FuturePlan DESCRIPTION OF PRODUCT WHAT ARE THE

Unrestricted

FuturePlan

Version date: 20 September 2011

FuturePlan

DESCRIPTION OF PRODUCT

FuturePlan is a unique contractual savings account that carries no bank charges and allows parents, grandparents, guardians, friends or family contribute toward giving children the best possible education. Benefit from nominal interest, bonus interest and an "Additional Absa Education Interest Contribution of 3.5%".

Important for new customers only

In order to apply for the Absa Future Plan account, please bring the following documents along.

SA Residents

•

The child’s birth certificate or green bar-coded identity document

•

Your green bar-coded Identity Document;

•

The original document or a certified copy of one of the following documents verifying your residential address, not more than 3 months old, e.g. utility bill, lease or rent agreement, Telkom statement, etc

Temporary residents and non-residents

•

Temporary residents and non-residents are allowed to open this account and need to produce a valid foreign passport as proof of identity.

WHAT ARE THE FEATURES OF THE PRODUCT?

•

(Flexible, disciplined savings plan that allows clients to accumulate funds in a regular and disciplined manner.)

•

A minimum balance of R100 is required

•

A deposit of at least R100 per month is required for at least three years

•

The ad hoc deposits can be from parents, extended family members and or sponsors.

•

You can elect to annually increase the contractual amount they contribute every month either as a percentage or a rand value

•

More than one account can be opened per customer i.e. Granny can open a FuturePlan account for each grandchild

•

Customers can ensure that the funds in the account are for the benefit of the child:

- Customers can nominate via their Will that the account is for the benefit of the child. If they do not stipulate this, then the parent or legal guardian will be identified as the beneficiary, if the child is a minor.

•

Funds are available at 32 days' notice after the initial 3 years.

•

Withdrawals after the initial period will be allowed but limited to 2 per annum at with no penalty if 32 days notice is given.

•

The savings term will be systematically extended if you do not inform your bank of your specific instructions.

•

There are no charges levied to this account

•

The longer the investment, the higher your interest rate

Disclaimer:

“All information contained herein, including information in respect of interest rates and terms and conditions, is subject to change as set out in the relevant terms and conditions.”

Absa Bank Ltd Reg No 1986/004794/06. Authorised Financial Services Provider and Registered Credit Provider, Reg No NCRCP7

Page 1 of 2

Unrestricted

•

Bonus interest is only applicable if the account has run for longer than 12 months.

FuturePlan

Version date: 20 September 2011

•

Nominal Interest is calculated daily and capitalised monthly.

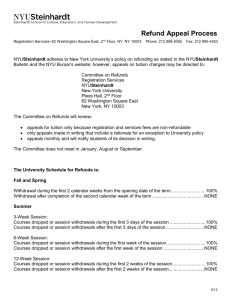

HOW DOES THE PRODUCT WORK?

•

The balance grows by way of the main monthly subscription amount paid in by the parent/ guardian, as well as ad hoc credits from guardians or extended family members or friends.

•

Funds are available at 32 days' notice after the initial 3 year period OR immediately on maturity date for a period of 10 days.

•

Part or full withdrawals can be made when funds are available on the account.

•

After maturity date, if no customer instruction is received the account will be automatically re invested for the same term.

HOW YOU CAN TRANSACT WITH THE PRODUCT?

•

Deposits can be made at any time via the branch, stop order or debit order or transfers via other channels.

•

Withdrawals can be done in the branch when funds are available at maturity.

•

A maturity instruction can also be completed depicting the pay out instructions.

•

Additional deposits can be made at any time

LIMITATIONS / EXCLUSIONS OF THE PRODUCT

•

Withdrawals within the first 3 years will be allowed however be subject to the forfeiting and recovery of the

3.5% additional Absa interest contributions

•

After the minimum savings period of three years all, or part of the FuturePlan savings can be withdrawn if 32 days notice is given

•

After the minimum savings period of three years, withdrawals will be restricted to two withdrawals per year.

These withdrawals will not incur a charge

RELATED PRODUCTS OR ALTERNATIVE PRODUCTS

•

TargetSave

PRICING STRUCTURE

•

No charges are related to this account

WHERE YOU CAN FIND OUT MORE INFORMATION ABOUT THIS PRODUCT?

For further information please contact your nearest branch, or call us on 0860 111 515.

Disclaimer:

“All information contained herein, including information in respect of interest rates and terms and conditions, is subject to change as set out in the relevant terms and conditions.”

Absa Bank Ltd Reg No 1986/004794/06. Authorised Financial Services Provider and Registered Credit Provider, Reg No NCRCP7

Page 2 of 2