TaxWise® 2006

IRS Train-the-Trainer Course Book

Course Materials

Version 1.0

© 2006 Universal Tax Systems, Inc.

ALL RIGHTS RESERVED

Acknowledgements

Author .................................................................................... Erin Stone

Editor ...................................................................Peggy Fowler Casillas

Vice President, TaxWise Training ..................... Susan Wimberly Honea

Universal Tax Systems, Inc. grants permission to the IRS “Tax Assistance Programs”

[e.g. IRS Employees (Employee e-file), Taxpayer Assistance Centers (TAC), Tax

Counseling for the Elderly (TCE), and Volunteer Income Tax Assistance (VITA),

including IRS partners, volunteers and employees] to copy, photocopy, modify,

create derivative works from and reproduce this course book solely for IRS Tax

Assistance Program purposes. All other rights – including, but not limited to,

distribution or use outside of the scope of the IRS Tax Assistance Programs – are

strictly prohibited and reserved by UTS. UTS reserves the right to modify or withdraw

this permission at any time.

This course book includes commercial computer software documentation, which was

developed exclusively at private expense by Universal Tax Systems, Inc., 6 Mathis

Drive, Rome, GA 30165. The TaxWise® software and this course book are provided

with RESTRICTED RIGHTS. TaxWise is "Restricted Computer Software." Use,

duplication, or disclosure by the U.S. Government is subject to restrictions as set

forth herein and in the TaxWise User Agreement and as provided in DFARS

227.7202-1(a) and 227.7202-3(a) (1995), DFARS 252.227-7013 (OCT 1988), FAR

12.212(a)(1995), FAR 52.227-19, or FAR 52.227-14, as applicable.

TaxWise®, the owl logo, InterviewPLUS® (U.S. Patent Pending), and Audit Shield®

are trademarks of Universal Tax Systems, Inc. All other products mentioned are

trademarks of their respective manufacturers.

Information in this manuscript is subject to change without notice. Any software

described in this manuscript is furnished under a license agreement and may be

used or copied only in accordance with the terms of the agreement.

Universal Tax Systems, Inc. is not engaged in rendering legal, technical, or other

professional services. Use of this manuscript or the information in this publication

does not relieve the user of responsibility for the operation and functionality of its

computers and/or network, for the maintenance and backup of all user data, or for the

preparation, content, accuracy, and review of all forms.

THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, INCLUDING

WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR

PURPOSE, MADE WITH RESPECT TO THESE MATERIALS OR ANY OTHER

INFORMATION PROVIDED TO THE STUDENT.

Using this Manual

Using this Course Book

Universal Tax Systems, Inc., has designed this course book to provide

you with the most up-to-date training information. To help you learn

better, this course book contains:

Key references presented in bold type (for example, Ctrl+Q).

Menu names, dialog boxes names, lists, entry boxes,

commands, and other key terms presented in bold type (for

example, the Help menu).

Symbols that have special meanings:

This symbol points out a note of additional information.

This symbol calls attention to a very important note or warning.

This symbol identifies a tip for using the software more

effectively.

This symbol indicates a shortcut for a procedure.

This symbol signifies a troubleshooting tip.

This symbol identifies a security tip.

This symbol references a Publication 3189 guideline.

© 2006 Universal Tax Systems, Inc.

iii

Using this Manual

Use this page for notes…

iv

© 2006 Universal Tax Systems, Inc.

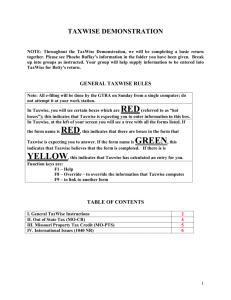

Table of Contents

Class Objectives .............................................................. 16

What is TaxWise? ............................................................................ 17

Chapter 1:

Installation and Configuring TaxWise ....... 18

Installing TaxWise ........................................................................... 19

Installing TaxWise from the CD .................................................... 19

Downloading the TaxWise Installation from the Internet .............. 26

Extracting the Downloaded File .................................................... 28

Carrying Forward Setup Information from the Prior Year................. 29

Configuring TaxWise Setup Options ................................................ 31

Entering Company Information ..................................................... 31

Entering General Information ....................................................... 33

Entering Printer Setup Information ............................................... 35

Entering Indirect Transmitter Information ..................................... 38

Entering Direct Transmitter Information ........................................ 39

Entering Color Setup Information ................................................. 40

Registering TaxWise ....................................................................... 41

Registering TaxWise to Transmit for Multiple Locations ............... 42

Practice Exercise ............................................................................. 43

Chapter 2:

Getting Started ............................................ 44

Starting TaxWise ............................................................................. 45

Logging in to TaxWise ..................................................................... 47

Introducing the TaxWise Home Page .............................................. 48

Creating Tabs ............................................................................... 52

Using the TaxWise Menus ............................................................... 55

The File Menu .............................................................................. 55

The Edit Menu .............................................................................. 57

The Form Menu ............................................................................ 58

The Letter Menu ........................................................................... 59

The View Menu ............................................................................ 59

The Bank Menu ............................................................................ 60

The Reports Menu ........................................................................ 60

The Communications Menu.......................................................... 61

© 2006 Universal Tax Systems, Inc.

1

Table of Contents

The Tools Menu ........................................................................... 62

The Help Menu ............................................................................. 63

Getting Help in TaxWise .................................................................. 65

Using TaxWise Help ..................................................................... 65

F1 Contextual Help....................................................................... 69

Context-Sensitive Help ................................................................. 70

IRS Instructions ............................................................................ 70

Viewing TaxWise and Help at the Same Time ............................. 72

Visual Cues in TaxWise ............................................................... 72

Practice Exercise ............................................................................. 74

Chapter 3:

Using Administrator Features ................... 75

Introducing the Admin User Functions............................................. 76

Assigning a Password to the Admin User ........................................ 77

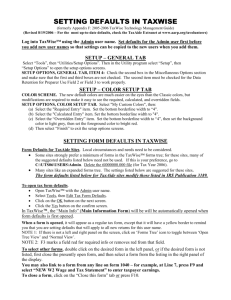

Configuring Defaults ........................................................................ 81

Editing Default Information on Forms ........................................... 81

Changing Default Information ....................................................... 83

Printing a Client Letter with a Return ............................................ 84

Working With User-defined History Lists ......................................... 85

Understanding History Lists ......................................................... 85

Pre-defined History Lists .............................................................. 85

User-defined History Lists ............................................................ 85

Creating User-defined History Lists .............................................. 85

Editing Return Stage Options ....................................................... 89

Exiting Edit Tax Form Defaults Mode ........................................... 90

Modifying Print Defaults ................................................................... 91

Understanding Print Packets ........................................................ 91

Editing Print Packets .................................................................... 92

Adding Forms to Print Packets ..................................................... 92

Changing Print Packets Settings for Only One Print Session ....... 95

Practice Exercise ............................................................................. 98

Chapter 4:

Working with Users and Groups ............... 99

Understanding Security Manager .................................................. 100

2

© 2006 Universal Tax Systems, Inc.

