Homework 1

Homework 1

Economics 503

Foundations of Economic Analysis

Practice

Module 1

1.

Luxury Goods We observe the income of the consumers of diamond rings increase by 10%. We observe that the equilibrium consumption of diamond rings goes up by 5%. Assume that nothing else happens to cause a change in the equilibrium in the diamond ring market. Explain why, we can infer that diamond rings are normal goods, but why we can’t say if they are income elastic luxury goods or income inelastic. Use at most 1 paragraph and 1 graph.

2.

Energy Markets For reasons of safety, the Chinese government orders the closure of 75% of the coal mines currently operating in the PRC. Draw a graph of the effect of this on closure on the world coal market. Draw a graph of the effect of this on the world oil market. Explain your graphs in 1 paragraph or less.

3.

Equilibrium: Algebra The demand for widgets is represented as Q

D

= 100 – 8 P and the supply of widgets are given by Q S = 40 + 4P. Calculate equilibrium price and quantity. Calculate the change in equilibrium price and quantity if a shift in the demand curve gives a demand schedule of Q

D

= 124 – 8 P .

4.

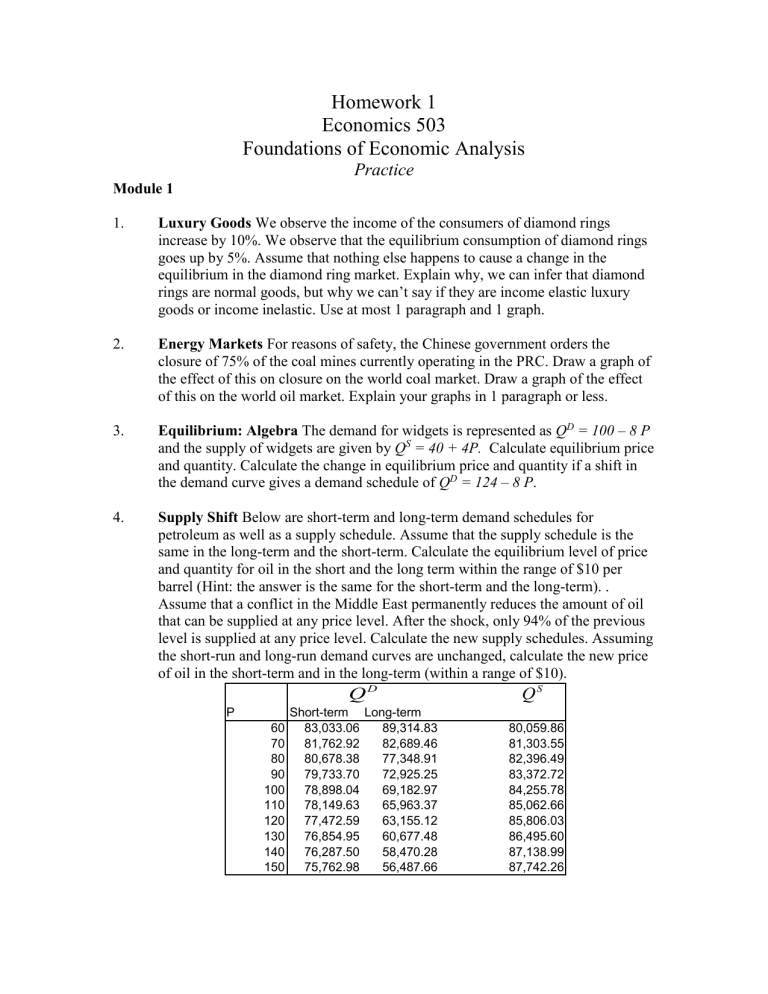

Supply Shift Below are short-term and long-term demand schedules for petroleum as well as a supply schedule. Assume that the supply schedule is the same in the long-term and the short-term. Calculate the equilibrium level of price and quantity for oil in the short and the long term within the range of $10 per barrel (Hint: the answer is the same for the short-term and the long-term). .

Assume that a conflict in the Middle East permanently reduces the amount of oil that can be supplied at any price level. After the shock, only 94% of the previous level is supplied at any price level. Calculate the new supply schedules. Assuming the short-run and long-run demand curves are unchanged, calculate the new price of oil in the short-term and in the long-term (within a range of $10).

