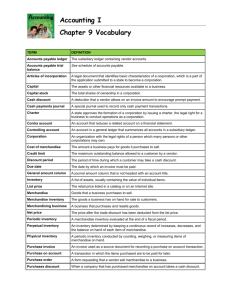

Accounting for Merchandising Operations

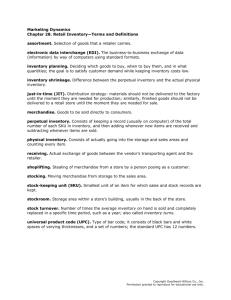

advertisement