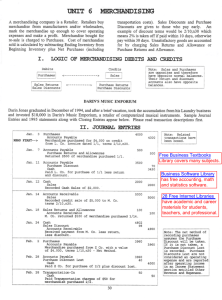

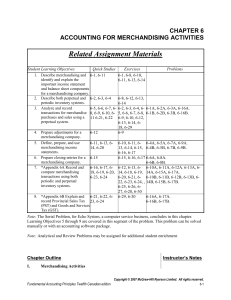

CHAPTER 5-PURCHASE & SALES OF MERCHANDISE

advertisement

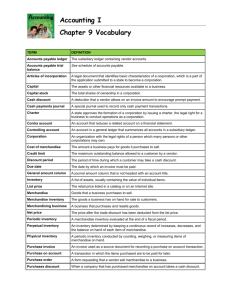

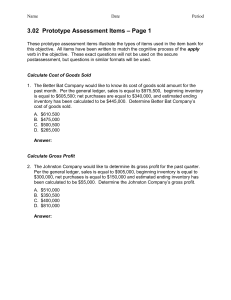

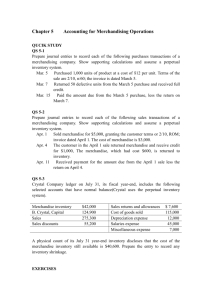

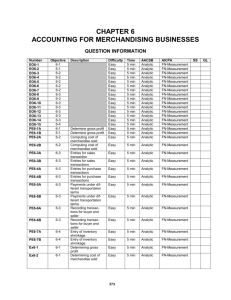

CHAPTER 5-PURCHASE & SALES OF MERCHANDISE MERCHANDISE Goods acquired for resale to customers COST OF GOODS SOLD The cost to the company of the merchandise it sells to customers Net Income of Merchandising CO. = Revenue (Net Sales) -Cost of Goods Sold =Gross Profit -Operating Expenses =Net Income Revenue – Expense = Net Income REVENUE FROM SALES Revenue Account is called SALES (Gross) Sales -Sales Returns & Allowances -Sales Discounts Net Sales Sales revenue is earned in the period in which merchandise is delivered to the customer Sales transactions (cash & credit) pg. 210 SALES RETURNS AND ALLOWANCES pg. 210 Return-Complete Refund Allowance-A decrease in sales price due to minor defect To record a sales return and allowance: DR Sales R & A CR Cash or A/R 100 100 Sales R & A pg. 221 A contra-revenue account is shown on the I/S as a deduction from sales We could just debit sales rather than using sales R & A but keeping a separate contra-account enables management to see 1) Total Sales and 2) Total Sales R&A. The relationship between these 2 amounts gives management an indication of customer satisfaction with merchandise. CREDIT TERMS (Terms of Payment) pg. 211 Net 30 days or n/30 → Amount due in 30 days 1 10 E.O.M. → Payment due in 10 days after end of month in which sale occurred SALES DISCOUNTS (or Cash Discount) pg. 211 Goods are often sold on credit terms of 30 to 60 says Sometimes a discount is offered for earlier payment Ex. 2/10, n/30 → Payment due in 30 days, but can take a 2% discount if – say (2,10 net 30) paid within 10 days →10 day period is called the DISCOUNT PERIOD Example: A sells to B $1000 merchandise. Terms 2/10, n/30 on Dec. 1 Dec. 1 “A” records: Dr A/R 1000 Cr Sales 1000 Dec. 10 “B” makes payment of $980 & “A” records DR Cash 980 DR Sales Discount 20 CR A/R 1000 SALES DISCOUNTS → Contra-revenue account shown on I/S as a deduction from gross sales 2 COST OF GOODS SOLD (COGS) Cogs= an Expense -Shown on I/S as a deduction from net sales Inventory=Merchandise available for sale during the period but not sold -on B/S at year end There are two alternative approaches to determining the value of these two items. 1. PERPETUAL INVENTORY SYSTEM pg. 227 -Units added to inventory and units removed for delivery to customers are recorded on a daily basis → providing Inventory Figure -Records are kept showing the cost of each item in stock. As units are sold the cost of the items are added to COGS. -Used mostly in companies that makes a relatively small number of sales each day of high unit value I.e. TV Stores, Auto Dealership 2. PERIODIC INVENTORY SYSTEM pg. 213 -Suitable for businesses which sell a variety of merchandise with low-unit prices. Inventory – Determined by a physical count. COGS=BEG. INV. + PURCHASES – END INV. Cog Available for Sale is beg. Inv. of the following year. Using this system, the Inventory Account is not debited or credited as goods are purchased or sold. During the year, the balance in the Inv. Acct. is equal to the Beg. Inv. and is not changed. PURCHASING MERCHANDISE FOR RESALE The purchases account is only used for merchandise acquired for resale (Not for other items purchased) DR Purchases 1000 CR A/P/Cash 1000 To a purchaser, a Sales Discount is called a Purchase Discount 3 Ex. $1000. - Purchase, terms 2/10, n/30, Jan. 1 JAN 1. 10. DR Purchases 1000 CR A/P 1000 DR A/P 1000 CR Purchase Discounts 20 CR Cash 980 Purchase Discounts will be shown on the I/S as a deduction from purchases PURCHASE RETURNS & ALLOWANCES pg. 215 Ex. Return $500. – Worth of Goods DR A/P 500 CR Purchase R&A 500 TRANSPORTATION- IN (FREIGHT IN) For transportation charges on merchandising purchased. DR Transpo. In (Freight In) 100 CR Cash/A/P 100 Transpo- In is combined with purchases on the I/S to determine Cogs available for sale. Transpo- In not to be confused with trans charges on outbound goods to customers → Selling Expense DR to delivery expense and not included in cogs. SHOPLIFTING & INVENTORY “SHRINKAGE” LOSS Read pg. 216 4 INCOME STATEMENT FOR A MERCHANDISING COMPANY See page 217 for a good reference CLASSIFIED INCOME STATEMENT 3 Sections 1. Revenue 2. COGS 3. Operating Expenses GROSS PROFIT IRATE Net Sales – COGS = Gross Profit GROSS PROFIT = Gross Profit Rate NET SALES EX: 240,000 = 40% 600,000 Good to compare gross profit rate from year to year, a measurement of financial strength. In most merchandising companies, the rate of gross profit usually varies between 30-50% of net sales. OPERATING EXPENSES (CLASSIFICATION) 1. SELLING – Includes all expenses of storing and displaying merchandise. For sales, advertising, sales salaries and delivering goods to the customers. 2. GENERAL & ADMINISTRATIVE – Expenses of the general offices, accounting dept, personnel office, credit and collections dept. Some expenses (ex. Depreciation) are sometimes allocated partly to each one. NON-OPERATING ITEMS Listed separately after income from operations Examples: Interest Expense, Interest Income, Income/Loss from Investments, Income Tax Expense. They do not relate to the daily operating activities of the business. EVALUATING THE ADEQUACY OF NET INCOME Net income of an unincorporated business must compensate the owner for 3 factors. 1. Personal services rendered to the business 2. Amount of capital invested 3. Degree of risk taken 5 6