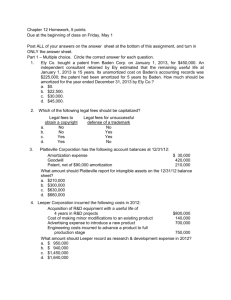

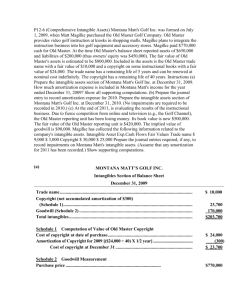

CHAPTER 12 Intangible Assets

advertisement