Solutions to Problem Set for Lectures 3-4:

advertisement

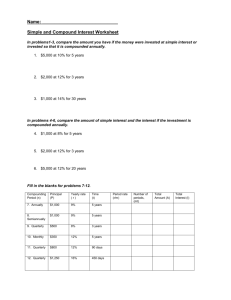

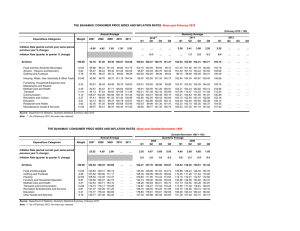

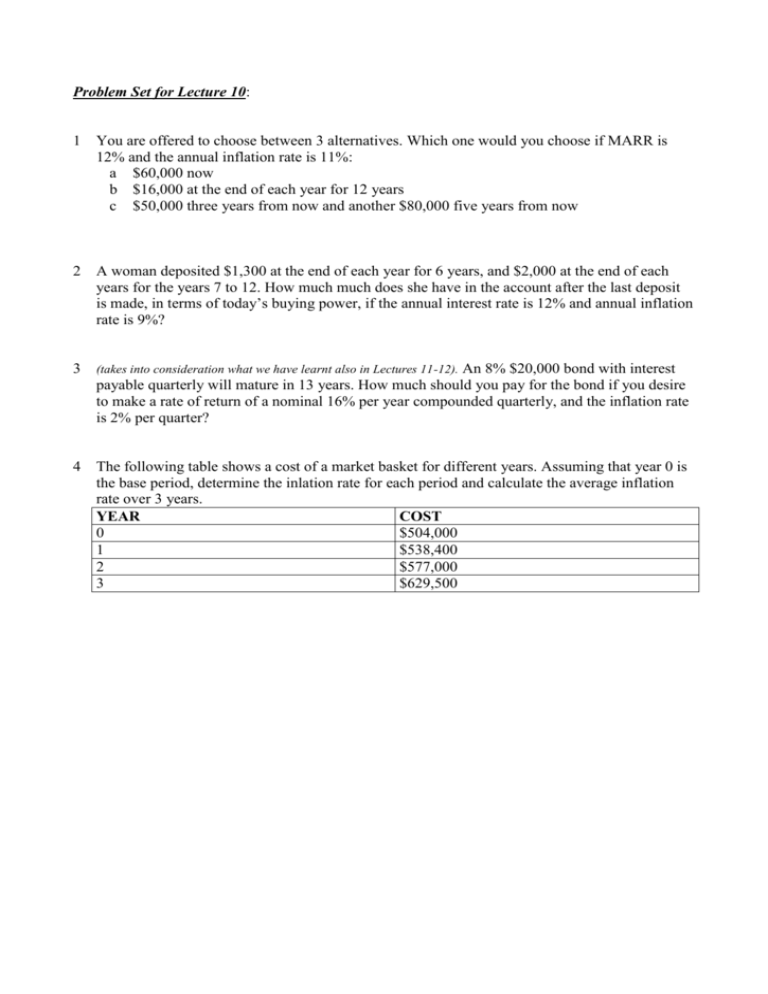

Problem Set for Lecture 10: 1 You are offered to choose between 3 alternatives. Which one would you choose if MARR is 12% and the annual inflation rate is 11%: a $60,000 now b $16,000 at the end of each year for 12 years c $50,000 three years from now and another $80,000 five years from now 2 A woman deposited $1,300 at the end of each year for 6 years, and $2,000 at the end of each years for the years 7 to 12. How much much does she have in the account after the last deposit is made, in terms of today’s buying power, if the annual interest rate is 12% and annual inflation rate is 9%? 3 (takes into consideration what we have learnt also in Lectures 11-12). 4 The following table shows a cost of a market basket for different years. Assuming that year 0 is the base period, determine the inlation rate for each period and calculate the average inflation rate over 3 years. YEAR COST 0 $504,000 1 $538,400 2 $577,000 3 $629,500 An 8% $20,000 bond with interest payable quarterly will mature in 13 years. How much should you pay for the bond if you desire to make a rate of return of a nominal 16% per year compounded quarterly, and the inflation rate is 2% per quarter?