Table of Contents

Opening Security Manager ......................................................... 100

Understanding Default Groups ...................................................... 102

Adding Groups ........................................................................... 103

Modifying Groups ....................................................................... 105

Deleting Groups ......................................................................... 105

Understanding Default User Names .............................................. 107

The Admin User ......................................................................... 107

The Guest User .......................................................................... 107

The Training User....................................................................... 108

Adding User Names ................................................................... 108

Modifying User Names ............................................................... 113

Deleting User Names ................................................................. 114

Practice Exercise ........................................................................... 116

Chapter 5:

Using TaxWise Explorer ........................... 117

Opening TaxWise Explorer ............................................................ 118

Using TaxWise Explorer ................................................................ 119

Practice Exercise ........................................................................... 126

Chapter 6:

Working with Reports ............................... 127

Using Management Reports .......................................................... 128

Running and Printing a Management Report ............................. 128

Review of Reports that Help with Site Management ...................... 132

Awaiting IRS Acks Summary ...................................................... 132

Client List w/o SSN..................................................................... 132

Military Preparer Summary ......................................................... 132

Office Information ....................................................................... 133

Preparer Field Values ................................................................. 133

Exporting Reports....................................................................... 134

Practice Exercise ........................................................................... 136

Chapter 7:

Backing Up and Restoring Returns ......... 137

Backing Up Returns ....................................................................... 138

Performing a Regular Backup .................................................... 139

Performing an Advanced Backup ............................................... 142

© 2006 Universal Tax Systems, Inc.

3

Table of Contents

Restoring Returns.......................................................................... 147

Exporting/Importing EIN Database ................................................ 154

Exporting the EIN Database ....................................................... 154

Importing the EIN Database ....................................................... 155

Practice Exercise ........................................................................... 158

Chapter 8:

Working with TaxWise Mail...................... 159

Introducing TaxWise Mail .............................................................. 160

Sending TaxWise Mail................................................................ 160

Saving a Message ...................................................................... 161

Addressing a Message to Multiple EFINs ................................... 162

Attaching a File to a Message .................................................... 164

Moving a Return Sent by Another EFIN ..................................... 165

Opening a Previously Saved Message....................................... 167

Printing a Message..................................................................... 168

Getting TaxWise Mail ................................................................. 168

Practice Exercise ........................................................................... 171

Chapter 9:

Working with Tax Returns ....................... 173

Getting Started .............................................................................. 174

Carrying Forward Prior Year Data ................................................. 175

Loading Prior Year Data into a Current Tax Return.................... 178

Starting a New Return ................................................................... 179

Working with the Main Information Sheet ................................... 181

Working with Forms.................................................................... 181

Adding a Form from the Find a Form List ................................... 181

Adding a New, Blank Copy of an Open Form ............................. 182

Linking to a Form........................................................................ 183

Working with Child and Parent Forms ........................................ 184

Opening and Linking a Form from the Find a form List .............. 185

Opening a Form by Linking ........................................................ 185

Removing a Form ....................................................................... 186

Moving Around in a Form ........................................................... 187

Scrolling Through the Forms in a Return .................................... 187

4

© 2006 Universal Tax Systems, Inc.

Table of Contents

Saving Returns ........................................................................... 188

Viewing Two Forms at One Time ............................................... 188

Working with Entries ...................................................................... 192

Completing Entries on a Form .................................................... 192

Understanding Color Coded Entries ........................................... 192

Working with Calculated Entries ................................................. 193

Working with Estimated Entries .................................................. 195

Entering Correct Data in Estimated Entries ................................ 195

Using the Calculator ................................................................... 196

Using the ZIP Code Locator ....................................................... 197

Working with Statements and Scratch Pads .................................. 198

Using Statements ....................................................................... 198

Inserting, Deleting, and Sorting Lines on Statements................. 199

Using Scratch Pads .................................................................... 200

Printing a Scratch Pad ................................................................ 201

Using Search and Query Features ................................................ 202

Understanding the Query Results Information............................ 202

Working with the Client Diary ..................................................... 204

Performing a Quick Search for Return Status ............................ 205

Practice Exercise ........................................................................... 208

Chapter 10: Understand the PIN Programs ................ 210

Self-Select PIN Method ................................................................. 211

Entering PIN Information ............................................................ 212

Practitioner PIN Method................................................................. 213

Entering Practitioner PIN Information ......................................... 214

Practice Exercise ........................................................................... 215

Chapter 11: Understanding Electronic Filing ............. 216

Running Diagnostics ...................................................................... 217

Running Diagnostics .................................................................. 217

Correcting Electronic Filing Errors .............................................. 218

Forms Lists ................................................................................. 218

Form 8453 Information ............................................................... 218

© 2006 Universal Tax Systems, Inc.

