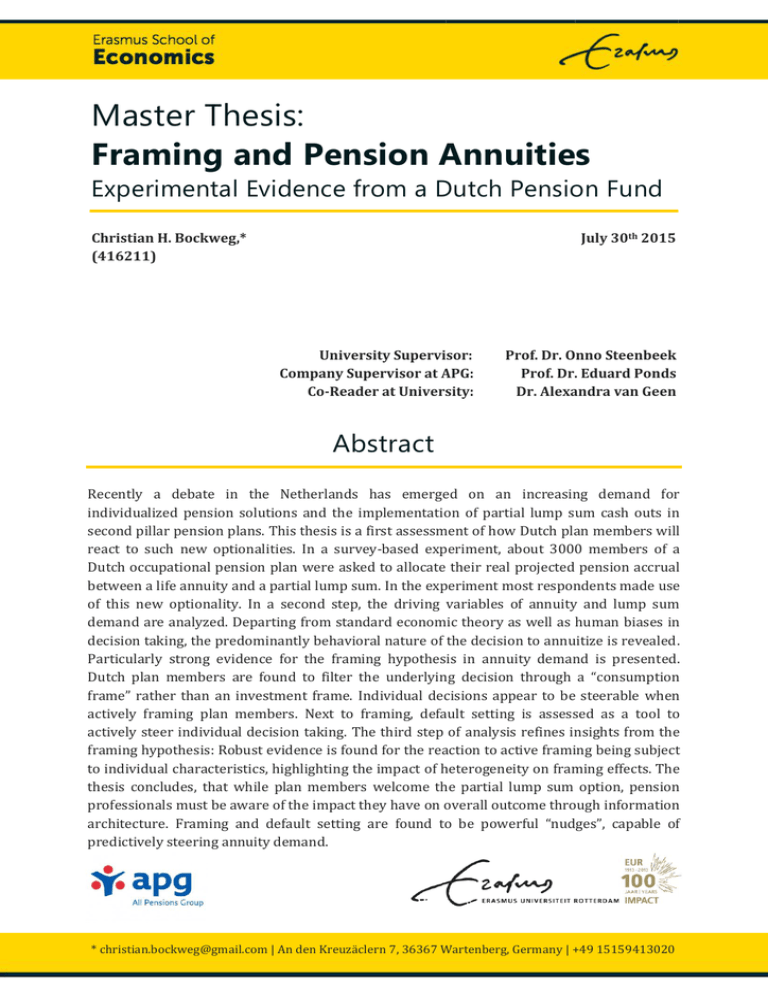

Master Thesis: Framing and Pension Annuities

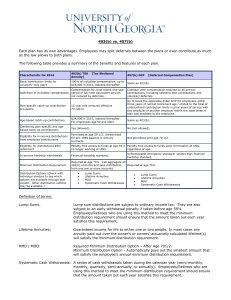

advertisement