Manufacturing Accg. Info

advertisement

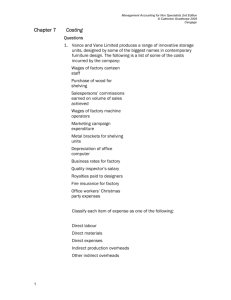

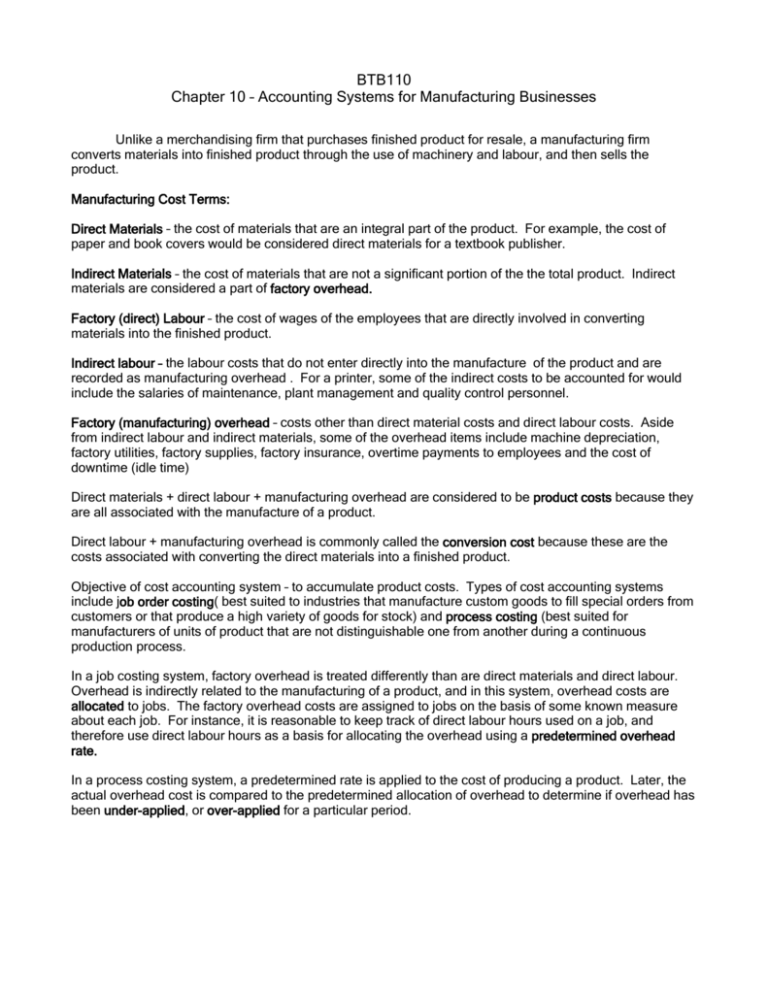

BTB110 Chapter 10 – Accounting Systems for Manufacturing Businesses Unlike a merchandising firm that purchases finished product for resale, a manufacturing firm converts materials into finished product through the use of machinery and labour, and then sells the product. Manufacturing Cost Terms: Direct Materials – the cost of materials that are an integral part of the product. For example, the cost of paper and book covers would be considered direct materials for a textbook publisher. Indirect Materials – the cost of materials that are not a significant portion of the the total product. Indirect materials are considered a part of factory overhead. Factory (direct) Labour – the cost of wages of the employees that are directly involved in converting materials into the finished product. Indirect labour – the labour costs that do not enter directly into the manufacture of the product and are recorded as manufacturing overhead . For a printer, some of the indirect costs to be accounted for would include the salaries of maintenance, plant management and quality control personnel. Factory (manufacturing) overhead – costs other than direct material costs and direct labour costs. Aside from indirect labour and indirect materials, some of the overhead items include machine depreciation, factory utilities, factory supplies, factory insurance, overtime payments to employees and the cost of downtime (idle time) Direct materials + direct labour + manufacturing overhead are considered to be product costs because they are all associated with the manufacture of a product. Direct labour + manufacturing overhead is commonly called the conversion cost because these are the costs associated with converting the direct materials into a finished product. Objective of cost accounting system – to accumulate product costs. Types of cost accounting systems include job order costing( best suited to industries that manufacture custom goods to fill special orders from customers or that produce a high variety of goods for stock) and process costing (best suited for manufacturers of units of product that are not distinguishable one from another during a continuous production process. In a job costing system, factory overhead is treated differently than are direct materials and direct labour. Overhead is indirectly related to the manufacturing of a product, and in this system, overhead costs are allocated to jobs. The factory overhead costs are assigned to jobs on the basis of some known measure about each job. For instance, it is reasonable to keep track of direct labour hours used on a job, and therefore use direct labour hours as a basis for allocating the overhead using a predetermined overhead rate. In a process costing system, a predetermined rate is applied to the cost of producing a product. Later, the actual overhead cost is compared to the predetermined allocation of overhead to determine if overhead has been under-applied, or over-applied for a particular period. Cost-Behavior and Cost-Volume-Profit Analysis- Chapter 11 Cost behavior refers to the manner in which costs changes as a related activity changes. To understand cost behavior, two factors must be considered: 1. we must identify the activities that cause the costs to be incurred 2. we must identify the range of activity over which the changes in cost are of interest There are 3 common classes of costs: Variable costs – these are costs that vary in proportion to changes in the level of activity. When the level of activity is measured in units produced, direct materials and direct labour costs are generally classified as variable costs. Fixed costs – these are costs that remain the same in total dollar amount as the level of activity changes. In a manufacturing activity, the indirect costs (most often the manufacturing overhead) are incurred regardless of how many units are produced within a given range. As the production numbers grow, the fixed cost per unit decreases. Mixed Costs - has characteristics of both a variable and fixed cost. For example, over one range of activity, the total mixed cost could remain the same. In that situation, it behaves like a fixed cost. Over another range of activity, the mixed cost could change in proportion to changes in the level of activity. It thus behaves like a variable cost. A mixed cost would contain both of these components to produce the mixed cost. In analysis, mixed costs are usually split into their fixed and variable components. The high-low method is a cost-estimation method technique used for this purpose. The high-low methoduses the highest and lowest activity levels and their related costs to estimate the variable cost per unit, and the fixed cost component of mixed costs. Eg. A review of a company’s records have revealed the following with respect to high and low level of activity and cost over the past 5 months. Units of Production 2,100 750 1,350 Highest level Lowest level Difference Variable cost per unit = Difference in total cost Difference in production Variable cost per unit = 20,250 1350 = $15 Total Cost = Unit variable cost * units of production + fixed costs $41,250 = $15*750 + x $41,250 – 11,250 = x $30,000 = fixed cost Total Cost $61,500 41,250 20,250