Q

D

Q

S

P Short-term Long-term

60 83,033.06

89,314.83

70 81,762.92

80 80,678.38

82,689.46

77,348.91

90 79,733.70

100 78,898.04

110 78,149.63

120 77,472.59

130 76,854.95

140 76,287.50

150 75,762.98

72,925.25

69,182.97

65,963.37

63,155.12

60,677.48

58,470.28

56,487.66

80,059.86

81,303.55

82,396.49

83,372.72

84,255.78

85,062.66

85,806.03

86,495.60

87,138.99

87,742.26

5.

Equilibrium: Tabular A market faces a demand function of the form

Q

D

28 .2

P and a supply function of the form Q

S

10 .2

P . Use these functions to fill out a supply and a demand schedule. Identify the equilibrium price and quantity.

P Quantity

Demanded

Quantity

Supplied

20

25

30

35

40

45

50

6.

Revenue and Elasticity Posit a simple demand curve for breakfast cereal of the form Q = 100 - 5P where Q is the quantity of breakfast cereal and P is the price per box. Calculate Q and Revenue (R) at each of the following price points. What is the price elasticity of demand as we move from price point to price point (use the mid point method)? What is the price point where revenue is largest? Explain why raising prices above that point does not increase revenues.

Price Q R evenue Elasticity

5

6

11

12

13

14

15

9

10

7

8

;

Module 2

1.

Real Hong Kong Box Office . It is 2004. You are analyzing the profitability of

Hong Kong’s movie industry. You hear that Steven Chao’s Kung Fu Hustle is the top grossing Hong Kong film of all time. You are given a list of local gross box office receipts for a number of Hong Kong movies.

1. Kung Fu Hustle

2. Shaolin Soccer

3. First Strike

4. Rumble In The Bronx

5. Infernal Affairs

6. God of Gamblers Return

7. Justice My Foot

8. All's Well, End's Well

9. Thunderbolt

10. Mr. Nice Guy

11. Fight Back to School

12. All for the Winner

13. Drunken Master II

14. God of Cookery

15. God of Gambers II

16. Flirting Scholar

17. All's Well, End's Well 1997

Box Office Revenues

HK$60,830,000

HK$60,770,000

HK$57,519,000

HK$56,911,000

HK$55,030,000

HK$52,540,000

HK$49,880,000

HK$48,990,000

HK$45,650,000

HK$45,420,000

HK$43,830,000

HK$41,330,000

HK$40,970,000

HK$40,860,000

HK$40,340,000

HK$40,170,000

HK$40,160,000

1992

1995

1997

1991

1990

1994

1997

1990

1993

1997

Year

2004

2001

1996

1995

2003

1993

1992

Year

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

CPI

63.5

70.8

77.4

84.0

90.8

98.7

104.6

110.6

113.5

109.8

106.6

104.8

101.4

99.3

99.3

(Source: www.Asianboxoffice.com)

Adjust these for inflation using the Hong Kong CPI. Convert all of these film grosses into 2004 dollars (i.e. use 2004 as the reference year) and rank the films by their grosses in 2004 dollars.

2.

Construct a CPI You are given some statistical accounts for the country of

Fruitopia which produces two goods, Apples and Oranges. The accounts contain information on the price of apples and the price of oranges for the years 1995 to

2005. You are asked to calculate a CPI, nominal GDP, real GDP and the GDP deflator using 1995 as the base year. Note that there is no investment, government spending, exports or imports in Fruitopia so GDP is equal to consumption.

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

Apples price

$1.00

$1.10

quantity

100

105

$1.21

$1.33

$1.46

$1.61

$1.77

$1.95

$2.14

$2.36

110

115

120

125

125

130

135

140

Oranges price

$2.00

$2.40

quantity

100

105

$2.88

$3.46

$4.15

$4.98

$5.97

$7.17

$8.60

$10.32

100

100

100

95

90

90

85

80

2005 $2.59

145 $12.38

75 a.

Calculate the CPI. The representative market basket for the Fruitopian consumer is 100 apples and 100 oranges. Calculate the cost of this market basket in 1995. The CPI in subsequent years is the price of this same market basket (100 apples and 100 oranges) relative to price of that basket in the base year (multiplied by 100). b.

Calculate the nominal GDP which is the sum of the market value of apples

(price × quantity) plus the market value of oranges in each period. c.

Calculate real GDP which is the sum of the market value of apples calculated using the 1995 price (1 × quantity of apples) plus the value oranges calculated using the 1995 price (2 × quantity of oranges). d.

Calculate the GDP deflator as the ratio of the nominal GDP to the real

GDP. e.

Calculate the average inflation rate over the period of 1996-2005 using both price measures. Which price index increases the most over time?

Explain. Notice that the market basket has switched toward apples whose price has not risen sharply over time.

CPI

CPI

Inflation

N/A

Nominal Real

GDP GDP

GDP GDP Deflator

Deflator Inflation

N/A

3.

Deflate Soccer Transfer Fees In European soccer leagues, teams will acquire players from other clubs by agreeing to pay a transfer fee. The below table shows the top 10 transfer fees paid by English Premier League sides along with the fee paid measured in British pounds and the year of the transfer. Use the accompanying table with the British CPI to convert all transfer fees to 2008 pounds. Who has the highest transfer fee in constant dollar terms?

1

2

3

4

5

6

7

8

9

Player

Robinho

Dimitar Berbatov

Andriy Shevchenko

Rio Ferdinand:

Juan Sebastian Veron: Lazio

Michael Essien

Didier Drogba:

Wayne Rooney

Shaun Wright-Phillips

10 Fernando Torres:

From:

Real Madrid

Tottenham

AC Milan

Leeds

Lyon

Marseille

Everton

Manchester City

Atletico Madrid

To

Manchester City

Fee Year

£32.50m 2008

Manchester United

£30.75m 2008

Chelsea £30m 2006

Manchester United

£29.1m

2002

Manchester United

£28.1m

2001

Chelsea

£24.43m 2005

Chelsea £24m 2004

Manchester United

£23m

2004

Chelsea

Liverpool

£21m

2005

£20m 2007

4.

2000

British CPI

93.7

2001 94.7

2002

2003

96.3

97.5

2004

2005

2006

2007

99.1

101.0

104.0

106.2

2008 109.5

4.

Cakeland GDP An economy called Cakeland produces three products at three separate products: cake mix, frosting, and birthday cakes. All of the cake mix and frosting are sold to the birthday cake company. The cake mix and frosting companies grow all the inputs they need to make their product; their only expense is wages. Define profits as the value of sales less wages and cost of inputs. The following charts outline the activities of each of these firms.

Cost of Inputs

Cake Mix

0

Frosting

0

Birthday Cake

$100 Cake Mix

$70 Frosting

$150

$400

Wages

Sales

$30

$100

$40

$70 a.

Solve for GDP using the expenditure method

Final Expenditure

Cake Mix

Frosting

Birthday Cakes

GDP b.

Solve for GDP using the production method

Cake Mix

Value Added

Frosting

Birthday Cakes

GDP c.

Solve for GDP using the income method

Wages

Income

Profit

GDP

Module 3

1.

Foreign Exchange Market. Diamonds are discovered in Australia. Foreigners want to buy these diamonds and need Australian dollars to do so. Assume that this discovery has no particular effect on Australian demand for foreign goods or assets. Draw two graphs of the Forex market: 1) Demonstrate the effect on the Australian dollar exchange rate if Australian monetary policy remains unchanged so the exchange rate is allowed to fluctuate; 2) Demonstrate the effect on the market if the Reserve Bank of

Australia conducts monetary policy to keep the exchange rate from changing.

2.

Stock Market Liberalization Consider an economy that operates a floating exchange rate. The government announces that next year, they will liberalize their stock market which will make investing in that economy more attractive in the future. Describe the effect of this announcement on the Forex market this year.

3.

Currency Board During much of the 1990’s, the South American country of

Argentina implemented a currency board system similar to Hong Kong with the

Argentine peso being fixed 1-to-1 with the US dollar. In January 2002, the Central Bank of Argentina abandoned the currency peg. Below are interest rates for the US dollar and money market interest rates for the Argentine Peso from 1995 to 2001.

