Macro Economy

advertisement

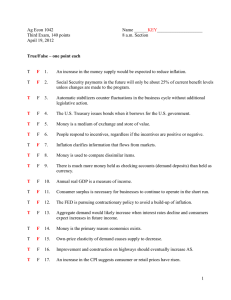

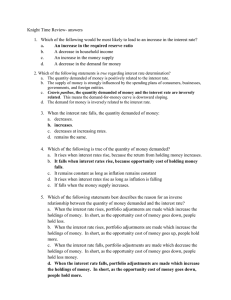

12.1 & 12.2 DOMESTIC AND GLOBAL MACRO-ECONOMY Domestic GDP Growth (total production of goods and services). Long-term US GDP growth rate of about 3% (pretty spectacular for a large mature economy). Last 5 years about 2%. Standard story touted is of economic prosperity, but why look at GDP? And not at GDP per capita ? Because it is tied to population growth. SGB-Macro-2010, Page 1 Japan has a declining GDP and a declining population but is better than US per capita! Somewhat the same story in Germany. Story for India is also not so good at 6.8% versus China (10.2%), the disparity is not so evident in GDP growth. Population growth hard to measure, ageing populations means productivity declines and higher pension costs, but worth a look. US estimates of recent quarter GDP are released monthly, revised as data comes in. Last 2 quarters of 2008 minus 5-6%, stimulus caused big jumps in 2009, Q-2, 2010 estimate 1.6% on Friday, August 27, market in a bit of a funk!!!! This is why there is so much worry about consumers ! SGB-Macro-2010, Page 2 See it as a lagging indicator. Seems to spike during recessions (shaded), not a smooth response to slowing growth. Productive resources become idle and fairly quickly. So recessions do matter, despite the long-term trend of growth. Numbers will get worse before they get better! Inflation: SGB-Macro-2010, Page 3 Flaws in the CPI (even WSJ notices now!!!!) : Component Weight In CPI Calculation Housing Food Transportation Energy Medical Education/Communication Recreation 38.0% 17.2 12.9 8.7 6.3 6.0 5.5 a) Core rate excludes food and energy (hangover of 70’s oil crisis). Long run, these are more likely to be transitory, why should the Fed be heavy handed if that is the case? b) Hedonics—take out the value of quality improvements to goods and services to more “accurately” capture a price change. Compounded by a heavier weighting attached to items dropping in price as people will substitute? Together understate inflation.. c) median or mean CPI, trimmed to eliminate outliers. PCE (personal consumption expenditure deflator). Updated more frequently than Core CPI, very popular with the Fed. d) Housing prices are measured as rent equivalents. In the 2000’s as people bought houses, rents were low so measuring housing costs as rent equivalents kept inflation numbers down. Today, the reverse is true perhaps even distorting upwards !!! Deflation:The good kind=> supply side, prices fall due to oversupply, cost –cutting and productivity rises (the US we hoped once?) The bad kind=> demand side, consumer spending and confidence decline, business investment suffers (Japan, are we like them?) Stagflation ??? slowing growth, higher inflation, high unemployment. TIPS rates: Mention AUGUST 2010-Bond Bubble Chatter. SGB-Macro-2010, Page 4 Interest rates: Budget Deficits: Increasing, SGB-Macro-2010, Page 5 rate of change also increasing in the last few years: but of late, trade deficits shrinking a bit due to weaker dollar! Consumer sentiment. (Do you really need this? Besides it’s fickle) WHY SAVE WHEN REAL INTEREST RATES ARE LOW ? BUT INCREASING NOW AS DELEVERAGING TAKING PLACE. AND HOW ABOUT ACTUAL SPENDING LEVELS? 12.3-12.4 INTEREST RATES, DEMAND AND SUPPLY SGB-Macro-2010, Page 6 There are many interest rates, prime rates, treasury rates, mortgage rates, some are long-term some are short term, generally tend to move together locally and now globally (recall the convergence trade!). Will talk about theories regarding them when we do bonds! For now, focus on how policy affects these. Supply of funds: savers will increase if real interest rates are higher, i.e. benefits to deferring consumption into the future. Demand for funds from business - will borrow if real interest rates are lower. Government : will affect both: higher budget deficits increase the demand for funds and therefore interest rates. Fed policy offsets these by increasing money supply which adjusts nominal rates. Inflation increases if demand levels are beyond the productive capacity of the economy. Demand shocks are: reduced taxes, export demand, budget deficits. Supply shocks are: oil prices, commodity prices both reduce productive capacity. 12.5 Monetary policy (easy to implement/reverse, takes time) Increases (decrease) in growth of money supply. Adjust short-term rates via open market transactions in T-bonds. Worked well the last 3 times, 1975, 1982, 1991. Typically precedes business expansions (contractions) by 8 (20) months. Worked so well that growth/employment targets get ambitious, triggering possible inflation. So Fed became pro-active, raising rates to slow economy to head off inflation. SGB-Macro-2010, Page 7 11 cuts in 2001-2002, from 6.5%. After Sep 11, Fed provided more liquidity via repos. Effective overnight rates were close to 0. Since then 12 hikes. Now credit crunch issues have distorted everything. b) Fiscal policy (hard to implement/reverse, works quickly) Tax relief (been there, done that). Deficit spending, keeps long-term interest rates high. c) Supply side –policies Both above policies are demand-side to push economy to achieve full employment equilibrium. In contrast, supply side policies address the economy’s productive capacity and devise incentive schemes to encourage growth. 