5

Table of Contents

Verifying Social Security Numbers ............................................. 218

Warnings .................................................................................... 219

Overridden Entries ..................................................................... 219

Estimated Entries ....................................................................... 219

Re-running Diagnostics .............................................................. 219

Creating Electronic Files ............................................................ 220

Managing Declaration Control Numbers ........................................ 222

Introducing State Electronic Filing ................................................. 225

Working with IRS Federal/State e-file States ............................. 225

Working with IRS State Only e-file States .................................. 225

Working with Stand-Alone e-file States ...................................... 226

Creating and Sending e-files for Returns ....................................... 227

Creating e-files for Federal/State Returns .................................. 227

Creating e-files for State Only Returns ....................................... 227

Creating e-files for Stand-alone States....................................... 227

Sending State e-files .................................................................. 227

Creating e-files and Transmitting Returns ..................................... 229

Creating e-files ........................................................................... 229

Creating an e-file From an Open Return .................................... 229

Creating a New e-file for a Stand-Alone State ............................ 230

Creating a New e-file for a State Only State ............................... 230

Creating the e-file From a Closed Return ................................... 231

Transmitting e-files ..................................................................... 233

Transmission Tips ...................................................................... 237

Getting and Processing Acknowledgments ................................... 239

Understanding Types of Acknowledgments ............................... 239

Getting Acknowledgements ........................................................ 239

Reprocessing/Reprinting Acknowledgements ............................ 242

Filtering the List of Acknowledgement Files ............................... 244

Correcting and Resending Rejected Returns ................................ 245

Correcting the Rejected Return .................................................. 245

Rejected State Returns for States Participating in Federal/State efile............................................................................................... 245

6

© 2006 Universal Tax Systems, Inc.

Table of Contents

Rejected State Returns for Stand-Alone States ......................... 246

Practice Exercise ........................................................................... 247

Chapter 12: Working with Client Letters..................... 248

Introducing the Client Letter........................................................... 249

Using the Edit Menu ................................................................... 250

Working with Letter Toolbars ...................................................... 250

Client Letter Formatting Toolbar ................................................. 251

Working with Client Letter Templates ............................................ 253

Working with Standard Letter Templates ................................... 253

Adding a Client Letter Template ................................................. 254

Previewing the Letter Template .................................................. 257

Printing Only the Letter ............................................................... 257

Removing a Letter Template ...................................................... 258

Mailing Addresses ...................................................................... 258

Practice Exercise ........................................................................... 259

Chapter 13: Printing Tax Returns................................ 260

Printing a Single Return ................................................................. 261

Printing an Open Return ............................................................. 261

Printing a Return That is Not Open ............................................ 264

Printing to a PDF file .................................................................. 267

Printing Forms ............................................................................... 269

Printing an Open Form ............................................................... 269

Chapter 14: Creating Estimates and Conducting

Interviews 270

What is the Tax Estimator?............................................................ 271

Opening and Configuring the Tax Estimator .............................. 271

Conducting an Interview ................................................................ 276

Deleting Forms Flagged by the Interview Sheet ......................... 276

Practice Exercise ........................................................................... 277

Chapter 15: Differences Between TaxWise and TaxWise

Online

279

Differences Between TaxWise Online and TaxWise Desktop ....... 280

© 2006 Universal Tax Systems, Inc.

7

Table of Contents

Practice Exercise ........................................................................... 282

Chapter 16: Accessing TaxWise Online ..................... 283

Creating a Desktop Shortcut.......................................................... 284

Creating a Favorite ........................................................................ 286

Logging In ...................................................................................... 288

The TaxWise Online Home Page .................................................. 289

Search/Filter Returns ................................................................. 290

Practice Exercise ........................................................................... 292

Chapter 17: Introducing the TaxWise Online

Administrator Functions ............................................... 293

Introduction of Admin User ............................................................ 294

Assigning a Password to the Admin User ...................................... 295

Practice Exercise ........................................................................... 297

Chapter 18: Creating Groups and Users in TaxWise

Online

298

Using User Manager ...................................................................... 299

Adding New Users ......................................................................... 300

Password Requirements for Created Users ............................... 302

Setting User Functions .................................................................. 304

Entering Tax Preparer Information ............................................. 304

Entering ERO Information .......................................................... 305

Practice Exercise ........................................................................... 307

Chapter 19: Working with Return Templates in TaxWise

Online

308

Creating Return Templates ........................................................... 309

Modifying Return Templates .......................................................... 311

Assigning the Return Template to User(s) ..................................... 313

Assigning the Return Template While the Return Template is Open

................................................................................................... 313

Assigning the Return Template to User(s) From the Return

Template List .............................................................................. 315

Practice Exercise ........................................................................... 317

Chapter 20: Working with e-files in TaxWise Online . 319

8

© 2006 Universal Tax Systems, Inc.

Table of Contents

Selecting and Submitting e-files .................................................... 320

Practice Exercise ........................................................................... 322

Chapter 21: Working with Acknowledgments in

TaxWise Online .............................................................. 324

Viewing Acknowledgments ............................................................ 325

Using the Date Filter ................................................................... 326

Chapter 22: Creating Returns Using the Interview

Process in TaxWise Online............................................ 327

Getting Help................................................................................... 328

Using the Contents Button ......................................................... 329

Using the Search Button ........................................................... 329

Using the Search Button ............................................................ 330

Getting State Help ...................................................................... 331

Completing the Interview ............................................................... 333

The Interview Progress Bar ........................................................ 335

Completing the Interview Step by Step ...................................... 335

Navigating the Tax Return ............................................................. 337

Understanding Color Coded Entries ........................................... 338

Using Shortcut Keys ................................................................... 338

Understanding the Forms Tree ...................................................... 339

Adding and Linking to Forms ......................................................... 340

Adding a Form ............................................................................ 340

Linking to a Form........................................................................ 340

Using the Refund Monitor .............................................................. 342

Setting the Return Stage ............................................................... 343

Practice Exercise ........................................................................... 344

Chapter 23: Running Diagnostics in TaxWise Online 346

Running Diagnostics ...................................................................... 347

Running Diagnostics .................................................................. 347

Correcting Electronic Filing Errors .............................................. 347

Verifying Social Security Numbers ............................................. 347

Warnings .................................................................................... 348

Overridden Entries ..................................................................... 348

© 2006 Universal Tax Systems, Inc.