1996

1997

1998

1999

2000

Peso US Dollar

Interest Interest

Rate Rate

6.23

5.14

6.63

6.81

6.99

8.15

5.2

4.9

4.77

6

2001 24.9

3.48

Calculate the expected exchange rate depreciation in every year (assuming that interest parity is true).

Module 4

1.

Loanable Funds Market Some economists argue that the savings behavior is not very responsive to the interest rate. Other economists argue that savings is strongly affected by the interest rate. Use the loanable funds framework for a large, closed economy. Compare the effect of expansionary fiscal policy (i.e. an increase in government deficits) on the interest rate and investment in A) an economy in which the supply of loanable funds (S) was inelastic with respect to the interest rate; with the effect in B) an economy in which the supply of loanable funds is very elastic. Draw a graph of each theory to show under which theory there is a bigger impact on investment and under which theory there is a bigger impact on the interest rate.

Module 5

1.

Using aggregate demand, short-run aggregate supply and long-run aggregate supply curves, explain the process by which each of the following economic events will move the economy from one long-run macroeconomic equilibrium to another. Illustrate with diagrams. In each case, what are the short-run and longrun effects on the aggregate price level and aggregate output? a.

There is a decrease in households’ wealth due to a decline in the stock market. b.

There is an increase in the wealth of households in the economy of a foreign trading partner.

2.

In 2005, a hurricane hit New Orleans, Louisiana, an important transportation and oil refining center in the USA, one of Hong Kong’s key for the petrochemical industry in that country. a.

Consider the impact of the recent hurricanes that devastated that city as a temporary supply shock for the USA. Discuss briefly, using one graph, the outcomes that we would have been likely to see in terms of goods markets in the USA as a result of this negative business cycle shock.

Analysts are also worried that the natural disaster might have had a negative impact on consumer confidence. Discuss briefly, using one graph, the differences in outcomes that we would observe if this demand side effect were stronger from the outcomes that we would observe if the supply side effects were dominant

Module 6

1.

The Liquidity Crisis and the Taylor Rule in Hong Kong. You are given the following Table listing the output gap, the CPI and the overnight HIBOR Rate in

Hong Kong.

Output Gap

2007Q4 xxx

2008Q1 0.049219808

CPI

2008Q2

2008Q3

2008Q4

2009Q1

0.0299929

0.013160519

-0.013435423

-0.063140353

Interest Rate Actual

Under Interest

Rate Inflation Taylor Rule

107.4 xxx

108.2 0.029795

xxx xxx

0.00781

110.1

107.7

109.6

109.5

0.00875

0.024375

0.00225

0.00375

2009Q2 -0.037229897

109.2

0.0013

2009Q3 -0.040702363

108.2

0.0013

a.

For each quarter, construct the inflation rate on an annual basis. This is obtained just by constructing the % growth rate of the price that occurs in a given quarter

P t

P t

1

P t

1 and then multiplying the result by 4. An example is constructed in the Table for the

1 st

Quarter of 2008. b.

Construct a hypothetical interest rate for HK with the Taylor rule using the CPI inflation. CPI data and an assumption of an inflation target of 2%. c.

Compare the interest rate with that observed in HK. Note that the interest rate has been below 1% in every quarter except the 2008Q3. Has the interest rate been higher or lower in HK than that suggested by the Taylor rule?

2.

Does the BOJ have a Taylor Rule? The following table shows numbers for

Japan’s inflation rate, output gap, and the uncollateralized call money interest rate for the years 1990 to 2000.

1990

1991

1992

1993

1994

1995

1996

1997

1998

Output

Gap

3.30%

4.09%

2.50%

0.51%

-0.87%

-1.20%

2.14%

2.32%

-1.48%

Actual

Inflation Interest Rate

3.02% 7.56%

3.22%

1.70%

1.26%

0.69%

7.48%

4.82%

3.18%

2.41%

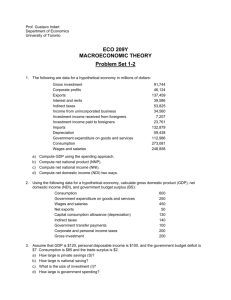

-0.12%

0.13%

1.75%

0.67%

1.15%

0.48%

0.52%

0.44%

1999 -2.46% -0.33% 0.06%

2000 -2.57% -0.71% 0.12% i.