12.6 Business Cycles Bonds prices Wages cost > price growth stock defensive sales profits low inventory, overcap. Seven years of plenty and seven years of lean ! SGB-Macro-2010, Page 8 Its death has been proclaimed several times, most recently in the late 1990’s. (postWW-II boom caused the Commerce dept to rename the Business Cycle Digest to the Business Conditions digest) Has been more subdued in the last 20 years (10% of the time in recessions versus 40% of the time in the previous 90 years due to a) decreasing variability of output: agriculture => manuf => services. b) inventory control, c) globalization, c) better monetary and fiscal d) financial and banking deregulation. Q. Why cylical downturns even if periodicity not predictable? Exogenous (rising oil prices in 9 out of last 10 post-war, 9-11) Animal spirits (Keynes, insufficient demand, market failure as business investment swings from optimism to pessimism, jobs and incomes fall amplifying the above, unemployment rises, needgovt). Excessive supply, overinvestment, mismatch with savings. Policy mistakes (Fed actions first allow economies to overheat and then apply the brakes too hard). Q. NBER Indicators Leading, lagged and coincident. Common convention that GDP decreases in 2 consecutive quarter implies recession! Recently dated as 2 quarters of 2001. Generally, leading indicators appear to increase 3-4 months prior to a recovery and decrease 7-8 months prior to a downturn. Skeptics claim ‘stock prices forecast 9 of the last 5 recessions.” Diffusion indexes focus on the number of indicators that are up (or down) rather than the magnitude. SGB-Macro-2010, Page 9 Q. CHANGING EXPECTATIONS! In 2000 = talk of New Economy, end of business cycle, driven by productivity growth and technology. In 2002 = talk of L, U or V shaped economic recovery. In 2004 = scenario of slow to stagnant, parallels to Japan being taken more seriously. In 2005 = ITS BACK !! In 2007 = HOW BAD IS IT GOING TO BE ? SGB-Macro-2010, Page 10 EXTRA: INDICATORS FROM FINANCIAL MARKETS `PEOPLE HAVE BEEN BUYING STOCKS! BUT HOW LONG ARE THEY HOLDING THEM? SGB-Macro-2010, Page 11 A QUICK LOOK AT VALUATIONS SGB-Macro-2010, Page 12 Stock prices too optimistic relative to earnings (2-years ago)? CURRENT CONCERNS 1. 2. 3. 4. 5. Have policy makers given up on the dollar? Is anyone else but the government spending at all? China buying up commodities? Is risk being “re-priced?” Last few years of “jobless” recovery—happened before in 199091. Productivity increases are slowing, M/A attracted extra corporate cash. 6. How about inflation in asset prices? Said this about equities in 1999-2000, about housing the last few years? 7. Bernanke’s global savings glut? Bit of a copout. 8. High debt and deficits (surpluses projected pre-Bush)—permissible in bad times, causes crowding out. Okay if GDP growth was more investment than consumption and/or overseas financing was more investment than buying T-bonds. SGB-Macro-2010, Page 13 SGB-Macro-2010, Page 14 RAY OF HOPE…Perhaps tax revenues will increase more than projected in the future, as the 11 trillion in boomer IRAs, 401K’s and pensions become taxable? OR! SGB-Macro-2010, Page 15 12.7 INDUSTRY ANALYSIS Can do a life-cycle analysis of the industry to isolate likelihood of dividend payments: Growth phase = no dividends Consolidation = growing dividends Maturity phase = steady/constant dividends Sectors and the economy (again each time a little different) a) Most correlated with expansions and contractions Capital goods (factory machinery, aircraft) Consumer cyclical (auto, housing) Technology (computers, telecom) Transportation (airlines, shipping) Best time to buy: growth has slowed and rates falling Worst time to buy: as fast growing economy slows b) Sectors that do well at end of expansions Basic materials (steel, aluminium) Energy (oil, natural gas) c) Sectors that do well when the economy slows Financial services Utilities d) Sectors best when heading into a recession Consumer staples (food, toothpaste) Healthcare (drugs, HMOs) Longer term: focus on whether earnings estimates are likely to be cut, maintained, or will go but up. Shorter term: are earnings surprises priced in? Not much bad news last week, Alcoa and a couple of others. Is silence REG-FD at work? SGB-Macro-2010, Page 16 A Merrill Lynch Model INFLATION BOTTOMS Cyclical Growth Cyclical Value TMT MINING OIL GROWTH EXP. BOTTOM Defensive Growth STOCKS COMMOD PHARM UTILS INSURANCE FOOD GROWTH EXP. PEAKS Defensive value INFLATION BONDS PEAKS CASH SGB-Macro-2010, Page 17