9

Table of Contents

Estimated Entries ....................................................................... 348

Re-running Diagnostics .............................................................. 349

Practice Exercise ........................................................................... 350

Chapter 24: Printing the Return in TaxWise Online .. 352

Printing the Return......................................................................... 353

Printing the Active Return ........................................................... 353

Printing Returns from the Home Page ........................................ 355

Chapter 25: Tax Law Changes for 2006 ..................... 359

2006 Tax Changes for Individuals ................................................. 360

Self-Select PIN ........................................................................... 360

Earned Income Credit ................................................................ 360

Electric and Clean-Fuel Vehicles................................................ 360

Exemption Amounts ................................................................... 360

Standard Deduction.................................................................... 361

Standard Mileage ....................................................................... 361

Alternative Minimum Tax ............................................................ 361

Child’s Unearned Income ........................................................... 362

Tax-Exempt Interest ................................................................... 362

IRA Catch-Up Contributions ....................................................... 362

Modified AGI Limit (Traditional IRA) ........................................... 362

SIMPLE Catch-Up Contributions ................................................ 362

Qualified Roth Contribution Programs ........................................ 362

Defined Benefit Plan................................................................... 362

401(k) Plans ............................................................................... 363

Simplified Employee Pensions (SEPs) ....................................... 363

Social Security Tax..................................................................... 363

Chapter 26: Troubleshooting Tips and Best Practices

365

Finding Prior Year Software and Registration Codes .................... 366

Working With Firewalls .................................................................. 367

Finding Information About Firewalls ........................................... 367

Solving Problems Using Utilities .................................................... 368

10

© 2006 Universal Tax Systems, Inc.

Table of Contents

Running Tech Setup ................................................................... 368

DB Repair ................................................................................... 368

Other Common Troubleshooting Tips and Tricks ....................... 369

Computer Maintenance .............................................................. 369

Chapter 27: Working with the Customer Support Web

Site

371

Introducing the Customer Support Web Site ................................. 372

Logging in to the Customer Support Site .................................... 372

Navigating the Customer Support Site ....................................... 374

Changing Users.......................................................................... 374

Working with the Home Page ........................................................ 375

Viewing Drain Monitor ................................................................ 375

Performing a Return Query ........................................................ 376

Viewing Rejected Returns .......................................................... 379

Viewing Approval Information ..................................................... 380

Working with the My Information Page .......................................... 382

Viewing Product Information....................................................... 383

Adding States to Your TaxWise Package ................................... 384

Working with Reports..................................................................... 386

Scheduling a New Report ........................................................... 388

Deleting a Report ....................................................................... 391

Downloading Updates and Other Products.................................... 392

Working with Product Updates ................................................... 392

Installing Federal Updates .......................................................... 395

Transferring Federal Updates..................................................... 398

Downloading States ................................................................... 400

Installing State Updates ............................................................. 403

Transferring State Updates ........................................................ 407

Downloading Help File Updates ................................................. 409

Installing Help Files .................................................................... 411

Downloading Utilities .................................................................. 414

Downloading Templates ............................................................. 417

Working with Support Options ....................................................... 420

© 2006 Universal Tax Systems, Inc.

11

Table of Contents

Contacting Customer Support .................................................... 420

Viewing Calendars and Charts ...................................................... 423

Tracking Packages ........................................................................ 425

Viewing Incident History ................................................................ 427

Practice Exercise ........................................................................... 429

Chapter 28: Using the Knowledge Base .................... 430

Introducing the Knowledge Base ................................................... 431

Accessing the Knowledge Base .................................................... 432

Entering the Knowledge Base from the Internet ......................... 432

Entering the Knowledge Base from TaxWise ............................. 435

Entering the Knowledge Base from TaxWise Online .................. 435

Searching the Knowledge Base..................................................... 437

Performing a Simple Search ...................................................... 437

Searching for a Specific Answer ID ............................................ 440

Printing an Answer ..................................................................... 440

E-mailing an Answer .................................................................. 441

Performing Advanced Searches .................................................... 444

Searching for a Specific Phrase or Set of Words ....................... 444

Searching for Words You Do Not Know How to Spell ................ 444

Improving the Knowledge Base .................................................. 445

Practice Exercise ........................................................................... 446

Chapter 29: Using TaxWise University ...................... 447

What is TaxWise University? ......................................................... 448

System Requirements for TaxWise University ........................... 448

Logging in to the Student Manager................................................ 451

Recovering a Forgotten Password ............................................. 454

Working with Groups ..................................................................... 459

Viewing Groups .......................................................................... 459

Creating a New Group................................................................ 460

Editing the Default Group ........................................................... 461

Restricting and Activating Curricula ............................................... 463

Managing Students........................................................................ 465

12

© 2006 Universal Tax Systems, Inc.

Table of Contents

Adding a New Student ................................................................ 465

Student Passwords .................................................................... 466

Deactivating a Student ............................................................... 467

Importing Students ..................................................................... 467

Tracking Student Progress ............................................................ 468

Logging in to TaxWise University .................................................. 470

Resetting a Forgotten Password ................................................ 472

The TaxWise University Home Page .......................................... 475

Taking Lessons, Quizzes, and Exams ........................................... 476

Viewing Your Status and Transcripts ............................................. 485

Printing a Certificate of Completion ............................................... 487

Tips for Troubleshooting TaxWise University ................................ 490

TaxWise Online .......................................................................... 490

Adding a Custom Internet Tab.................................................... 491

Practice Exercise ........................................................................... 493

Chapter 30: Using the Training Electronic Filing Center

494

Requirements for Using the Training EFC ..................................... 495

Creating SSNs for Training Returns .............................................. 496

Workshop Returns ......................................................................... 497

The Transmission Process for Training Returns ........................ 498

Acknowledgments and Rejects ...................................................... 499

Practice Exercise ........................................................................... 500

Chapter 31: Viewing TaxWise TV ................................ 502

Accessing TaxWise TV .................................................................. 503

System Requirements for TaxWise TV ...................................... 503

Viewing an Archived Show ............................................................ 504

Practice Exercise ........................................................................... 505

Chapter 32: Training Tips and Techniques ................ 506

Communication Skills .................................................................... 507

Verbal Communication Skills ...................................................... 507

Using Humor .............................................................................. 509

© 2006 Universal Tax Systems, Inc.

