Instructor-Manual-Introduction-2.0

advertisement

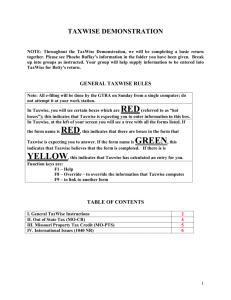

2016 Tax Season Scenario Based Training Instructor Manual Dear VITA Instructor, Thank you for volunteering to teach VITA volunteers. Your job is very important and without your support thousands of volunteers would not be prepared to assist tax filers at the tax sites. Many of you have been instructing for years, while others are new to instructing. We hope that Scenario Based Training 2.0 for VITA will augment your teaching curriculum (for those that are experienced) and for those of you that are new, will ease the planning and preparing stages of instructing. This revamped training came to fruition because volunteers continuously requested more hands-on training on the tax preparation software and it was recognized that this vital piece was important as volunteers started volunteering at tax sites. It is our hope that this new training will provide the students the necessary tools to be successful at our VITA sites and increase our volunteer retention. The key goals of this training are: 1. Learning based on “possible” client scenarios at a VITA site; 2. Learning how to navigate TaxWise; and 3. Learning how to effectively use the resource materials to apply proper tax law. How to use Scenario Based Training Curriculum to teach: 1. There are 6 client scenarios that will take the volunteers through topics covered in the Advanced Certification Test. Each scenario includes: Interview Notes; a filled out Intake & Interview sheet (13614-C); all tax forms and supporting documents for the client and their dependents (if applicable); and a copy of the completed 1040. 2. Each scenario is distinct and covers different tax law topics that will allow volunteers to prepare different client returns on TaxWise. 3. There are interactive opportunities at the end of each lesson to allow your class to come together to review the tax law covered, data entry into TaxWise and/or general questions to spark discussion. 4. There will be video links, which will be posted on the EKS website, which you can use to help supplement your training. 5. Scenarios will be outlined with icons for quick reference : Need to Know These are high level and need-to-know notes you’ll need to drive home with your students. This information has been drawn out for quick reference for instructors and should be revisited if needed. Video Opportunity These links to videos can be found on the EKS website. These videos have been vetted and/or created by EKS to be shown during training OR given as homework. Use your Resources Page/section in resources are called out for quick reference for instructors. The key is to continually come back to the use of resources so volunteers feel comfortable using it. TaxWise Entry Items with this icon are meant to pause from teaching tax law and taking some time to work on TaxWise and practice inputting tax client information. Knowledge Check This section will provide instructors with questions at the end of each lesson that can be used to check the class’s understanding of the material taught. These questions can also be used to have discussions to clarify tax law confusions or questions. What does each scenario cover? Each scenario will contain: the lesson, client interview & intake sheet, client interview notes, client documents and completed 1040 for the scenario. Each scenario has an overview that contains information about the tax law topics that will be covered in scenario, the ojectives, materials to use and scenario overview for the instructor. How to prepare for each lesson? This curriculum requires instructors to prepare and coordinate the use of resource material, TaxWise and instructing tax law. The curriculum is meant to guide the instructor but does not take the place of prior preparation of delivery of material. It is recommended that instructors spend time preparing to teach and using the scenarios as a foundation. Remember… “You are prepared enough if you are able to pay more attention to what the class knows than to what you yourself do or do not know. If you are able to improvise and respond to the class's true state while making clear progress toward defined goals, then you are prepared enough.” -Center for Teaching & Learning https://teaching.uchicago.edu/?/ctl-archive/course-design-tutorials/preparing-to-teach Class management is critical to using SBT, how will you prepare? Things to consider when preparing… • Experienced volunteers can be a distraction to new volunteers, you may want to think about sitting the experienced volunteers together or make it real clear that they should not be distracting new volunteers from learning the material or having side coversations. • Test all online resources prior to starting. Especially TaxWise, Link and Learn and videos in the PowerPoint training slides. • Lay classroom ground rules early to eliminate distractions, e.g.: cell phone etiquette, bathroom breaks, food in lab, etc. • Clearly communicate that students need to be listening to instructions at all time, e.g.: usage of computers is permitted only when instructed by you. If you are demonstrating on TW, all volunteers should have their hands OFF their keyboard. • Encourage students to ask questions! How will this training be evaluated? Instructors will be given a link to an online evaluation of the course. In addition, we will ask instructors to evaluate the curriculum and give us information that we can use to stregthen it for next season. Instructors will not be required to collect a paper evaluation, but we do ask that you allot some time at the end of the training and encourage your students to evaluate the course. Evaluation results will be provided to instructors in early February.