- Barnett Waddingham

advertisement

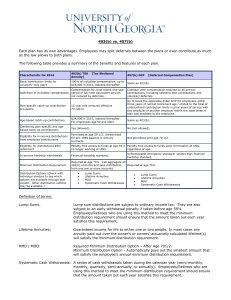

UK - Actuarial Advisory Firm of the Year UK - Pensions Advisor of the Year January 2015 Agenda Changes to DC pensions Product innovation Engagement innovation Global lessons Market structure changes 2 Benefit access from 6 April 2015 Income drawdown (flexi-access drawdown) Taking a single or series of lump sums from uncrystallised funds (UFPLS) Buying a lifetime annuity Scheme pension 3 Previous DC investment focus Growth phase Investment choice and engagement focused here 4 Protection phase Common destination point of purchasing an annuity DC investment focus now Growth phase May need to simplify choice in the growth phase so that more of the governance budget can be re-directed to the protection phase 5 Protection phase Governance budget focused on designing strategies based on how members are expected to retire Protection phase – in reality Growth phase May need to simplify choice in the growth phase so that more of the governance budget can be re-directed to the protection phase 6 Protection phase Governance budget focused on designing strategies based on how members are expected to retire Investment framework 7 Drawdown innovation – wish list Growth-seeking but with a capital preservation focus Provides sustainable level of income Provides inflation protection 8 Drawdown innovation - launching Focus on downside risk • • • low volatility DGFs volatility management (e.g. cap overlay) ‘hedge your bets’ investment option Price cap friendly DGFs • 9 diversified beta funds? Developments in the annuity market Biggest unknown is life expectancy Consistently underestimated Biggest risk is running out of money •Annuities benefit from the pooling of longevity risk allowing for health status •Deferred annuities? Temporary annuities? Variable annuities? 10 No ‘default’ default Membership specific Pot size specific Analysis needs to evolve with the membership Needs of those retiring now different vs those retiring in 15 years 11 The engagement journey Key messages: Stay In How much? Age 22 - 30 30 – 50 Growth 12 How and when to take this benefit 50 – SRD & beyond Shape Access Innovation in communication Good member communications need to accompany innovative investment products 13 Key challenges Administration systems Legacy issues Pressure applied by ‘all’ schemes trying to be ready by April Communication issues (e.g. double defaulters) Investment strategy agreed now will need to change (mitigated somewhat by future-proofing) 14 What can we learn from others? 15 Insight from Australia DC formula • Mandatory DC – introduced in 1992 • 81% coverage 16 • Employer contributions subject to annual cap of $50,000 • Average employee rate of 3%; Mandatory employer contributions currently 9.25% • Were legislated to increase to 12% by 2020 … now will be frozen at 9.5% for 7 years • Minority invest outside of default • Typical: ‘Cautious’, ‘Balanced’, ‘Adventurous’ – Lifestyle to 100% cash • Growing interest in US-style TDFs • Collective memory of capital loss – move to low volatility / hedging and guaranteed investment options DC 2020 Trust 17 Master Trust Contract Summary Step-change in DC pensions DC innovation requires more than just clever investment products Some early innovation; more to come No immediate need to appoint first movers 18 Regulatory Information The information in this presentation is based on our understanding of current taxation law, proposed legislation and HM Revenue & Customs practice, which may be subject to future variation. This presentation is not intended to provide and must not be construed as regulated investment advice. Returns are not guaranteed and the value of investments may go down as well as up. Barnett Waddingham LLP is a limited liability partnership registered in England and Wales. Registered Number OC307678. Registered Office: Cheapside House, 138 Cheapside, London, EC2V 6BW Barnett Waddingham LLP is authorised and regulated by the Financial Conduct Authority and is licensed by the Institute and Faculty of Actuaries for a range of investment business activities. 19