13

Table of Contents

Non-Verbal Communication Skills .............................................. 509

Recognizing and Managing Distracting Mannerisms.................. 511

Presentation Skills ......................................................................... 513

Using Your Voice........................................................................ 513

The Pace of the Class ................................................................ 515

Using Visual Aids ....................................................................... 516

Questioning Skills .......................................................................... 517

Types and Use of Questions ...................................................... 518

Encouraging Student Questions ................................................. 520

Handling Responses to Questions ............................................. 521

What Should I Avoid? ................................................................. 522

Professionalism ............................................................................. 523

Professionalism and Your Appearance ...................................... 523

Professionalism and Your Verbal Communication ..................... 524

Maintaining a Professional Demeanor........................................ 525

Maintaining an Open and Flexible Attitude ................................. 526

Group Interaction Skills ................................................................. 527

Seeing Your Class as a Group ................................................... 527

Group Interaction and the Learning Boundary ........................... 528

Learning Boundary Characteristics ............................................ 529

Causes and Cures for Rigid Learning Boundaries ..................... 530

Causes and Cures for Overly Flexible Boundaries ..................... 530

Facilitating Group Interaction ..................................................... 531

Positive and Rapport-Building Communication .......................... 531

Maintaining Control of the Class ................................................ 532

Group Interaction and Difficult Students ..................................... 532

Managing Situationally Difficult Students ................................... 532

Managing Dispositionally Difficult Students ................................ 533

Using the Endless Loop ............................................................. 535

The One-on-One ........................................................................ 536

When All Else Fails .................................................................... 536

Motivational Skills .......................................................................... 537

14

© 2006 Universal Tax Systems, Inc.

Table of Contents

Motivation and the Attributes of the Adult Learner...................... 538

Explaining the Benefit and Relevance of Learning ..................... 538

Providing Motivational Feedback................................................ 538

Providing Motivational Feedback to Questions or Comments .... 539

Providing Motivational Feedback on Student Performance ........ 539

Monitoring Student Reactions .................................................... 540

Chapter 33: Working with Your Training Materials .... 541

Saving the Template ...................................................................... 542

Using Your Styles .......................................................................... 543

Chapter 34: Advanced Topics ..................................... 545

Configuring a Network Workstation ............................................... 546

Installing 2005 States from the CD ................................................ 552

Working with Color Setup .............................................................. 558

Changing the Look and Feel of TaxWise ................................... 558

Carrying Forward the Previous Year’s Defaults ............................. 559

Printing Mailing Labels................................................................... 562

Printing Mailing Labels from the Query Results Window ............ 562

Printing Mailing Labels from the Home Page ............................. 563

Printing Non-Returning Client Logs and Mailing Labels ................ 564

Printing Non-Returning Client Logs ............................................ 564

Printing Non-Returning Client Mailing Labels ............................. 565

Working with Extenstions............................................................... 567

Selecting and Completing an Extension Form............................ 567

State Extensions ........................................................................ 567

Sending Extension e-files ........................................................... 567

Correcting Rejected Extension Returns ..................................... 568

Troubleshooting Font Problems ..................................................... 570

Transferring IRS/RAL Files to Transmitting PC ............................. 572

© 2006 Universal Tax Systems, Inc.

15

Class Objectives

Class Objectives

Review class

objectives, set

expectations,

call for

questions.

After completing this training course, you should be able to:

Install TaxWise Desktop and complete TaxWise Setup Options

in TaxWise Desktop

Create and modify Tax Form Defaults in TaxWise Desktop

Add Groups and Users in TaxWise Desktop

Run, print, and export management reports in TaxWise Desktop

Back up and restore returns in TaxWise Desktop

Use TaxWise Mail in TaxWise Desktop

Get help, use support options, and use TaxWise’s training

resources

Prepare, print, and transmit individual income tax returns in

TaxWise Desktop and TaxWise Online

Use time-saving program features

Understand how the 2006 tax law changes have been and will

be incorporated in TaxWise

Create and modify Return Templates in TaxWise Online

Add Groups and Users in TaxWise Online

Give pre-test

crossword

puzzle. Est

completion

time = 10 min.

Collect, but do

not grade

now.

16

© 2006 Universal Tax Systems, Inc.

Class Objectives

What is TaxWise?

TaxWise® is a commercial tax preparation software program produced

by Universal Tax Systems, Inc. The Internal Revenue Service has

chosen TaxWise to assist partners in preparing tax returns at IRS

volunteer sites.

TaxWise performs real-time calculations and helps identify forms

required to properly file a tax return. With TaxWise, volunteers can file

returns electronically, receive refunds in a little more than a week.

TaxWise is available in two versions for the volunteer programs.

TaxWise Desktop is the version that has been historically distributed to

the volunteer sites. This year TaxWise Desktop will be running

software version 21, or TaxWise 2006. TaxWise Desktop is distributed

either on a CD-ROM or can be downloaded from the Universal Tax

Systems Web site. TaxWise Desktop is characterized by having the

software resident on the computer(s) at the volunteer site. TaxWise

Desktop can be configured to work very powerfully in a local area

network (LAN) or, if the resources are not available, as a series of

stand-alone workstations.

TaxWise Online is an online version of the same software suite.

TaxWise Online is characterized by having all the software residing on

the web server at UTS which allows the volunteer sites to use their

Internet web-browsers to prepare taxes. The advantages of TaxWise

Online include the following:

The administrator has a reduced workload.

UTS keeps the software current.

A volunteer can use any computer with Internet access to

prepare a return.

Networking of computers is unnecessary.

The technology is very secure.

Point out

Conversely, TaxWise Online may not be appropriate if the site’s

Internet connectivity is unreliable or slower than 600 Mbps.

© 2006 Universal Tax Systems, Inc.

17

Chapter 1: Installing and Configuring TaxWise

Chapter 1: Installation and Configuring

TaxWise

In this chapter, you should learn how to:

Review

objectives and

call for

questions.

18

Install TaxWise.

Carry forward setup information from the prior year.

Configure TaxWise setup options.

Register TaxWise.

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

Installing TaxWise

There are several ways to install TaxWise. The following section

includes instructions for:

installing TaxWise from the CD,

installing TaxWise from the Internet, and

installing 2005 TaxWise states from the CD.

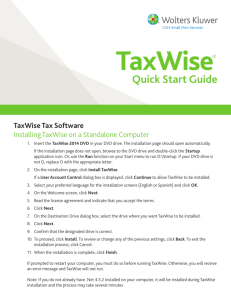

Installing TaxWise from the CD

To install TaxWise from the CD, use the following steps:

If this is a network installation from a workstation to the server,

map a drive from the workstation to a shared drive on the server

before proceeding. Contact your site administrator or technical

coordinator for assistance in doing this.

1. Insert your TaxWise 2005 CD into your CD drive.

If the TaxWise installation program does not start automatically,

click the Start button on the Windows Taskbar and then click Run.

