MASTER MINDS

No.1 for CA/CWA & MEC/CEC

17. BUDGETARY CONTROL

SOLUTIONS TO ASSIGNMENT PROBLEMS

Problem No. 1

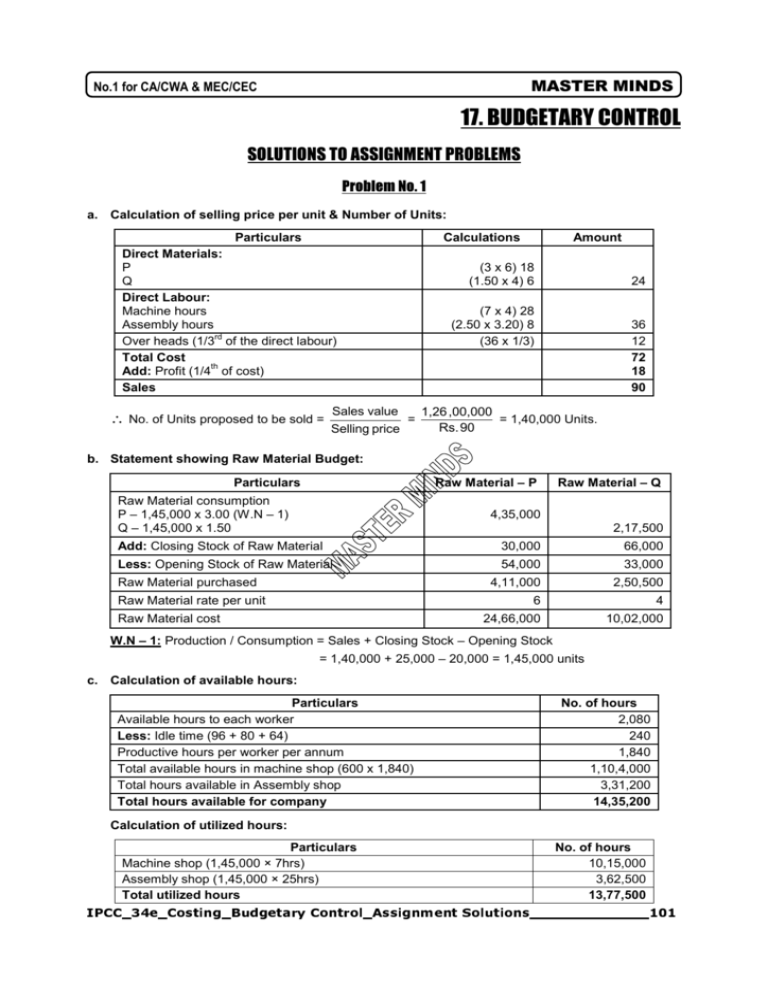

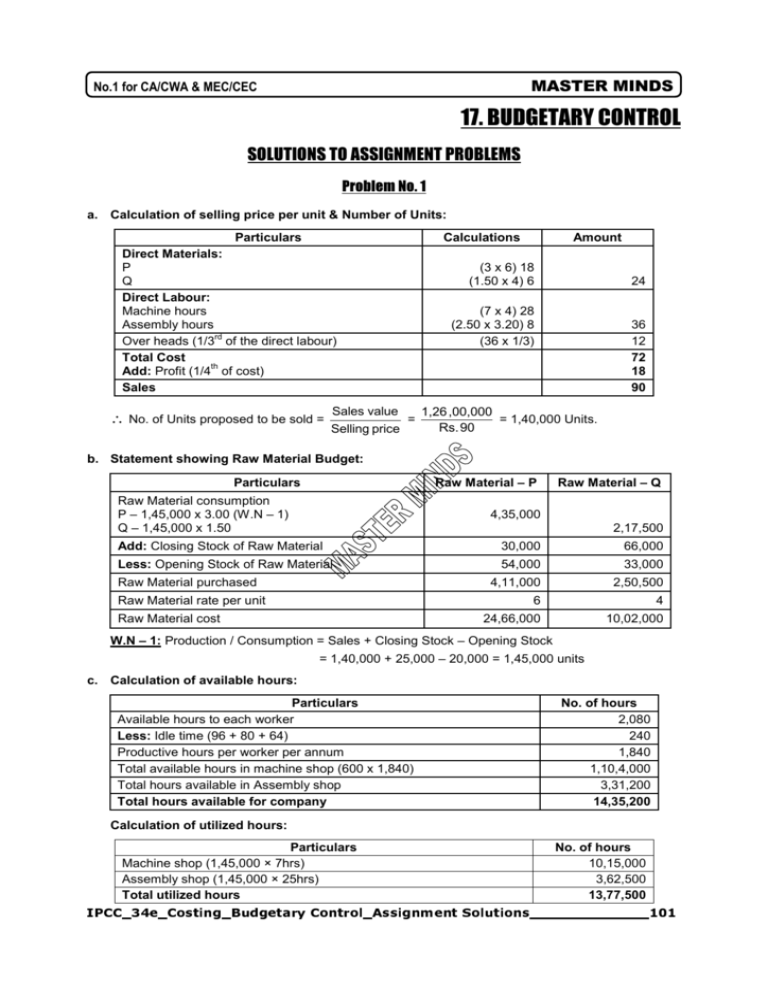

a. Calculation of selling price per unit & Number of Units:

Particulars

Direct Materials:

P

Q

Direct Labour:

Machine hours

Assembly hours

rd

Over heads (1/3 of the direct labour)

Total Cost

th

Add: Profit (1/4 of cost)

Sales

∴ No. of Units proposed to be sold =

Calculations

Amount

(3 x 6) 18

(1.50 x 4) 6

24

(7 x 4) 28

(2.50 x 3.20) 8

(36 x 1/3)

36

12

72

18

90

Sales value

1,26 ,00,000

= 1,40,000 Units.

=

Rs. 90

Selling price

b. Statement showing Raw Material Budget:

Particulars

Raw Material – P

Raw Material consumption

P – 1,45,000 x 3.00 (W.N – 1)

Q – 1,45,000 x 1.50

Raw Material – Q

4,35,000

2,17,500

Add: Closing Stock of Raw Material

30,000

66,000

Less: Opening Stock of Raw Material

54,000

33,000

4,11,000

2,50,500

Raw Material purchased

Raw Material rate per unit

Raw Material cost

6

4

24,66,000

10,02,000

W.N – 1: Production / Consumption = Sales + Closing Stock – Opening Stock

= 1,40,000 + 25,000 – 20,000 = 1,45,000 units

c. Calculation of available hours:

Particulars

Available hours to each worker

Less: Idle time (96 + 80 + 64)

Productive hours per worker per annum

Total available hours in machine shop (600 x 1,840)

Total hours available in Assembly shop

Total hours available for company

No. of hours

2,080

240

1,840

1,10,4,000

