IBM 6014

advertisement

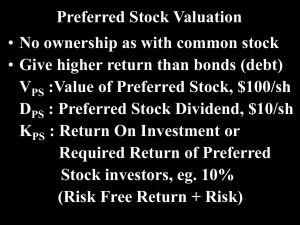

Syllabus and Course Description Fall/Spring Semester of the Academic Year of Fall, 2013 Department/ Institute of Business Course Title:(Chinese) 財務管理 Institute and Management Permanent Course (English) Financial Management IBM 6014 ID Instructor: Chiung-Min Tsai Credits Required/ Elective 3 Credits 3 Required/Elective Required competence or courses that must be previously taken by students: Accounting, Economics Course Descriptions and Objectives: The objective of this course is to give students the capacity to understand the theories and apply the techniques that have been developed in corporate finance. The course touches on all areas of corporate finance, including the business objective vs. the agent problem, ratio analysis, the trade-off between risk and expected return, investment valuation, the financing decision, and the dividend policy. All these things fitting together leads to final firm valuation. This course will also cover issues related to international financial market and management. The theoretical and empirical topics include balance of payment, exchange rate determination, how to manage the currency risk. The course will help students to build up the ability to deal with today’s global environment and the challenges. Textbooks (please specify titles, authors, publishers and year of publication) Ross, S.A., R.W. Westerfield, J. Jaffe, Annotated by Cheng-kun Kuo (2013) Corporate Finance, McGraw-Hill International Editions, 10th ed. 華泰文化。 References:Statistics for Business and Financial Economics by Cheng-few Lee, John Lee and Alice C. Lee, World Scientific Publishing, 2nd edition, 2000. 華泰 Course Contents Topics Part1 Outlines 1. Introduction to Introduc Corporate Finance and tion and Financial Statement Valuatio Analysis n 2. Investment and Stock Valuation Hours Lectures 9 12 Part2 Risk 3. Risk and Return 6 Part3 Cost of Capital 4. Cost of Capital, and Capital Budgeting 5. Dividend Policy 9 6 Demonstration Remarks Experiment Othersi Part4 Hedging 6. Option, Futures and Risk Hedging Risk 9 Description of Course Details: 1. Homework and Assignments: Case Study 2. Exams and Quizzes: Midterm, Final Exam 3. Evaluation and Grading Policy: Case Study 30%; Midterm 30%; Final Exam 40% Time Slot Location Contact Information Office Hours Subject to reservation Faculty Lounge, 0988358880 NCTU Taipei Campus Syllabus Week Contents/Topic Date 1 Ch1 Introduction to Corporate Finance 2 Ch2-3 Financial Statement Analysis 3 Ch4 Discounted Cash Flow Valuation 4 Ch5 Net Present Value and Other Investment Rules Ch6 Making Capital Investment Decisions 5 Ch7 Risk Analysis, Real Options, and Capital Budgeting 6 Ch8 Interest Rates and Bond Valuation 7 Ch9 Stock Valuation Ch10 Risk and Return:Lessons from Market History 8 Ch11 Risk and Return:The Capital Asset Pricing Model Ch12 An Alternative View of Risk and Return:The Arbitrage Pricing 9 Theory Ch13 Risk, Cost of Capital, and Capital Budgeting 10 Midterm 11 Ch14 Efficient Capital Markets and Behavioral Challenges 12 Ch16-17 Capital Structure:Basic Concepts, Limits to the Use of Debt 13 Ch18 Valuation of Capital Budgeting h for Levered Firm 14 Ch19 Dividend Policy 15 Part VI Option, Futures, and Corporate Finance 16 Ch25 Derivatives and Hedging Risk 17 Review and Discussion 18 Final Exam Remarks: 1、Inclusive of visiting institutes/organizations outside the NCTU or other academic events. 2、Please adhere to pertinent regulations/laws on intellectual property rights. Do not use pirated textbooks. 附件三