Strath Haven High School Syllabus

Course Title (Course Number):

I.

Business Math (3540)

Grade: 11 -12

Course Description/Overview

This course introduces the student to the mathematics involved in business administration. It provides a

foundation for buisness literacy for all students. The course will cover fundamental principles and vocabulary of

accounting, highlighting financial statement preparation and interpretation according to generally accepted

accounting principles (GAAP). In addition, the course will discuss partnerships, bonds, corporations, cash flow

statements and capital budgeting. Students will be introduced to IRS rules and regulations as applied to a

business. At the completion of the course, the student will understand the mathematical decisions involved in the

operation of a business.

II.

Course Objectives

Understand legal forms of business organizations.

Determine meaning and measurement of risk and return.

Address preparation and evaluation of Financial Statements and Statement of Cash Flows.

Show students methods of calculation and analysis of key financial ratios.

Address present and future value of investments.

Address valuation and characteristics of stocks and bonds.

Understand tax issues related to different business organizations.

Address legal and ethical issues in business operation.

Utilize effective interpersonal skills by working in cooperative groups.

Provide students with realistic decision-making activities that draw on a range of skills and understandings.

Show students the usefulness and importance of mathematical skills and logical reasoning in the operation of a

business.

Utilize effective interpersonal skills by working in cooperative groups.

III.

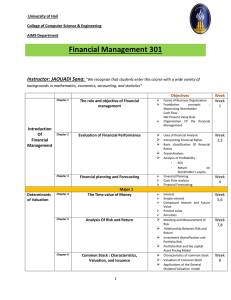

Course Content (Chapter Concepts)

A. The Scope and Environment of Financial Management

1. Key Concepts

Introduction to the Foundations of Financial Management

Financial Markets and Interest Rates

Understanding Financial Statements and Cash Flow

Evaluating a Firm’s Financial Performance

2. Resources

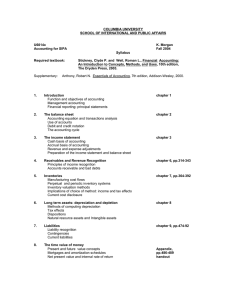

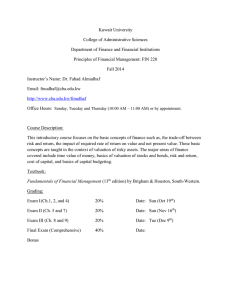

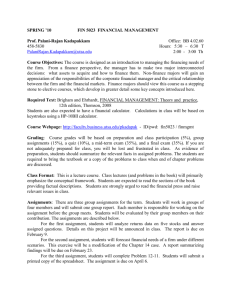

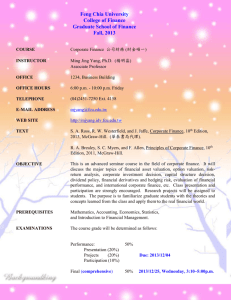

Calculators and Computers, particularly Internet; Financial Papers and Journals; Textbook: Keown, A.J.,

et.al. (2006). Foundations of Finance - The Logic and Practice of Financial Management (5th ed.). New

Jersey: Pearson-Prentice Hall.

B. Valuation of Financial Assets

1. Key Concepts

The Time Value of Money

The Meaning and Measurement of Risk and Return

Valuation and Characteristics of Bonds

Valuation and Characteristics of Stock

2. Resources

See A2.

REV 01/13/07

C. Investment in Long -Term Assets

1. Key Concepts

Capital-Budgeting Techniques and Practice

Cash Flows and Other Topics in Capital Budgeting

Cost of Capital

2. Resources

See A2.

D. Capital Structure and Dividend Policy

1. Key Concepts

Determining the Financial Mix

Dividend Policy and Internal Financing

2. Resources

See A2.

E. Working – Capital Management and International Business Finance

1. Key Concepts

Short-Term Financial Planning

Working-Capital Management

Current Asset Management

International Business Finance

2. Resources

See A2.

IV.

Types of Student Assessments and Evaluations

Quizzes, tests, homework assignments, classroom performance and participation, and projects.

V.

Grading Policy

Grades are based on a point system. Averages are calculated by dividing the total points earned by the student

by the total number of possible points. The school scale is used to determine grades. Final grades are

determined as follows: first quarter (40%), second quarter (40%), and final exam grade (20%).

VI.

Homework

Homework is given a regular basis. Most assignments are due the next day. However, there will be long term

assignments given.

All members of the school community are expected to be respectful of each other. Negative

comments about anyone’s race, nationality, religion, physical appearance or ability, intellectual

capabilities, gender identity, sexual orientation, work ethic, or character are unacceptable and will not

be tolerated. Students are encouraged to discuss any concerns with any adult in the building.

REV 01/13/07