Windows displays the Run dialog box:

Place CD in CD

ROM drive.

Demonstrate

how to open if

the screen does

not auto run.

Type D:\Startup in the Run dialog box and click OK.

This step assumes that your CD drive is mapped to D:\. If this is

not the case, simply replace D:\ with the appropriate drive letter.

© 2006 Universal Tax Systems, Inc.

19

Chapter 1: Installing and Configuring TaxWise

The following Installation screen displays:

The links on this

page offer

information

about services

and additional

products offered

by TaxWise.

2. Click INSTALL on the left.

20

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

The Installation Wizard displays the following screen:

Point out options

for 3rd Party

Products and

Resources.

3. Select TaxWise 2006 in the INSTALL NOW box on the right side of

the window.

© 2006 Universal Tax Systems, Inc.

21

Chapter 1: Installing and Configuring TaxWise

The Installation Wizard displays the License Agreement dialog

box:

It is

recommended

that you print a

copy of the

license

agreement.

4. Read the license agreement and click Yes.

22

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

5. Do one of the following:

If you do not have TaxWise installed on your computer, skip

this step.

If you already have TaxWise installed on your computer, the

Installation Wizard displays the Select Option dialog box:

6. Select Re-Install TaxWise® 2006, or and click Next.

© 2006 Universal Tax Systems, Inc.

23

Explain what it

means to

configure a

workstation

and when it

would be

appropriate to

choose this

option.

Chapter 1: Installing and Configuring TaxWise

Regardless of the option you chose in step 6, the Installation

Wizard displays the Drive Selection dialog box:

We strongly

recommend that

you use the

default (C:\)

install location.

Tell them what

happens during

the installation

process as the

program is

installing.

7. Select the drive to which you want to install TaxWise, and click

Next.

The default installation is to the C drive.

As TaxWise installs, a status box in the lower left corner of your

screen indicates the progress of the installation process.

Once installation is complete, TaxWise displays the following

message box:

Is anyone running

on a network?

24

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

8. Do one of the following:

If this is a stand alone installation, click No.

The box asking

about network

installation only

displays when

the workstation

number on the

computer has

not been

specified.

Otherwise, click Yes.

If you clicked Yes, TaxWise displays the following dialog box:

9. Follow the on-screen directions for defining a workstation number.

If students ask

questions about

wkstn #s at this

point, defer

them until a

break.

See the chapter on Advanced Topics for more information

about defining workstation numbers.

TaxWise prompts you to restart your computer by displaying the

following message box:

10. Click OK.

© 2006 Universal Tax Systems, Inc.

25

Chapter 1: Installing and Configuring TaxWise

The reason

you should

select “No” to

running

TaxWise now

is so that you

can look at the

icon to make

sure that it

installed

correctly.

Click No to

starting TW

now.

Before class,

download

taxwise.zip to

TW

Installation

folder.

Point out

reference to

broadband.

Point out web

address.

Windows restarts and TaxWise completes its installation process

and displays the following message box:

11. Do one of the following:

Click Yes to launch TaxWise.

Click No to return to Windows.

Downloading the TaxWise Installation from the Internet

A broadband (Cable/DSL) Internet connection is required for

this option.

To install TaxWise from the Internet, use the following steps:

1. Double-click the icon for your web browser.

2. Type http://download.taxwise.com/taxwise.zip in the Address

box and press Enter.

Internet Explorer displays the File Download dialog box:

You will need

an extraction

tool such as

WinZip.

www.downloa

ds.com is a

secure site

where you can

download a

free copy of

WinZip.

Show how to

make folder

on desktop

TW

Installation.

Walk through

and show File

Download

box, click

Save.

3. Click Save.

26

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

Show how to

navigate to TW

Installation

folder.

Internet Explorer displays the Save As dialog box:

4. If Desktop does not display in the Save in box, click the Desktop

icon in the left side of the Save As dialog box.

Click Cancel.

5. Click the Save button to save the file taxwise.zip to your desktop.

© 2006 Universal Tax Systems, Inc.

27

Chapter 1: Installing and Configuring TaxWise

Open TW Install.

Walk through

steps and show

that it displays

the same screen

as CD install.

Extracting the Downloaded File

To extract the file, use the following steps:

1. Double-click the taxwise.zip folder on your desktop.

Windows displays the contents of the taxwise.zip folder.

Double-click the TaxWise06CD folder.

Double-click the Startup.exe icon to begin extracting the files.

Click the Extract All button.

Browse to the destination to which you want to extract the files and

click Next.

When the files have been extracted, click the Finish button.

Windows displays the contents of the TaxWise06CD folder.

Double-click the Startup.exe icon to launch the TaxWise

Installation.

Follow the steps for installing TaxWise, starting on page 21.

28

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

Carrying Forward Setup Information from the Prior Year

If you have last year’s program installed on your computer, you will be

given the option to carry forward the following information from the

previous year the first time you start TaxWise:

Click TW icon on

desktop.

Setup Information

Client Letters

EIN Database

© 2006 Universal Tax Systems, Inc.

Explain what

happens when

you carry forward

each of these

items. This is a

good time to talk

about the kinds of

things that do

NOT carry

forward. Need

points or list. Not

everyone knows

what carries

forward.

29

Chapter 1: Installing and Configuring TaxWise

Users and Groups

These options are only available the first time you start

TaxWise.

Point out

warning.

30

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

Configuring TaxWise Setup Options

If you carried forward your setup files from last year, much of

the information in Setup Options is already complete. View the

information on each tab to ensure that all information is correct.

The first time you start TaxWise, you must complete the Setup

Options dialog box with information about your site and your system,

such as network, printers, communication methods, and more.

TaxWise uses the information in Setup Options in many ways;

therefore, it is critical that you enter this information accurately.

If you are not sure the information is correct, you should revisit

Setup Options to verify and correct the information.

Entering Company Information

By default, TaxWise displays the Company tab of the Setup Options

dialog box:

Remind

students that

they are

required to

follow 3189

guidelines for

Setup

Options.

Some of the

information

will be

defaulted on

the CDs they

receive, but it

is up to them

to ensure

compliance

with 3189.

Point out

warning.

The Company tab allows you to define basic information about your

site, such as your name, address, contact information and EFIN.

To complete the Company tab, use the following steps:

1. Enter your EFIN in the EFIN (Electronic Filing Identification

Number) or Customer ID box and press the Tab key.

