Quiz chpt 12 13 Fall 2009[1].doc

advertisement

![Quiz chpt 12 13 Fall 2009[1].doc](http://s3.studylib.net/store/data/008065145_1-9341d7c32393454ecadd4d67922dfd05-768x994.png)

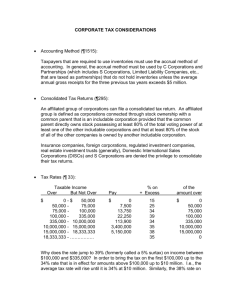

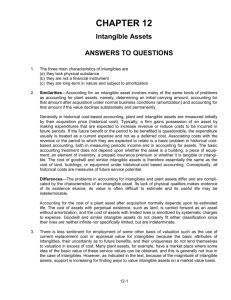

Acct. 350, Fall 2009 Quiz, Chpts. 12 & 13 Name 1. Jeff Corporation purchased a limited-life intangible asset for $120,000 on May 1, 2008. It has a useful life of 10 years. What total amount of amortization expense should have been recorded on the intangible asset by December 31, 2010? A) $ -0B) $24,000 C) $32,000 D) $36,000 2. Danks Corporation purchased a patent for $450,000 on September 1, 2008. It had a useful life of 10 years. On January 1, 2010, Danks spent $110,000 to successfully defend the patent in a lawsuit. Danks feels that as of that date, the remaining useful life is 5 years. What amount should be reported for patent amortization expense for 2010? A) $103,000. B) $100,000. C) $94,000. D) $78,000. 3. Blue Sky Company's 12/31/10 balance sheet reports assets of $5,000,000 and liabilities of $2,000,000. All of Blue Sky's assets' book values approximate their fair value, except for land, which has a fair value that is $300,000 greater than its book value. On 12/31/10, Horace Wimp Corporation paid $5,100,000 to acquire Blue Sky. What amount of goodwill should Horace Wimp record as a result of this purchase? A) $ -0B) $100,000 C) $1,800,000 D) $2,100,000 4. General Products Company bought Special Products Division in 2010 and appropriately recorded $500,000 of goodwill related to the purchase. On December 31, 2011, the fair value of Special Products Division is $4,000,000 and it is carried on General Product's books for a total of $3,400,000, including the goodwill. An analysis of Special Products Division's assets indicates that goodwill of $400,000 exists on December 31, 2011. What goodwill impairment should be recognized by General Products in 2011? A) $0. B) $200,000. C) $50,000. D) $300,000. Page 1 5. The following information is available for Barkley Company's patents: Cost Carrying amount Expected future net cash flows Fair value $1,720,000 860,000 800,000 650,000 Barkley would record a loss on impairment of A) $ 60,000. B) $210,000. C) $860,000. D) $920,000. 6. Jenks Corporation acquired Linebrink Products on January 1, 2010 for $4,000,000, and recorded goodwill of $750,000 as a result of that purchase. At December 31, 2010, Linebrink Products had a fair value of $3,400,000. The net identifiable assets of the Linebrink (excluding goodwill) had a fair value of $2,900,000 at that time. What amount of loss on impairment of goodwill should Jenks record in 2010? A) $ -0B) $250,000 C) $350,000 D) $600,000 7. MaBelle Corporation incurred the following costs in 2010: Acquisition of R&D equipment with a useful life of 4 years in R&D projects Start-up costs incurred when opening a new plant Advertising expense to introduce a new product Engineering costs incurred to advance a product to full production stage $600,000 140,000 700,000 400,000 What amount should MaBelle record as research & development expense in 2010? A) $ 550,000 B) $ 740,000 C) $1,000,000 D) $1,140,000 8. The effective interest on a 12-month, zero-interest-bearing note payable of $300,000, discounted at the bank at 10% is A) 10.87%. B) 10%. C) 9.09%. D) 11.11%. Page 2 9. Vista newspapers sold 4,000 of annual subscriptions at $125 each on September 1. How much unearned revenue will exist as of December 31? A) $0. B) $333,333. C) $166,667. D) $500,000. 10. A company gives each of its 50 employees (assume they were all employed continuously through 2010 and 2011) 12 days of vacation a year if they are employed at the end of the year. The vacation accumulates and may be taken starting January 1 of the next year. The employees work 8 hours per day. In 2010, they made $14 per hour and in 2011 they made $16 per hour. During 2011, they took an average of 9 days of vacation each. The company's policy is to record the liability existing at the end of each year at the wage rate for that year. What amount of vacation liability would be reflected on the 2010 and 2011 balance sheets, respectively? A) $67,200; $93,600 B) $76,800; $96,000 C) $67,200; $96,000 D) $76,800; $93,600 11. Recycle Exploration is involved with innovative approaches to finding energy reserves. Recycle recently built a facility to extract natural gas at a cost of $15 million. However, Recycle is also legally responsible to remove the facility at the end of its useful life of twenty years. This cost is estimated to be $21 million (the present value of which is $8 million). What is the journal entry required to record the asset retirement obligation? A) No journal entry required. B) Debit Natural Gas Facility for $21,000,000 and credit Asset Retirement Obligation for $21,000,000 C) Debit Natural Gas Facility for $6,000,000 and credit Asset Retirement Obligation for $6,000,000. D) Debit Natural Gas Facility for $8,000,000 and credit Asset Retirement Obligation for $8,000,000. 12. Warranty4U provides extended service contracts on electronic equipment sold through major retailers. The standard contract is for three years. During the current year, Warranty4U provided 21,000 such warranty contracts at an average price of $81 each. Related to these contracts, the company spent $200,000 servicing the contracts during the current year and expects to spend $1,050,000 more in the future. What is the net profit that the company will recognize in the current year related to these contracts? A) $451,000. B) $1,501,000. C) $150,333. D) $367,000. Page 3 13. A company offers a cash rebate of $1 on each $4 package of light bulbs sold during 2010. Historically, 10% of customers mail in the rebate form. During 2010, 4,000,000 packages of light bulbs are sold, and 140,000 $1 rebates are mailed to customers. What is the rebate expense and liability, respectively, shown on the 2010 financial statements dated December 31? A) $400,000; $400,000 B) $400,000; $260,000 C) $260,000; $260,000 D) $140,000; $260,000 14. During 2009, Vanpelt Co. introduced a new line of machines that carry a three-year warranty against manufacturer's defects. Based on industry experience, warranty costs are estimated at 2% of sales in the year of sale, 4% in the year after sale, and 6% in the second year after sale. Sales and actual warranty expenditures for the first three-year period were as follows: 2009 2010 2011 Sales $ 600,000 1,500,000 2,100,000 $4,200,000 Actual Warranty Expenditures $ 9,000 45,000 135,000 $189,000 What amount should Vanpelt report as a liability at December 31, 2011? A) $0 B) $15,000 C) $204,000 D) $315,000 Page 4 Answer Key 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. C B C A B B A D B C D D B D Page 5