FIN 301

advertisement

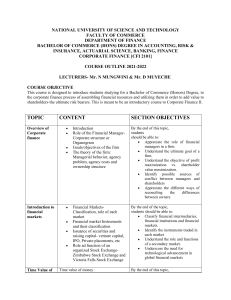

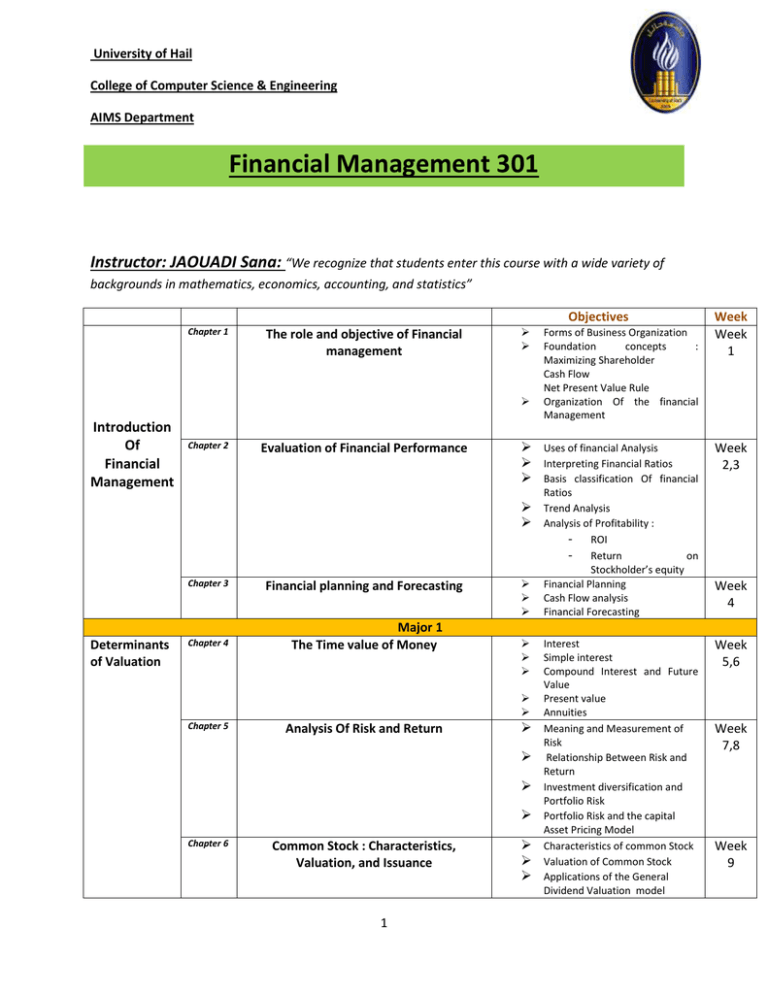

University of Hail College of Computer Science & Engineering AIMS Department Financial Management 301 Instructor: JAOUADI Sana: “We recognize that students enter this course with a wide variety of backgrounds in mathematics, economics, accounting, and statistics” Objectives Chapter 1 The role and objective of Financial management Introduction Of Financial Management Chapter 2 Evaluation of Financial Performance Uses of financial Analysis Interpreting Financial Ratios Basis classification Of financial Determinants of Valuation Chapter 3 Financial planning and Forecasting Chapter 4 Major 1 The Time value of Money Chapter 5 Analysis Of Risk and Return Chapter 6 Common Stock : Characteristics, Valuation, and Issuance 1 Forms of Business Organization Foundation concepts : Maximizing Shareholder Cash Flow Net Present Value Rule Organization Of the financial Management Ratios Trend Analysis Analysis of Profitability : - ROI - Return on Stockholder’s equity Financial Planning Cash Flow analysis Financial Forecasting Interest Simple interest Compound Interest and Future Value Present value Annuities Meaning and Measurement of Risk Relationship Between Risk and Return Investment diversification and Portfolio Risk Portfolio Risk and the capital Asset Pricing Model Characteristics of common Stock Valuation of Common Stock Applications of the General Dividend Valuation model Week Week 1 Week 2,3 Week 4 Week 5,6 Week 7,8 Week 9 University of Hail College of Computer Science & Engineering AIMS Department The Capital Investment Decision Chapter 7 Major 2 Capital Budgeting and Cash Flow Analysis The Cost Of Capital Chapter 8 The cost of capital Chapter 9 Capital structure concepts Additional Topics in Contemporary Financial Management Chapter 10 International Financial Management Chapter 11 Corporate Restructuring Final Exam 2 Key Terms and concepts in capital Budgeting Basic Framework for capital Budgeting Principles of Estimating cash flows Weighted cost of capital Relative cost of capital Computing the component costs of capital Divisional costs of capital Determining the weighted cost of capital schedule Capital structure decisions and Maximization of shareholder wealth Business risk Financial risk and Financial leverage Factors that affect Exchange rates Forecasting Future exchange rates Foreign Exchange risk Mergers Business Failure Week 10 Week 11, 12 Week 13,14 Week 15 Week 16