial statements 10 5 Comprehensive Annual Financial Report Statistical Section • Tables and charts showing multiple - year trends in financial and socioeconomic information 11 General Purpose External Financial Reports Management’s discussion and analysis Government-wide financial statements Fund financial statements Notes to the financial statements Required supplementary information (other than MD&A) 12 6 GASBS 34 Reporting Model GOVERNMENT-WIDE Government-Wide Financial Statements Primary Government Governmental Activities BusinessType Activities Total Discretely Presented Component Units Statement of Net Assets Statement of Activities FUNDS Governmental Funds Fund Financial Statements General Fund Proprietary Funds Special Debt Capital Revenue Service Projects Permanent Fund Fund Fund Funds Balance Sheet Statement of Revenues, Expenditures, and Changes in Fund Balance Internal Service Enterprise Funds Funds Statement of Net Assets Statement of Revenues, Expenses and Changes in Fund Net Assets Statement of Cash Flows Fiduciary Funds Agency Funds Trust Funds Statement of Fiduciary Net Assets Statement of Changes in Fiduciary Net Assets 13 Basic Financial Statements Government-wide Financial Statements • • • • Statement of Net Assets (Illustrations 1-4 and 9-4) Statement of Activities (Illustrations 1-5 and 9-5) Fund Financial Statements (see next slide) Notes to the Financial Statements 14 7 Fund Financial Statements Balance Sheet- Governmental Funds (Illustrations -1 6 and 9- 6) Statement of Revenues, Expenditures, and Changes in Fund Balances- Governmental Funds (Illustrations -1 7 and 9- 6) with reconciliation (Ill. -1 8) Statement of Net Assets - Proprietary Funds (Ill.1- 9) Statement of Revenues, Expenses, and Changes in Fund Net Assets- Proprietary Funds (Ill. 1- 10) Statement of Cash Flows- Proprietary Funds (Ill. -1 11) Statement of Fiduciary Net Assets (Ill. -1 12) Statement of Changes in Fiduciary Net Assets (Ill. -1 13) 15 GASB 34 Reporting Model Government-wide financial statements: • Entity - wide perspective • Long - term focus on operational accountability • All governmental and business- type activities of the government as a whole are reported on the accrual basis—essentially same as for- profit entities 16 8 GASB 34 Reporting Model Fund financial statements: • Short-term focus on fiscal accountability • Most activities of the government reported on the modified accrual basis; business-type activities essentially the same as for-profit entities 17 GASB 34 Reporting Model Preparation of the government-wide financial statements at year-end requires: • Adjusting entries to record annual depreciation and accrual of interest receivable and payable. • Entries to close all program and general revenues and expenses. • Entries to reclassify, as necessary, Net AssetsUnrestricted to Net Assets- Restricted (various purposes) and Net Assets- Invested in Capital Assets, Net of Related Debt 18 9 Current Issues-Service Efforts and Accomplishments Focused on measuring and reporting on the efficient and effective uses of government resources Three categories of measures: • Measures of service efforts (input measures) • Measures of service accomplishments (output and outcome measures) • Measures that relate efforts to accomplishments (efficiency and effectiveness measures) 19 Current Issues – Popular Reporting Many accounting professionals, politicians, and others believe current governmental financial statements are excessively complex and not understandable except to those knowledgeable about governmental accounting Some governments have begun to experiment with simplified, summary reports called “popular reports” Graphical presentation is used to a greater extent than traditional financial statements 20 10 Implementation of GASB 34 Reporting Model The GASBS 34 reporting model is a result of NCGA and GASB Standards that have evolved since the 1930s and reflects the changing needs of information users. Until software vendors modify their software to meet the financial reporting requirements of the GASBS 34 model, most governments are expected to continue to use their current fund accounting software systems, then prepare reclassification spread sheets at year-end in order to prepare the full accrual government-wide financial statements. 21 Concluding Comments The GASBS 34 reporting model requires each financial reporting entity to prepare as a minimum: MD&A; Basic financial statements (government-wide and fund); Notes to the financial statements; Required supplementary information, other than MD&A. In addition, each reporting entity is recommended to prepare as its official financial record a comprehensive annual financial report (CAFR). As the financial needs of users continues to change, so will financial reporting standards. 22 11 The Next Step Chapter 9 City of Smithville simulation. Due no later than midnight CDT, July 10. Chapter 9 CARF assignment. Due no later than midnight, CDT, July 10. Problems 9-2, 9-3, 9-4, 9-5, and 9-6. 23 12