3,31,200

14,35,200

Calculation of utilized hours:

Particulars

Machine shop (1,45,000 × 7hrs)

Assembly shop (1,45,000 × 25hrs)

Total utilized hours

No. of hours

10,15,000

3,62,500

13,77,500

IPCC_34e_Costing_Budgetary Control_Assignment Solutions_____________101

Ph:

98851 25025/26

www.mastermindsindia.com

10,15,000

x 100 = 91. 94%

11,04,000

3,62,500

x 100 =109%

Assembly shop utilization =

3,31,200

Machine shop utilization =

Total capacity utilization =

13,77,500

Copy Rights Reserved

To

MASTER MINDS, Guntur

x 100 = 95. 98%

14,35,200

Comments:

1. In the Machine shop, utilization ratio is nearly 92% i.e, 8% is treated as normal idle time or normal loss.

2. In the Assembly shop, utilization ratio is nearly 109% i.e, overtime, it is a good sign to the company.

3. In case of overall company, utilization ratio is 96% i.e, 4% is treated as normal loss.

Problem No. 2

a. Production bedjet showing month wise number of units to be manufactured:

Gamma:

Sales

Add: closing stock

Less: closing stock

production

Apr

900

550

450

1000

May

1100

700

550

1250

June

1400

900

700

1600

July

1800

1100

900

2000

Aug

2200

1100

1100

2200

July

2100

850

1050

1900

Aug

1700

850

850

1700

Sep

2200

900

1100

2000

Total

10050

Delta:

Sales

Add: closing stock

Less: closing stock

production

Apr

2900

1450

1450

2900

May

2900

1250

1450

2700

June

2500

1050

1250

2300

Sep

1700

950

850

1800

Total

13300

b. Production cost budget for the half year:

