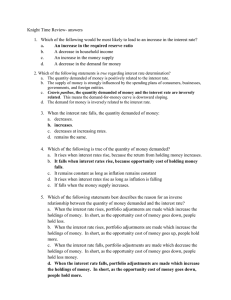

Exam 3a

advertisement

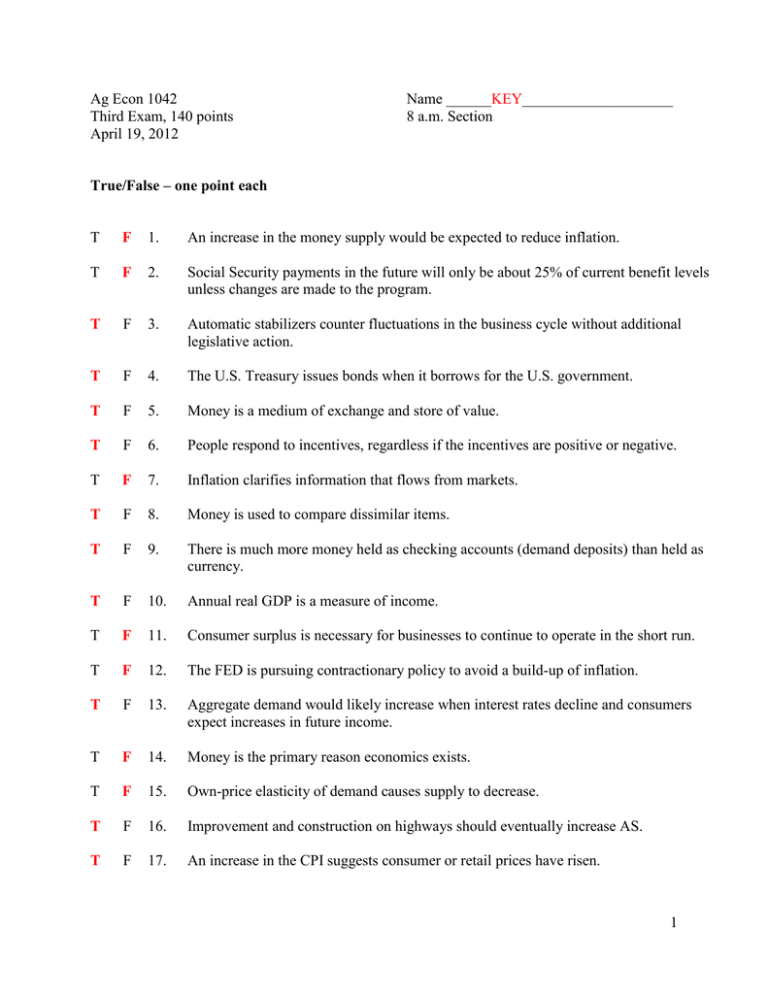

Ag Econ 1042 Third Exam, 140 points April 19, 2012 Name ______KEY____________________ 8 a.m. Section True/False – one point each T F 1. An increase in the money supply would be expected to reduce inflation. T F 2. Social Security payments in the future will only be about 25% of current benefit levels unless changes are made to the program. T F 3. Automatic stabilizers counter fluctuations in the business cycle without additional legislative action. T F 4. The U.S. Treasury issues bonds when it borrows for the U.S. government. T F 5. Money is a medium of exchange and store of value. T F 6. People respond to incentives, regardless if the incentives are positive or negative. T F 7. Inflation clarifies information that flows from markets. T F 8. Money is used to compare dissimilar items. T F 9. There is much more money held as checking accounts (demand deposits) than held as currency. T F 10. Annual real GDP is a measure of income. T F 11. Consumer surplus is necessary for businesses to continue to operate in the short run. T F 12. The FED is pursuing contractionary policy to avoid a build-up of inflation. T F 13. Aggregate demand would likely increase when interest rates decline and consumers expect increases in future income. T F 14. Money is the primary reason economics exists. T F 15. Own-price elasticity of demand causes supply to decrease. T F 16. Improvement and construction on highways should eventually increase AS. T F 17. An increase in the CPI suggests consumer or retail prices have risen. 1 T F 18. GDP growth in China could be much faster than expected growth in the U.S. or Germany. T F 19. The primary goal of the economy is to generate economic growth. T F 20. Market transactions allow both parties to be better off than before the transaction or trade. T F 21. The CPI is used to establish the COLA for Social Security. T F 22. Inflation creates an increase in purchasing power for the holders of money. T F 23. The marginal tax rate will be lower than the average tax rate if the tax is progressive. T F 24. A restaurant will increase its revenue if it raises meal prices and demand for those meals is price elastic. T F 25. Options for fiscal stimulus include reducing government purchases and raising taxes. T F 26. Gasoline prices are rising despite falling consumption of gasoline in the U.S. T F 27. Credit card accounts are part of the money supply. T F 28. Banks make profit from borrowing money and then lending that money to others. T F 29. A bond is a debt of the organization or institution issuing the bond. T F 30. Bond prices move the same directions as interest rates. 2 Multiple choice – two points each __D___ 31. The growth and contraction in the production of goods and services over time a) Makes long term planning simpler b) Reduces unemployment c) Increases GDP growth in the long run d) Suggests macroeconomic policy may help stabilize the economy e) None of the above __E___ 32. Financial intermediaries a) Help individuals get loans b) Reduce risk in getting loans c) Make getting loans less costly d) Get their profit primarily through making loans e) All of the above __C___ 33. The CPI a) Measures input price changes b) Is used to determine GDP changes c) Will increase when AD increases d) Weights all items equally e) None of the above __D___ 34. The U.S. debt can be reduced a) By cutting the deficit in half b) By