Accumulating and Assigning

Costs to Products

Chapter 4

© 2012 Pearson Prentice Hall. All rights reserved.

Cost Flows in Organizations

In order to compute product costs, management

accounting systems should reflect the actual cost

flows in an organization

Manufacturing, retail, and service organizations

have different patterns of cost flows resulting in

different management accounting priorities

© 2012 Pearson Prentice Hall. All rights reserved.

Cost Flows in a Manufacturing

Organization

3

Cost Flows in a Retail

Organization

4

Cost Flows in a Service

Organization

5

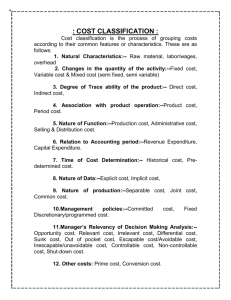

Cost Terms

Cost Object—is anything for which a cost is

computed

– Examples of cost objects are: activities, products,

product lines, departments, or even entire

organizations

© 2012 Pearson Prentice Hall. All rights reserved.

Resource Costs

Consumable Resource

Consumed or used up by the

production process

Cost of depends on how

much of the resource is used

Examples

Capacity-Related Resource

Supports the production

process

Cost depends on how much

of the resource is acquired

Examples

– Wood in furniture making

– Supervisory labour

– Engines in auto making

– Warehouse space

– Processors in laptop making

– Admin Employees

7

Cost Terms

Direct Cost—a cost that is uniquely and

unequivocally attributable to a single cost object

– Almost all variable costs are direct costs

Indirect Cost—a cost that fails the test of being

direct is classified as indirect

– Most capacity-related costs are indirect

© 2012 Pearson Prentice Hall. All rights reserved.

Direct vs. Indirect

Which costs are direct/indirect of you going to WLU?

Tuition

Joining a sorority

Buying a laptop

Additional fees on Laurier bill (excl tuition)

Books

Costing System Architecture

10

Applied and Incurred Indirect

Costs

11

How are Indirect Costs

Applied?

12

The Best Arguments for Using

Practical Capacity

Provides a solid basis to compute long run cost

Isolates the cost of idle capacity which is charged

to the income statement instead of being included

in inventory valuations

13

Product Costing

Job Order

Process Costing

Allocates costs to products

that are readily identifiable

Average costs over large number of

nearly identical units

Common in construction,

print shops, unique goods

Common in chemical, textiles,

lumber, glass, food processing

Accumulate costs for

specific jobs

Accumulate costs

by departments

Produce for sale

Produce for inventory

Job-Order Costing – An

Overview

Direct Materials

Job No. 1

Direct Labour

Manufacturing

Overhead

Job No. 2

Job No. 3

Charge direct

material and

direct labour

costs to each

job as work is

performed.

Direct Manufacturing Costs

Direct Materials

Job No. 1

Direct Labour

Manufacturing

Overhead

Job No. 2

Job No. 3

Manufacturing

Overhead,

including

indirect

materials and

indirect labour,

are allocated

to all jobs

rather than

directly traced

to each job.