403(b) and 457(b)

403(b) vs. 457(b)

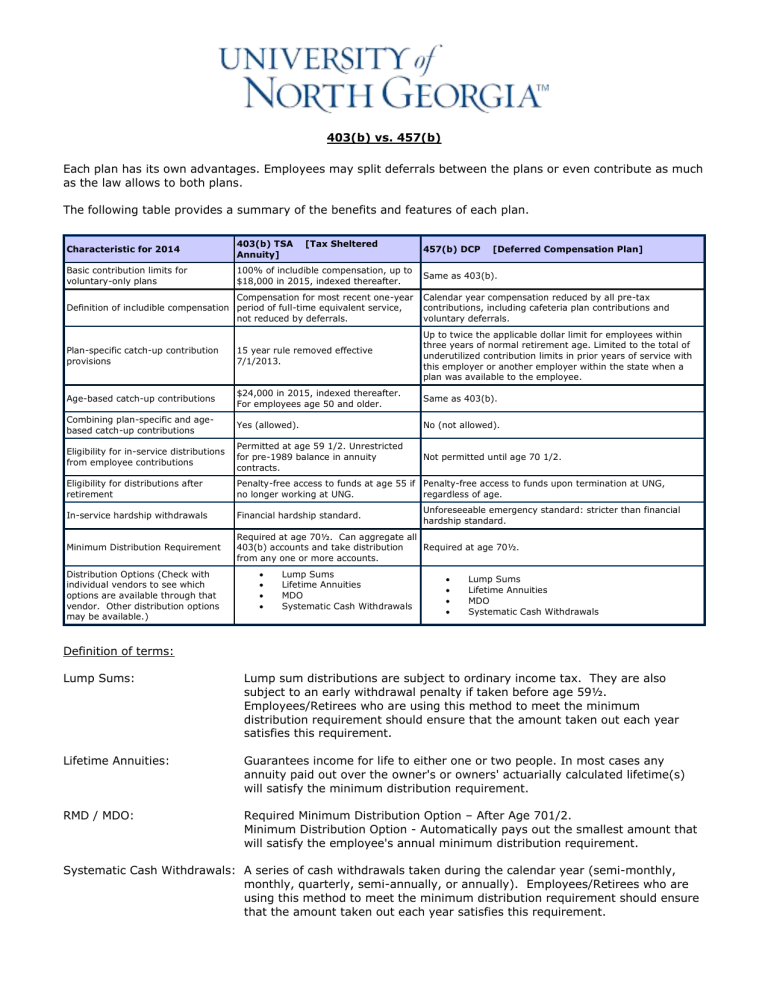

Each plan has its own advantages. Employees may split deferrals between the plans or even contribute as much as the law allows to both plans.

The following table provides a summary of the benefits and features of each plan.

Characteristic for 2014

Basic contribution limits for voluntary-only plans

403(b) TSA [Tax Sheltered

Annuity]

100% of includible compensation, up to

$18,000 in 2015, indexed thereafter.

Definition of includible compensation

Compensation for most recent one-year period of full-time equivalent service, not reduced by deferrals.

Plan-specific catch-up contribution provisions

15 year rule removed effective

7/1/2013.

457(b) DCP [Deferred Compensation Plan]

Same as 403(b).

Calendar year compensation reduced by all pre-tax contributions, including cafeteria plan contributions and voluntary deferrals.

Up to twice the applicable dollar limit for employees within three years of normal retirement age. Limited to the total of underutilized contribution limits in prior years of service with this employer or another employer within the state when a plan was available to the employee.

Age-based catch-up contributions

$24,000 in 2015, indexed thereafter.

For employees age 50 and older.

Same as 403(b).

Combining plan-specific and agebased catch-up contributions

Yes (allowed). No (not allowed).

Eligibility for in-service distributions from employee contributions

Eligibility for distributions after retirement

In-service hardship withdrawals

Minimum Distribution Requirement

Distribution Options (Check with individual vendors to see which options are available through that vendor. Other distribution options may be available.)

Permitted at age 59 1/2. Unrestricted for pre-1989 balance in annuity contracts.

Not permitted until age 70 1/2.

Penalty-free access to funds at age 55 if no longer working at UNG.

Penalty-free access to funds upon termination at UNG, regardless of age.

Financial hardship standard.

Required at age 70½. Can aggregate all

403(b) accounts and take distribution from any one or more accounts.

Required at age 70½.

Lump Sums

Lifetime Annuities

MDO

Systematic Cash Withdrawals

Unforeseeable emergency standard: stricter than financial hardship standard.

Lump Sums

Lifetime Annuities

MDO

Systematic Cash Withdrawals

Definition of terms:

Lump Sums: Lump sum distributions are subject to ordinary income tax. They are also subject to an early withdrawal penalty if taken before age 59½.

Employees/Retirees who are using this method to meet the minimum distribution requirement should ensure that the amount taken out each year satisfies this requirement.

Lifetime Annuities: Guarantees income for life to either one or two people. In most cases any annuity paid out over the owner's or owners' actuarially calculated lifetime(s) will satisfy the minimum distribution requirement.

RMD / MDO: Required Minimum Distribution Option – After Age 701/2.

Minimum Distribution Option - Automatically pays out the smallest amount that will satisfy the employee's annual minimum distribution requirement.

Systematic Cash Withdrawals: A series of cash withdrawals taken during the calendar year (semi-monthly, monthly, quarterly, semi-annually, or annually). Employees/Retirees who are using this method to meet the minimum distribution requirement should ensure that the amount taken out each year satisfies this requirement.