BAF3M Accounting

advertisement

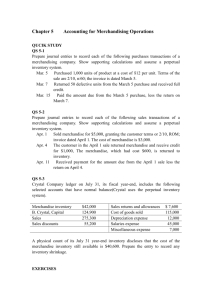

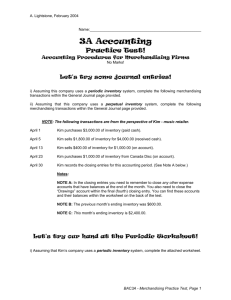

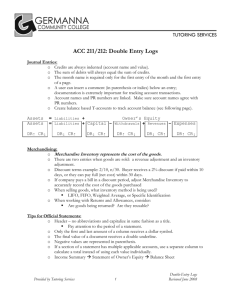

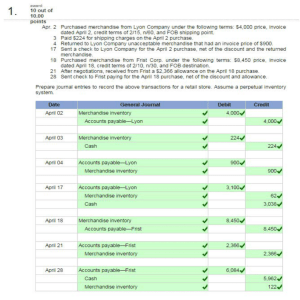

BAF3M Accounting Chapter 11 – Accounting for a Merchandising Business • Merchandising Video • So far, we’ve only studied service businesses, now we move on to merchandising businesses – Major difference is inventory “stuff to sell” – Two major categories • Wholesaler – buys from manufacturers and sells to retailers • Retailers – buys from wholesalers and sells to final consumers 11.1 Merchandise Inventory • Merchandise is the name given to items bought by a business in order to be sold to consumers • Merchandising businesses have the extra cost of inventory compared to service businesses – This is an I/S amount called “Cost of Goods Sold” aka “COGS” A SIMPLIFIED PARTIAL BALANCE SHEET SHOWING MERCHANDINSE INVENTORY AS A CURRENT ASSET EASTPORT HARDWARE BALANCE SHEET 30-Jun-08 CURRENT ASSETS Bank $1 2 0 5 Account Receivable 18 3 0 5 Merchandise Inventory 42 5 8 2 Supplies Prepaid Insurance 5 2 6 3 5 6 4 $69 1 8 2 PLANT AND EQUIPMENT Store Equipment Delivery Equipment $25 6 5 8 18 3 5 0 44 0 0 8 $113 1 9 0 11.1 Merchandise Inventory INVENTORY CYCLE • The goal is to sell inventory quickly thus inventory moves in and out of the business frequently SO… 1) There is inventory to begin the accounting period with. 2) Merchandise is sold and moves out throughout the inventory period. 3) Merchandise is replaced by the purchase of new stock from time to time. 4) The ending inventory should be more or less the same as the beginning inventory. 11.1 Merchandise Inventory • COGS on the I/S p. formula to calculate the COGS figure Cost of Beg. Inv + Cost of Merch Purchases - Cost of Ending inventory = Cost of Merch sold A SIMPLE INCOME STATEMENT FOR A MERCHANDISING BUSINESS EASTPORT HARDWARE INCOME STATEMENT 30-Jun-08 REVENUE Sales COST OF GOODS SOLD Inventory, January 1 Purchases Cost of Goods Available for Sale Less Inventory, December 31 Cost of Goods Sold GROSS PROFIT OPERATING EXPENSES Bank Charges Expense Building Maintenance Expense Car Expense Depreciation Expense Miscellaneous Expense Rent Expense Telephone Expense Utilities Expense Wages Expense TOTAL OPERATING EXPSES NET INCOME $231 $55 120 $175 57 3 4 7 3 2 0 2 5 9 6 7 5 2 7 0 118 3 7 7 $113 5 9 0 $ 2 1 12 1 36 3 8 5 0 2 0 9 8 5 7 7 0 7 7 0 5 5 8 5 5 7 5 5 0 7 0 7 56 5 0 1 $57 0 8 9 OBSERVE THE FOLLOWING ABOUT THE PRECEEDING INCOME STATMENT 1) The C.O.G.S. is considered to be so significant that the statement is prepared in 2 stages. 2) The first stage determines the gross profit. Gross profit is the difference between the selling price and the cost price of the goods sold. It can also been seen as the profit figure before deducting expenses. 3) The C.O.G.S. is shown on the income statement. 4) The expense section is now called OPERATING EXPENSES. CLOSING ENTRIES FOR A MERCHANDISING COMPANY • • The process is the exact same as in a service company The steps go: 1) 2) 3) 4) • Close revenue/sales to income summary Close expenses to income summary Close income summary to capital Close drawings to capital The process neatly cancels out the old inventory figure and sets up the new one, so that you will have the correct opening balances SOME NEW TERMS PURCHASE RETURNS & ALLOWANCES – used to record the value of merchandise returned (damaged goods, mistaken deliveries, etc.) to the supplier PURCHASE DISCOUNTS – used to record discounts given for early payment SALES DISCOUNTS – the seller may give discounts to credit customers if they pay within a specified time period FREIGHT IN VS. DELIVERY EXPENSE FREIGHT IN - the cost incurred to ship the merchandise to the store or warehouse DELIVERY EXPENSE – this account is used to record the cost of shipping the sold merchandise to the customer JOURNAL ENTRIES •The merchandise purchased during the fiscal period is collected in the Purchases account. •This account if found in the expense section of the ledger. HMV purchased 600 CD’s for resale at a cost of $10/cd. Date Particulars Purchases GST Recoverable Bank P.R. Debit Credit 6 0 0 03 0 06 3 0 0- JOURNAL ENTRIES •If a customer returns a good because it is damaged, not what they expected etc. The entry is as follows. A customer returned 20 CDs to HMV that were purchased for $20 each. Date Particulars Sales Returns and Allowances P.R. Debit 4 0 0- PST Payable 3 2- GST Payable 2 0- Cash Credit 4 5 2-