Calculate the inflation gap (i.e. the difference between inflation and target inflation) in each period if Japan had used a target inflation rate of 2% in each year. What is the average inflation gap during the period 1990-1995

(inclusive) and for 1996-2000? ii.

Calculate the interest target, i

TGT

, for every period if the Bank of Japan had used a Taylor rule as specified in class. Compare this with the actual interest rate. Does the Bank of Japan adjust the target interest rate to domestic inflation and output? iii.

Some have argued that the BOJ was not aggressive enough in cutting interest rates in the early 1990’s to get the economy out of the slump. What was the average interest rate during the period 1992-1997? What was the average interest rate suggested by a Fed-style Taylor rule. Which was larger? iv.

What difficulties did the Bank of Japan have in implementing the Taylor rule in 1999 and 2000?

Production

Level

Module 7

1.

Costs of Running a Factory

You examine the production of an auto-parts factory which uses labor, materials and capital machinery referred to as a die press to produce goods. To start producing any goods, the factory has sunk set-up costs of $25,000 per year. Up to 300 die presses can be installed in the factory in increments of 50. The costs of owning and using a die press (including depreciation and financing costs) in a given year are $5,000 per press. Therefore, fixed costs are $25,000 plus $5000 times the number of die presses used. Die presses are varied in increments of 50. In addition, producing goods requires some variable inputs including materials, energy, and labor. Producing each good requires material and energy costs of $20 per unit. For various reasons, production can only be done in batches of 10,000 units. The following Table 1 reports the variable labor costs of producing different levels of output at different levels of die-press usage.

Table 1. Variable Labor Costs at the Auto Parts Factory

50

# of Die Presses

100 150 200 250 300

10000

20000

30000

40000

50000

60000

70000

80000

$121,904.74

$60,113.22

$501,327.80

$247,212.94

$163,477.55

$121,904.74

$1,146,431.10

$565,323.92

$373,838.72

$278,770.47

$222,023.30

$184,345.99

$2,061,688.19 $1,016,652.16

$39,751.81

$672,294.10

$3,250,269.77 $1,602,761.17 $1,059,877.64

$29,642.81

$501,327.80

$790,347.74

$4,714,646.67 $2,324,869.37 $1,537,395.02 $1,146,431.10

$23,608.65

$97,089.53

$399,276.34

$629,462.71

$913,060.90

$19,602.27

$80,613.45

$331,519.22

$522,642.99

$758,114.63

$6,456,848.58 $3,183,977.62 $2,105,508.13 $1,570,071.43 $1,250,464.01 $1,038,260.49

$8,478,600.52 $4,180,936.56 $2,764,779.45 $2,061,688.19 $1,642,006.11 $1,363,357.96

90000 $10,781,403.97 $5,316,486.60 $3,515,698.63 $2,621,646.48 $2,087,977.98 $1,733,648.48

100000 $13,366,589.17 $6,591,283.69 $4,358,699.41 $3,250,269.77 $2,588,637.25 $2,149,345.96

A.

Short-run The factory has set up 100 die presses. Fill in the Table 2 cost chart for the firm in the short term. Calculate the marginal cost for each level of production as the cost of producing one more batch (i.e. the cost of producing another 10,000).

B.

Long-run Now assume that the factory managers can vary the number of die presses. Calculate the average total cost function for each level of production for each # of die presses. For each quantity of die-pres ses, calculate the minimum average cost. For each level of production , calculate the minimum average cost and the number of die presses that would generate the lowest average total cost. Draw a diagram of those minimum points. Over what range is the firm operating according to increasing returns to scale? Over what range is the firm operating over decreasing returns to scale? What is the minimum efficient scale (i.e. what scale of production will result in the lowest overall level average total cost when we can vary energy, workers, and # of die presses)? At what number of die-presses is that minimum achieved?