Bond practice

advertisement

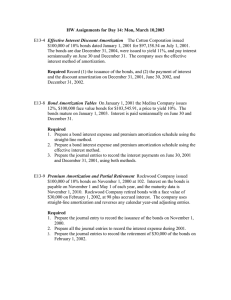

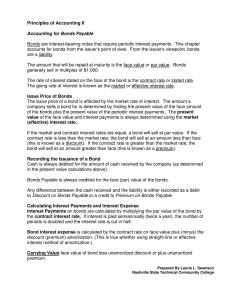

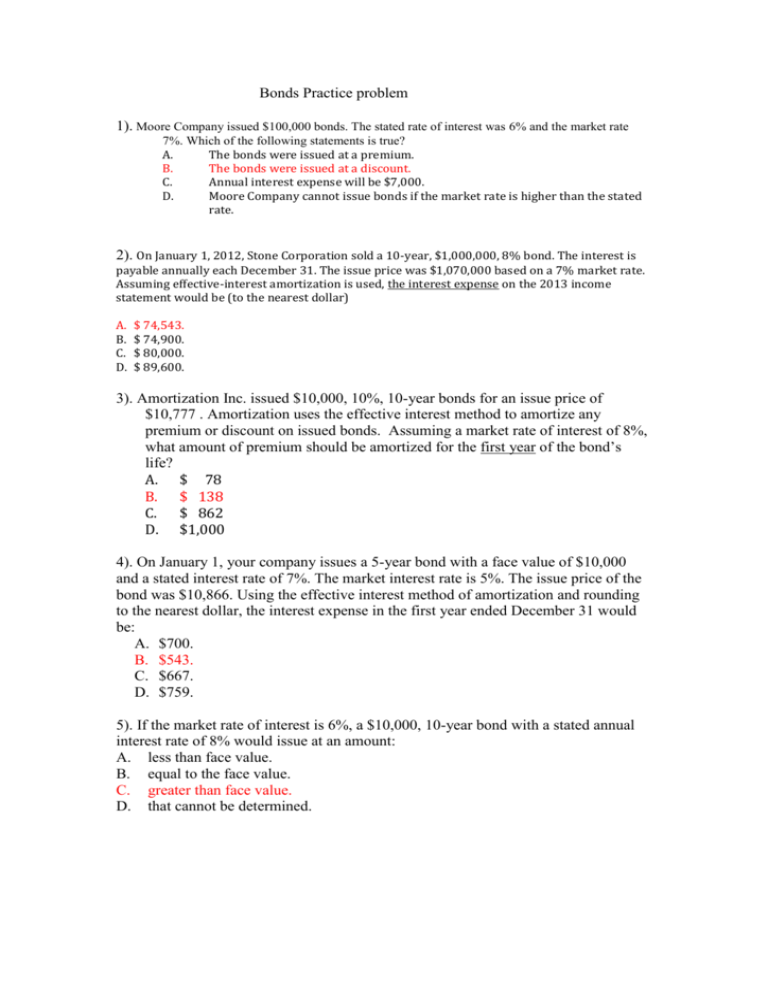

Bonds Practice problem 1). Moore Company issued $100,000 bonds. The stated rate of interest was 6% and the market rate 7%. Which of the following statements is true? A. The bonds were issued at a premium. B. The bonds were issued at a discount. C. Annual interest expense will be $7,000. D. Moore Company cannot issue bonds if the market rate is higher than the stated rate. 2). On January 1, 2012, Stone Corporation sold a 10-year, $1,000,000, 8% bond. The interest is payable annually each December 31. The issue price was $1,070,000 based on a 7% market rate. Assuming effective-interest amortization is used, the interest expense on the 2013 income statement would be (to the nearest dollar) A. B. C. D. $ 74,543. $ 74,900. $ 80,000. $ 89,600. 3). Amortization Inc. issued $10,000, 10%, 10-year bonds for an issue price of $10,777 . Amortization uses the effective interest method to amortize any premium or discount on issued bonds. Assuming a market rate of interest of 8%, what amount of premium should be amortized for the first year of the bond’s life? A. $ 78 B. $ 138 C. $ 862 D. $1,000 4). On January 1, your company issues a 5-year bond with a face value of $10,000 and a stated interest rate of 7%. The market interest rate is 5%. The issue price of the bond was $10,866. Using the effective interest method of amortization and rounding to the nearest dollar, the interest expense in the first year ended December 31 would be: A. $700. B. $543. C. $667. D. $759. 5). If the market rate of interest is 6%, a $10,000, 10-year bond with a stated annual interest rate of 8% would issue at an amount: A. less than face value. B. equal to the face value. C. greater than face value. D. that cannot be determined.