3.02 Prototype Assessment Items – Page 1

Name Date Period

3.02 Prototype Assessment Items – Page 1

These prototype assessment items illustrate the types of items used in the item bank for this objective. All items have been written to match the cognitive process of the apply verb in the objective. These exact questions will not be used on the secure postassessment, but questions in similar formats will be used.

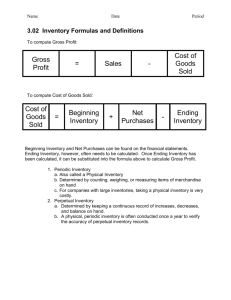

Calculate Cost of Goods Sold

1. The Better Bat Company would like to know its cost of goods sold amount for the past month. Per the general ledger, sales is equal to $975,500, beginning inventory is equal to $605,500; net purchases are equal to $340,000, and estimated ending inventory has been calculated to be $445,000. Determine Better Bat Company’s cost of goods sold.

A. $610.500

B. $475,000

C. $500,500

D. $265,000

Answer:

Calculate Gross Profit

2. The Johnston Company would like to determine its gross profit for the past quarter.

Per the general ledger, sales is equal to $905,000, beginning inventory is equal to

$300,000, net purchases is equal to $150,000 and estimated ending inventory has been calculated to be $55,000. Determine the Johnston Company’s gross profit.

A. $510,000

B. $350,500

C. $400,000

D. $810,000

Answer:

Name Date

3.02 Prototype Assessment Items – Page 2

Calculate Estimated Inventory – Gross Profit Method

3. The Thomas Toy Company needs to estimate ending inventory for its interim financial statements. The following information is available: sales $750,000; beginning inventory $300,250, net purchases $167.500, gross profit 43%.

Determine estimated ending inventory using the Gross Profit Method.

A. $40,250

B. $145,250

C. $322,500

D. $467,750

Correct Answer

Calculate Estimated Inventory – Retail Method

4. The Bead Boutique Company needs to estimate ending inventory for its interim financial statements. The following information is available:

Beginning inventory at cost $56,500; at retail $85,000

Net purchases at cost $38,000; at retail $65,000

Retail sales to date $130,500

Estimate the ending inventory using the Retail Method.

A. $55,500

B. $27,500

C. $19,500

D. $12,285

Answer:

Period

Name Date Period

3.02 Prototype Assessment Items – Page 3

Prepare a Statement of Gross Profit with Component Percentages

The Schuler Company

Figure 3.02-A

Interim Departmental Statement of Gross Profit

For Month Ended June 30, 20xx

Clothing

% of Net

Sales

Housewares

% of Net

Sales

Operating Revenue:

Net Sales

Cost of Merchandise Sold

Est Mdse. Inv. September 1

Net Purchases

Mdse. Available for Sale

Less Est. End Inv September 30

Cost of Merchandise Sold

$ 30,500.00

17,500.00

25,500.00

$ 70,500.00

$ 46,000.00

22,500.00

38,500.00

$ 65,500.00

$ 76,500.00

$ 40,000.00

$ -

$ 64,000.00

Total

$ 136,000.00

Gross Profit on Operations $ -

5. The Schuler Company is preparing a Statement of Gross Profit with Component

Percentages. Using the information in Figure 3.02-A , what would the Gross Profit on Operations for the Clothing Division be?

A. $32,500

B. $48,000

C. $27,500

D. $35,500

Answer:

Prepare a Departmentalized Worksheet

6. Good Clothing store has two divisions, the Junior’s Department and the Children’s

Department. Amelia Accountant is preparing interim reports for the company and is currently working on completing the worksheet. She has started the worksheet by creating the heading and completing the Trial Balance section and Adjustments section. All columns balance to this point. What is the next step that Amelia should do to properly complete the Departmental Worksheet?

A. Calculate net income

B. Total and calculate departmental margin

C. Extend the assets, liabilities, and equity, plus or minus adjustments, to the

Balance Sheet columns

D. Extend the income, revenue, cost and direct expenses to the appropriate departmental columns.

Answer:

Name Date Period

3.02 Prototype Assessment Items – Page 4

Prepare Departmental/Contribution Margin Statement

Figure 3.02-B

Sk8tr World Customs

Departmental Margin Statement - Skateboards

For Month Ended April 30, 20xx

Skateboards

Operating Revenue:

Net Sales

Cost of Merchandise Sold

Est Mdse. Inv. September 1

Net Purchases

Mdse. Available for Sale

Less Est. End Inv September 30

$ 5,500.00

7,000.00

$ 12,500.00

8,500.00

$ 6,500.00

Cost of Merchandise Sold

Gross Profit on Operations

% of Net

Sales

100%

0%

0%

Direct Expenses

Advertising Expense

Deprec. Exp - Store Equipment

Payroll Taxes Expense

Salary Expense

Supplies Expense

Total Direct Expenses

$ 250.00

95.00

250.00

850.00

125.00

1,570.00

24%

Departmental Margin 0%

7. Sk8tr World Customs offers custom skateboards and skateboard gear for sale.

Anna is the Accountant for the company, and she is currently preparing the departmental margin statements. Using Figure 3.02-B above, determine gross profit for the Skateboard Division.

A. $7,500

B. $2,500

C. $8,500

D. $15,500

Answer: