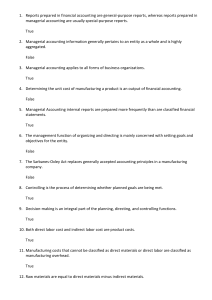

Cost Behavior and classification: indicate whether the

advertisement

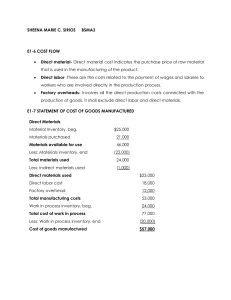

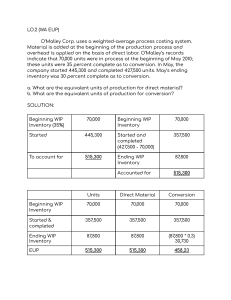

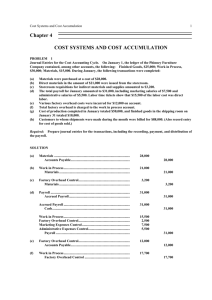

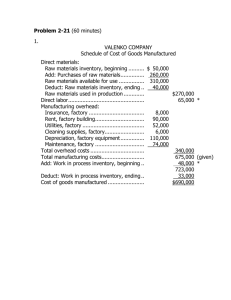

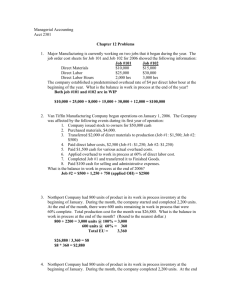

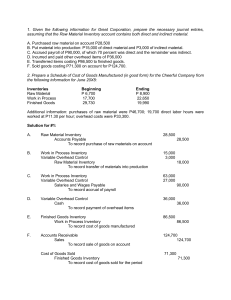

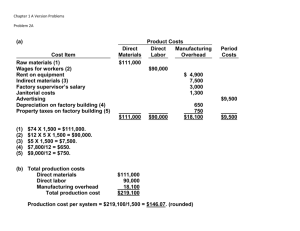

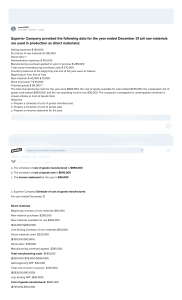

Cost Behavior and classification: indicate whether the following are fixed (F), variable (V) or mixed (M) as well as a product service (PT) or period cost (PD) Wages of factory maintenance workers V - PT Wages of forklift operators who move finished goods from a central warehouse to the loading dock V - PT Insurance premiums paid on the headquarters of a manufacturing company F - PD Cost of labels attached to shirts made by a company V - PT Property taxes on a manufacturing plant F - PT Paper towels used in factory restrooms V - PT Salaries of office assistants in a law firm F - PT Freight costs of acquiring raw material from suppliers F - PT Computer paper used in an accounting firm V - PT Cost of wax to make candles V - PT Freight in on a truckload of furniture purchased for resale F - PT Cost behavior and classification: (costs associated in the manufacturing of bicycles) indicate whether the following are fixed (F), variable (V) or mixed (M) (using number of units produced as the activity measure) as well as a direct material (DM) direct labor (DL) or Overhead (OH) Factory supervision F - OH Aluminum tubing V - DM Rims V - DM Emblem V - DM Gearbox V - DM Straight-line depreciation on paint machine F - OH Fenders V - DM Inventory clerks salary F - OH Inspectors salary F - OH Handlebars V - DM Metal workers’ wages V - DL Roller chain V - DM Spokes (assuming cost is considered significant) V - DM Paint (assuming cost is considered significant) V - DM (CGM;CGS) The cost of goods sold in March 2008 for Raggae Rocks Co. was $2,300,000. March 31 Works in Process Inventory was 40 percent of the March 1 Work in Process Inventory. Overhead was 225 percent of Direct labor cost. During March $1,182,000 of direct material was purchased. Other March information follows: Inventories March 1 March 31 Direct Material $30,000 $42,000 Work in Process 90,000 ? Finished Goods 125,000 24,000 a. b. c. d. a Prepare a schedule of the cost of goods sold for March Prepare the March cost of goods manufactured schedule What was the amount of prime cost incurred in March What was the amount of conversion cost incurred in March Finished Goods Inventory, beginning Cost of Goods Manufactured Total FGI Available Finished Goods Inventory, ending Cost of Goods Sold $ 125,000 2,199,000 $2,324,000 (24,000) $2,300,000 b WIP, beginning Manufacturing Costs: Direct Materials Used: DMI, beginning Purchases Total DM Available DMI, ending Direct Labor Manufacturing Overhead Total Cost to Account For WIP, ending Cost of Goods Manufactured $ $ 30,000 1,182,000 $1,212,000 (42,000) $1,170,000 300,000 675,000 90,000 2,145,000 $2,235,000 (36,000) $2,199,000 c. Prime Cost = Direct Material + Direct Labor = $1,170,000 + $300,000 = $1,470,000 d. Conversion Cost = Direct Labor + MOH = $300,000 + $675,000 = $975,000