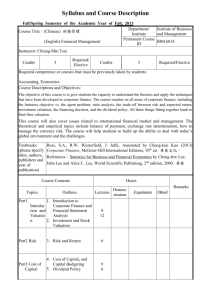

Date Lecture Topic Chapter Problems

advertisement

SPRING ’10 FIN 5023 FINANCIAL MANAGEMENT Prof. Palani-Rajan Kadapakkam 458-5830 PalaniRajan.Kadapakkam@utsa.edu Office: BB 4.02.60 Hours: 5:30 – 6:30 T 2:00 - 3:00 Th Course Objectives: The course is designed as an introduction to managing the financing needs of the firm. From a finance perspective, the manager has to make two major interconnected decisions: what assets to acquire and how to finance them. Non-finance majors will gain an appreciation of the responsibilities of the corporate financial manager and the critical relationship between the firm and the financial markets. Finance majors should view this course as a stepping stone to elective courses, which develop in greater detail some key concepts introduced here. Required Text: Brigham and Ehrhardt, FINANCIAL MANAGEMENT: Theory and practice, 12th edition, Thomson, 2008 Students are also expected to have a financial calculator. Calculations in class will be based on keystrokes using a HP-10BII calculator. Course Webpage: http://faculty.business.utsa.edu/pkadapak - ID/pwd: fin5023 / finmgmt Grading: Course grades will be based on preparation and class participation (5%), group assignments (15%), a quiz (10%), a mid-term exam (35%), and a final exam (35%). If you are not adequately prepared for class, you will be lost and frustrated in class. As evidence of preparation, students should summarize the relevant facts in assigned problems. The students are required to bring the textbook or a copy of the problems to class when end of chapter problems are discussed. Class Format: This is a lecture course. Class lectures (and problems in the book) will primarily emphasize the conceptual framework. Students are expected to read the sections of the book providing factual descriptions. Students are strongly urged to read the financial press and raise relevant issues in class. Assignments: There are three group assignments for the term. Students will work in groups of four members and will submit one group report. Each member is responsible for working on the assignment before the group meets. Students will be evaluated by their group members on their contribution. The assignments are described below. For the first assignment, students will analyze returns data on five stocks and answer assigned questions. Details on this project will be announced in class. The report is due on February 9. For the second assignment, students will forecast financial needs of a firm under different scenarios. This exercise will be a modification of the Chapter 14 case. A report summarizing findings will be due on February 23. For the third assignment, students will complete Problem 12-11. Students will submit a printed copy of the spreadsheet. The assignment is due on April 6. Student Responsibilities: Students are expected to be fully comfortable with financial ratios, time value of money concepts, and the calculation of NPV and IRR. Students are also expected to be fully comfortable with statistical concepts such as standard deviation and correlation coefficients. There will be no make-up exams except under very unusual circumstances. Missed exams will be treated as a zero score. Students are expected to provide an explanation for missing an exam at the earliest possible time. Appropriate academic accommodation will be made for any student registered through the Office of Disability Services. Please note only the Office of Disability Services, 210-4584157, (http://www.utsa.edu/disability/) may issue instructions for academic accommodations. Academic Integrity Policy: Cheating is a very serious academic offense and is not tolerated in any form. Students are expected to abide by the following pledge. "On my honor, as a student of The University of Texas at San Antonio, I will uphold the highest standards of academic integrity and personal accountability for the advancement of the dignity and the reputation of our university and myself." Master of Business Administration Degree Program Goals: Students will be 1. Able to apply business concepts and principles to a broad range of organizational and corporate decision problems, both local and global. 2. Able to apply business concepts and principles to assess the attractiveness of various industries, and identify the strengths and weaknesses of firms. 3. Proficient at using a broad set of quantitative problem solving tools that may be used as aids in decision making in all functional areas of management. 4. Knowledgeable of the ethical and other leadership issues facing business organizations, and have an appreciation of the various leadership roles and social responsibilities of the players in a business environment. Finance 5023 supports the MBA Degree Program Goals through the following objectives: Students will 1. Understand the measurement of value and the creation of value that occurs through different business activities (Goal 3). 2. Understand the measurement and impact of risk on value (Goal 3). 3. Develop the analytical skills necessary to engage in financial analysis and planning activities (Goal 2). 4. Be knowledgeable in the various alternatives to financing business activities. 5. Be knowledgeable of the issues relating to corporate governance (Goal 4). COURSE SCHEDULE Adjustments will be made if necessary based on actual progress during class meetings. Date Jan Lecture Topic 12 19 26 Feb 2 9* 16 23* Mar 2 9 16 23 30 Apr 6* 13 20 27 May 4 Chapter Problems Introduction, Taxes and Ethics 1 Understanding Financial Statements 3 5, 11, 12 Understanding Financial Statements 3 Case, parts a-h Valuation of Bonds 5 1,2,14,16 Valuation of Stocks 8 4, 2, 11,18 Financial Options 9 1,2,3,6 Quiz (10%) Risk and Return 6 1,2,3,10 Risk and Return 7 Cost of Capital 10 15,16,17 Financial Forecasting 14 Case, parts c, f Valuation 15 1,7,10 Valuation Capital Budgeting 11 1-6,13,14,15,16,22 Capital Budgeting 12 1,2,4 Review MID-TERM EXAM (30%) SPRING BREAK Capital Budgeting 12 Chapter 13-1 Leasing 20 1,4 Issuing Securities 19 Convertible Securities 21 5-a, b Capital Structure 16 Ch 16 Case –Parts h,i Capital Structure 17 5,6 Capital Structure Dividend Policy 18 3,10 Dividend Policy Multinational Finance 26 1,2,3,9 Current Asset Management 22 1,6,11 Review FINAL EXAM (35%) 8:00 – 10:30 (Estimated; check ASAP for confirmation) Suggested review problems on time value of money: Present Value 2 (1-6), 12,13,24,25