reducing spending and taxes equally c) Easiest during a recession d) Only after the deficit has been eliminated e) None of the above __C___ 35. Structural unemployment a) Causes the business cycle b) Is welcomed by workers c) Is necessary for long term economic growth d) Promotes inefficient resource use e) None of the above 3 Matching are valued at one point each F Expansion A Financial intermediaries D Trough B Value of a country’s output C Consumer surplus C Net value from a market for buyers X Consumer confidence D Bottom of cycle M Federal Reserve E Gross income R Debt F Economic growth time period W Fiscal policy G Excess supply of output at a particular price T Frictional unemployment H Measure of quantity response to price change H Own price elasticity I Output/worker U Investment J Price level increase resulting from increases in purchasing N Interest rate K A recurring situation for a nation’s output A Banks L Willingness and ability to sell at various prices S Inflation M U.S. national bank L Supply N Price of money J Demand pull inflation O A situation that is currently stable Q Resources P Directed by FED O Equilibrium Q Inputs E Revenue R Accumulated deficits minus surpluses V Opportunity cost S Increase in overall price level K Business cycle T Worker created I Productivity U Profits increase this G Surplus V What exists with every decision Y Scarcity W Taxation and government spending B GDP X Determinant of personal consumption P Monetary policy Y Wants exceed resources 4 Short answers are valued at five points each 61. What is the price of money? Interest rate 62. What are the three characteristics of money? 1. Medium of exchange 2. Store of value 3. Standard of measure or unit of account 63. What would prompt the FED to push interest rates higher at the next meeting? Inflation or inflation potential 64. An increase in the CPI tells us the typical consumer is facing what? Inflation 65. What is the immediate effect of an increase in government expenditures? AD ↑, rGDP ↑, PL ↑ 66. What is the FED’s most important function? Controlling money supply or quantity of money 67. What do we call it when a worker can produce more output per day? ↑ productivity 5 68. Completely diagram the market scenario where the price of corn increases as supply increases. Show initial consumer surplus. $/Q S S1 P1 P0 D1 D 0 Q0 Q1 Q 69. The increase in overall price level is called __inflation____________________________. 70. Current evidence of consumption and AD increases has been the increase in ____retail_____________________ ____sales______________________ 71. How would we estimate inflation for 2010 using the Consumer Price Index (CPI)? Be specific. CPI10 – CPI9 x 100 = inflation CPI9 Ten point questions 72. Regarding monetary policy a) What are open market operations? Buying and selling of bonds by FED b) How does the FED use open market operations to stimulate the economy? Buying bonds increases money supply Selling bonds decreases money supply c) Given a weak labor market and slow growth, what has the FED done more of in terms of open market operations? Buying bonds 6 73. What is the impact of the following changes in macroeconomic policy on aggregate demand and aggregate supply? Include both short and long run changes. Increase (↑), decrease (↓), or no change (blank). Change Reducing taxes AD ↑ Reduce money in circulation ↓ Increased spending on education ↑ Paying off part of the federal debt ↓ Increase in safety regulation AS ↑ ↑ ↓ 7