© 2006 Universal Tax Systems, Inc.

31

Chapter 1: Installing and Configuring TaxWise

Enter:

Enter only your transmitting EFIN in this box and DO NOT

change it during tax season. Changing the EFIN will corrupt

your database.

EFIN 288241

Your name

10 Main St

If you plan to transmit returns for multiple EFINs from one

location, please see the topic Registering TaxWise to

Transmit for Multiple Locations later in this course book.

30145

Kingston GA

706-291-2222

Explain last 2

fields are left

blank.

2. Enter the name of the primary contact person at your site in the

Your company’s contact name box and press the Tab key.

3. Enter the name of your site in the Your company’s name box and

press the Tab key.

4. Enter your street address in the Your company’s street address

box and press the Tab key.

5. Enter your city, state, and ZIP Code in the Your company’s city,

state, ZIP Code box and press the Tab key.

What should

they do if they

need to

change the

EFIN?

Do not use any punctuation when you enter your city, state, and

ZIP Code information.

6. Enter your area code and phone number in the Your company’s

telephone number box and press the Tab key.

Do not use any hyphens or parentheses when you enter your

phone number. TaxWise enters hyphens for you.

7. If necessary, enter your EIN in the Your company’s Federal

Employer Identification Number (EIN) box and press the Tab

key.

Point out note

under step 7.

This step does not apply for IRS volunteers and employees.

8. If you are using TaxWise on a network, select the Save as

Workstation Defaults check box to ensure that all of your settings

carry over to each workstation on the network.

This option is available on all the Setup Options tabs. If you

skip this step now, you can click the Save as Workstation

Defaults check box at any point in the setup process.

9. Click the Next button to proceed to the General tab.

32

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

Select No

Network.

Entering General Information

TaxWise displays the General tab of the Setup Options dialog box:

Select Do

NOT auto

number. This

keeps price

sheet from

loading with

return.

The General tab allows you to configure your network options, set your

current Declaration Control Number, and determine your client

invoicing settings. There are also options to enable history list

functions.

To complete the General tab, use the following steps:

1. Do one of the following:

If your computer is not attached to any other computer,

select No Network.

If you are using TaxWise on multiple computers or over a

network of any kind, select Network.

2. Enter the current DCN on the Current Declaration Control

Number (DCN) box by doing one of the following:

This number should be 1 if you use TaxWise on multiple

workstations on a network, you only use TaxWise on one

computer, or you do not e-file any returns.

If you are using multiple non-networked computers, you

must preset the DCN on each computer prior to tax season

by estimating the number of returns you will prepare on each

© 2006 Universal Tax Systems, Inc.

33

Chapter 1: Installing and Configuring TaxWise

machine and entering the current DCNs far enough apart to

prevent duplication. The IRS will reject duplicate DCNs.

The Declaration Control Number (DCN) is the number containing your

EFIN that uniquely identifies each tax return. TaxWise assigns the

DCN to a tax return the first time you create the e-file. Assigning the

DCN at this point is advantageous, as the DCN prints on Form

8453/8879 if you create the e-file before you print the return. In

addition, the DCN does not change, regardless of how many times you

edit and create a new e-file for the return.

The number in the Current Declaration Control Number (DCN)

box on the General tab increases by one number every time

you create a tax return e-file for a new Social Security number.

For example, if you have two non-networked computers in your office

and a laptop that you use in clients’ homes, and you estimate that you

will complete no more than 1000 returns on each machine, logical

settings for your DCNs might be as follows:

Point out

these notes.

Reference

class to

course book.

Computer 1 – enter 1000

Computer 2 – enter 2000

Computer 3 – enter 3000

If the computers are not networked, you must designate one

computer as the transmitting computer and send all your returns

and get all your acknowledgments on that computer. We will

cover moving returns from one computer to another later in this

course.

3. Select Do NOT auto number, which prevents the Price Sheet from

loading in the initial tree.

34

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

4. Select any or all of the following Miscellaneous options:

Option

Description

Enable AutoComplete for

entries with history

lists

Allows you to type the first character or first few

characters of an entry and TaxWise autocompletes the entry for you.

Display UserDefined and AutoPopulated history

lists

By default, this option is the only one selected.

This option does not affect your ability to see and

use pre-defined history lists, such as Relationship

to You for dependents.

Automatically

display history lists

Causes the history list to open automatically when

you are on the entry.

Under

Miscellaneous

options, make

sure that the

option Display

User-Defined

and AutoPopulated

history lists is

checked. If not,

you will not have

access to any of

the drop-down

lists.

This is the

default option for

the IRS.

5. Click the Next button to proceed to the Printer Setup tab.

Entering Printer Setup Information

TaxWise displays the Printer Setup tab of the Setup Options dialog

box:

The Printer Setup tab determines the default behavior of many

TaxWise functions.

© 2006 Universal Tax Systems, Inc.

35

Chapter 1: Installing and Configuring TaxWise

Some print behaviors not controlled by the Printer Setup tab include

the following:

The Declaration Control Report (DCR) always prints to screen

first. You must print a paper copy by clicking the print icon at the

top of the Print Preview screen.

Reports print to screen unless you change the destination on

the Report Criteria window.

To complete the Printer Setup tab, use the following steps:

Select

Windows.

Point out

difference

between

Windows and

PCL.

1. Select a default printing method by doing one of the following:

If you use an inkjet printer, or if you have no problems with

Windows printing, select Windows.

If you have experienced problems with Windows printing,

select PCL.

2. Select a default printer for each of the printing options by selecting

a printer from each respective drop-down list.

This list of printers is generated from the list of printers Windows

indicates are attached to your system.

Point out

notes.

By default, TaxWise displays your Windows default printer in

each drop-down list. If you need to select a different printer, or if

you want to select different printers for each item, select those

from their respective drop-down lists.

Select from the following additional printing options:

36

Option

Description

Print blank page after

EACH tax return or

report?

Selecting this option inserts a blank sheet

between returns or reports when you print more

than one.

Print tax returns in

ALL CAPITAL

LETTERS?

Some states require that form data be typed in

all capital letters. This option automatically prints

your typed data in all capitals, regardless of how

you entered it.

Collate multiple

copies of tax returns?