Gamma

Direct material

Direct labour

Moh

Delta

Total

50

20

80

30

2,00,000

20,000

3,75,000

25,000

10

Cost per unit

Production

Production cost

15

80

10,050

8,04,000

125

13,300

16,62,500

24,66,500

Problem No. 3

(i) Production Budget for the year 2012 by Quarters

I

Sales demand(Unit)

18000

II

22000

III

IV

25000

27000

Total

92000

IPCC_34e_Costing_Budgetary Control_Assignment Solutions ____________102

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

I

Opening Stock

6000

7200

8100

8700

30000

II

70% of Current

Quarter ‘s

Demand

12600

15400

17500

18900

64400

III

30% of Following

Quarter’s Demand

6600

7500

8100

7400*

29600

IV

Total Production(II

&III)

19200

22900

25600

26300

94000

V

Closing Stock (I+IVSales)

7200

8100

8700

8000

32000

*Balancing Figure

(ii) Break Even Point = Fixed Cost/ PV Ratio

= 220000/13.75% = 1600000 or 40000 units.

P/V Ratio = (40 - 34.50 = 5.50)/40 × 100 =13.75%

(Or, Break Even Point= Fixed Cost/ Contribution = 2,20,000/5.50 = 40,000 Units)

Total sales in the quarter II is 40000 equal to BEP means BEP achieved in II quarter.

Problem No. 4

(i) Production Budget for January to March 2009 (Quantitative):

Budgeted Sales

Add: Budgeted Closing Stock (20%

of sales of next month)

Less: Opening Stock

Budgeted Output

Jan

10,000

Feb

12,000

Mar

14,000

April

15,000

2,400

12,400

2,700

9,700

2,800

14,800

2,400

12,400

3,000

17,000

2,800

14,200

3,000

18,000

3,000

15,000

Total Budgeted Output for the Quarter ended March 31, 2009 = (9,700 + 12,400 + 14,200) = 36,300

units.

(ii) Raw Material Consumption Budget (in quantity):

Month

Jan

Feb

Mar

Apr

Total

Budgeted Output

(Units)

9,700

12,400

14,200

15,000

Material ‘X’ @ 4 kg

per unit (Kg)

38,800

49,600

56,800

60,000

2,05,200

Material ‘Y’ @ 6 kg

per unit (Kg)

58,200

74,400

85,200

90,000

3,07,800

(iii) Raw Materials Purchase Budget (in quantity) for the Quarter ended

(March 31,2009):

Raw material required for production

Add: Closing Stock of raw material

Less: Opening Stock of raw material

Material X (kg)

1,45,200

30,000

1,75,200

19,000

Material Y (kg)

2,17,800

45,000

2,62,800

29,000

IPCC_34e_Costing_Budgetary Control_Assignment Solutions_____________103

Ph:

98851 25025/26

www.mastermindsindia.com

1,56,200

Material to be purchased

2,33,800

Problem No. 5

Working Note :

1. Statement showing contribution:

Sub assemblies

ABC

Selling price per 520

unit (p.u.) : (A)

Marginal Cost p.u.

Components

60

Base board

IC08

160

IC12

48

IC261

6

Labour

Grade A

40

Grade B

64

Variable

36

production

overhead

Total

marginal 424

cost p.u. : (B)

Contribution p.u. : 96

(C) = (A) – (B)

Sales ratio : (D)

3

Contribution

× 288

Sales ratio : [(E) =

(C) × (D)]

MCB

500

DP

350

60

60

40

120

48

40

48

64

30

48

24

20

32

24

370

288

130

62

4

520

2

124

Total

932

2. Desired Contribution for the forthcoming month December, 2012

Rs.

Fixed overheads

7,57,200

Desired profit

12,00,000

Desired contribution

19,57,200

3. Sales mix required i.e. number of batches for the forthcoming month December, 2012

Sales mix required =Desired contribution/contribution × Sales ratio

=` 19,57,200/932 (Refer to Working notes 1 and 2)

= 2,100

Budgets for December, 2012

(i) Sales budget in quantity and value

Sub-assemblies

ACB

MCB

DP

Total

Sales

(quantity) 6,300

8,400

4,200

(2,100 × 3:4:2)

(Refer to working

note 3)

Selling price p.u. 520

500

350

(` )

Sales value (` )

32,76,000

42,00,000

14,70,000

89,46,000

(ii) Production budget in quantity

Sub-assemblies

ACB

Sales

6,300

Add : Closing stock 720

(Opening stock less

10%)

