PM Cost Management Flash Cards 1. Inputs to estimating |WBS

advertisement

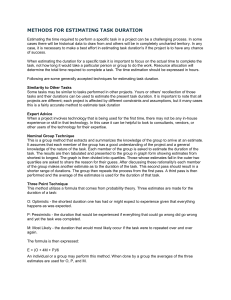

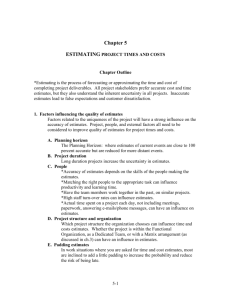

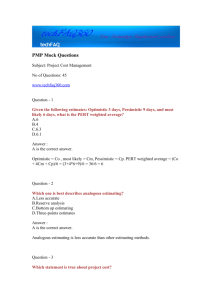

PM Cost Management Flash Cards 1. Inputs to estimating |WBS, Network diagram, Schedule, Historical records, Resources, Risks, Constraints 2. Cost estimating |Analogous, bottom up, parametric, computerized tools 3. Analogous |Top down estimating that looks to the past to predict the future. “The last three projects cost US$25,000, and so should this one.” Bottom Up |Estimating based on the details of the project, e.g. from the bottom of the WBS 4. Parametric |Extrapolating from historical information to estimate costs, e.g. dollars per line of code 5. Variable cost |A cost that varies with the amount of work done on the project 6. Fixed Cost |A cost that does not vary with the amount of work done on the project. 7. Direct Cost |A cost directly attributable to the project. 8. Indirect Cost |Overhead 9. Earned value analysis |Method of measuring project performance that looks at the value earned for work accomplished. 10. Cost Variance |EV-AC 11. Schedule Variance |EV-PV 12. Cost performance index |EV/AC 13. Schedule performance index |EV/PV 14. Estimate to complete |EAC-AC 15. Variance at completion |BAC-EAC 16. Value Analysis |Also know as Value Engineering - Finding a less costly way of doing essentially the same statement of work. 17. Life Cycle Costing |Consider the cost of operating and maintaining the item over its life when planning and managing the project. 18. Accuracy of estimates |Order of Magnitude, Budget, Definitive 19. Order of magnitude estimate |Done during initiation. Range -25% +75% 20. Budget estimate |Done during planning. Range -%10 +25% 21. Definitive estimate |Done during planning. Range -5% +%10 22. Present Value |The value today of some future cash flow (FV/(1+r)^n 23. Net present value |The value today of some future costs and expenses over many years. For cost, the lower the number the better. For revenue, the higher the number the better. 24. Internal rate of Return |The rate the project will return. The higher the number the better. The rate at which a projects inflows and outflows are equal. i:\tec320pm\pm training\delgarmo pm training\cost flash cards post all.docx 25. Payback Period |The number of time periods to recover the investment. A lower number is better than a larger. 26. Benefit cost ratio |Benefit/Cost - Pick the higher number (>1 is good <1 is not very good.) 27. Opportunity Cost |The opportunity given up by selecting one project over another. 28. Sunk Cost |Expended costs. 29. Law of Diminishing Returns |The more you put into the effort the less you get out of it. 30. Working Capital |Current assets minus current liabilities. The amount of funds available to spend on projects. 31. Project selection methods |Methods to select one project from many projects: PV NPV IRR Payback BCR 32. Depreciation |Straight line and accelerated. 33. Straight line depreciation |Depreciation the same amount each time period. 34. Accelerated depreciation |Depreciate an amount greater than straight line each time period. i:\tec320pm\pm training\delgarmo pm training\cost flash cards post all.docx