This option is selected by default. It is possible

that clearing this checkbox may speed up

printing. THIS APPLIES ONLY TO CLASSIC

PRINT.

If you have more than

one, print each EFIN

on separate report

pages?

By default, returns are grouped by EFIN in

management reports. Selecting this option

inserts a page break between EFINs.

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

Option

Description

Auto load soft fonts

each time a tax return

is sent to the printer?

This option is selected by default when you

choose PCL printing. Selecting this option

ensures that laser forms print correctly. If you

see stray letters, such as j or k, or odd

characters on your forms, select this option.

Print EACH rejected

SSN on separate

pages

Selecting this option prints reject messages for

each return on a separate page when you print

IRS acknowledgments that involve rejected

returns.

Automatically print

form 9325 as each

IRS tax return is

acknowledged?

Selecting this option prints Form 9325 for each

accepted return at the time you process the

acknowledgment.

Show a screen

shot of what this

looks like (slide).

3. Click the Next button to proceed to the Indirect Transmitter tab.

© 2006 Universal Tax Systems, Inc.

37

Chapter 1: Installing and Configuring TaxWise

Entering Indirect Transmitter Information

All sites are Indirect Transmitters.

Make sure

that you

change back

to Internet

protocol after

showing the

modem

option.

TaxWise displays the Indirect Transmitter tab of the Setup Options

dialog box:

The IRS tollfree modem

number is 1800-829-5945.

The Indirect Transmitter tab allows you to configure your

communications information so you can communicate with the

TaxWise Electronic Filing Center (EFC).

Point out note

and warning.

You can also send TaxWise Mail to Customer Support if you do

not have your own e-mail provider and connect to the EFC to

pick up e-mail from UTS.

If you communicate with the EFC via your Internet Service

Provider, accept the default setting on this page, click the Next

button, and proceed to the Direct Transmitter tab.

To complete the Indirect Transmitter tab, do one of the following:

If you want to use the default Internet protocol (this is also

128-bit SSL), select Use default internet protocol for

communications.

38

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

If you do not connect to the EFC via the Internet select Use

modem and then select your modem from the drop-down

list.

Begin each telephone number with the number, if any, that you

must dial to obtain an outside line.

Use commas to wait for a dial tone, and use colons to pause. If

necessary, enter a comma after the outside line access code

and before the phone number to pause the dialing process.

Write an

example of

how this would

work on the

whiteboard.

Point out note

with phone

number.

You can use hyphens or spaces for clarification; however,

TaxWise and your modem will ignore them. Do not use any

other punctuation in the telephone number.

The toll-free transmission number is 1-800-839-5945.

Click the Next button to proceed to the Direct Transmitter tab.

Entering Direct Transmitter Information

TaxWise displays the Direct Transmitter tab of the Setup Options

dialog box:

If they make any

changes to

Direct

Transmitter,

they get an error

when exiting the

setup

information that

they are missing

company

information. It

primarily just

causes

confusion in the

field.

DO NOT CHANGE ANY INFORMATION ON THE DIRECT

TRANSMITTER TAB.

© 2006 Universal Tax Systems, Inc.

39

Chapter 1: Installing and Configuring TaxWise

Entering Color Setup Information

Point out first

sentence.

Classic color setup is recommended for all sites, and the CD you

receive will default to that color setup.

TaxWise displays the Color Setup tab of the Setup Options dialog

box:

What about

changing the

background

color for prior

year software?

For information on changing the options on your Color Setup

tab, see the chapter on Advanced Topics.

Click the Finish button to save your setup options.

40

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

Registering TaxWise

When you receive your software, you will also receive a

document that identifies your EFIN and TaxWise Registration

Code. For security purposes, the first two digits of your EFIN will

be replaced with two Xs, as illustrated below:

Explain EFIN.

XX0002

When you register your software, replace the two Xs with the first two

digits of your IRS-issued EFIN.

Once you have completed Setup Options, TaxWise displays the

Register Software box:

Enter reg

code.

Reg Code is

eight letters.

To register TaxWise, use the following steps:

1. Verify your EFIN in the EFIN/Customer Number box and press the

Tab key.

2. Enter your registration code in the Registration Code box and click

OK.

TaxWise displays the login page.

© 2006 Universal Tax Systems, Inc.

41

Chapter 1: Installing and Configuring TaxWise

Registering TaxWise to Transmit for Multiple Locations

Log in as Admin

user. Go to

Register

Software and

explain the

steps to set up

for multiple

EFINs.

If your site transmits returns for other sites, follow the steps in

this section.

To register TaxWise to transmit for multiple EFINs, use the following

steps:

1. After you have registered the EFIN and Registration Code for your

transmitting office, click Register Software on the Setup menu in

TaxWise Utility.

To access TaxWise Utility, click the Tools menu from the

TaxWise home page, and then click Utilities/Setup Options.

TaxWise displays the Register Software box:

2. Enter the EFIN for the next site in the EFIN/Customer Number box

and press the Tab key.

3. Enter the Transmit Code (also called XMIT Code) in the

Registration Code box and press the Enter key.

You can get the XMIT Code from the SPEC Manager or by

calling TaxWise Customer Support.

An EFIN’s Transmit Code is not the same as that EFIN’s

Registration Code.

Point out

warning.

4. Repeat these steps for each EFIN for which you will transmit

returns.

DO NOT change the EFIN on the Company tab in Setup

Options during tax season! Do not attempt to transmit returns

for another EFIN by changing the EFIN in Setup Options. This

will corrupt your TaxWise database.

Round out

chapter. Touch

on key points.

Call for

questions.

42

© 2006 Universal Tax Systems, Inc.

Chapter 1: Installing and Configuring TaxWise

Practice Exercise

Recap the

topics covered

in this chapter.

1. Install TaxWise to the C: drive of your computer.

2. Configure your setup screens using the EFIN displayed on your

name tent and your site contact, address, phone, and other

information.

Est.

completion

time = 10 min.

3. Register your software with the registration code that is on your

name tent.

© 2006 Universal Tax Systems, Inc.

43

Chapter 2: Getting Started

Chapter 2: Getting Started

In this chapter, you should learn how to:

Review

objectives and

call for

questions.

44

Start TaxWise.

Log in to TaxWise.

Navigate the home page.

Use the TaxWise menus.

Get help in TaxWise.