Total quantity required

7,020

MCB

8,400

1,080

DP

4,200

2,520

9,480

6,720

IPCC_34e_Costing_Budgetary Control_Assignment Solutions ____________104

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Less : Opening stock

Production

800

6,220

1,200

8,280

(iii) Component usage budget in quantity

Sub-assemblies

ACB

MCB

Production

6,220

8,280

Base board (1 6,220

8,280

each)

Component IC08 49,760 (6,220 × 8) 16,560 (8,280 ×

(8 : 2 : 2)

2)

Component IC12 24,880 (6,220 × 4) 82,800 (8,280 ×

(4 : 10 : 4)

10)

Component IC26 12,440 (6,220× 2) 49,680 (8,280 × 6)

(2 : 6 : 8)

(iv) Component Purchase budget in quantity and value

SubBase board

IC08

IC12

assemblies

Usage

in 18,420

74,160

1,23,360

production

Add : Closing 1,440

1,080

5,400

stock (Opening

stock

less

10%)

19,860

75,240

1,28,760

Less : Opening

stock

Purchase

(Quantity)

Purchase price

(` )

Purchase

value (` )

2,800

3,920

DP

3,920

3,920

Total

18,420

7,840 (3,920 × 2)

74,160

15,680 (3,920 × 4)

1,23,360

31,360 (3,920 × 8)

93,480

IC26

Total

93,480

3,600

97,080

1,600

1,200

6,000

4,000

18,260

74,040

1,22,760

93,080

60

20

12

8

10,95,600

14,80,8 00

14,73,120

7,44,640

47,94,160

(v) Manpower budget showing the number of workers and the amount of wages

Payable

Direct labour hour

Grade A

Grade B

Sub

Budgeted

Hours per Total hours

Hours per Total hours

assemblies

production

unit

unit

ACB

6,220

8

49,760

16

99,520

MCB

8,280

6

49,680

12

99,360

DP

3,920

4

15,680

8

31,360

(A) Total hours

(B) Hours per man per

month

(C) Number of workers

per month : (A/B)

(D) Wage rate per

month (` )

(E) Wages payable (` ) :

(C × D)

1,15,120

200

2,30,240

200

576

1,152

1,000

800

5,76,000

9,21,600

Total

14,97,600

Problem No. 6

Flexible budget at 70% capacity:

IPCC_34e_Costing_Budgetary Control_Assignment Solutions_____________105

Ph:

98851 25025/26

www.mastermindsindia.com

Particulars

Variable cost:

Material

Labour

FOH

AOH

Per unit

70% capacity(7000 units)

500 X 102% = 510

150

90

50

800

Total

Fixed cost:

FOH

AOH

Total(A)

Sales(B)

56,00,000

3,00,000

2,50,000

61,50,000

68,60,000

5,000 units X 60

5,000 units X 50

7,000 units X (1,000-2%)

7,10,000

Profit(B-A)

Problem No. 7

Head of Account

Budgeted hours

Variable expenses

Semi-variable expenses

Fixed expenses

Total expenses

Recovery rate per hour

Control basis

V

SV

F

70%

7,000

1,260

1,200

1,800

4,260

0.61

80%

8,000

1,440

1,200

1,800

4,440

0.55

90%

9,000

1,620

1,320

1,800

4,740

0.53

100%

10,000

1,800

1,440

1,800

5,040

0.50

We notice that the recovery rate at 70% activity is Rs. 0.61 per hour. If in a particular month the Factory

works 8,000 hours, it will be incorrect to estimate the allowance as Rs. 4,880 @ Rs. 0.61. The correct

allowance will be Rs. 4,440 as shown in the table. If the actual expenses are Rs. 4,500 for this level of

activity, the company has not saved any money but has over-spent by Rs. 60 (Rs. 4,500 – Rs. 4,440).

Problem 8

Flexible Budget of Department....of Company ‘X’

Expenses

(1)

Sales

Administration costs:

Office salaries

General expenses

Depreciation

Rates & taxes

Total administration costs

Selling costs :

Salaries

Travelling expenses

Sales office expenses

General expenses

Total selling costs :

Distribution costs :

Basis

(2)

6,00,000

80%

(`)

(3)

6,75,000

Level of activity

90%

100%

(`)

(`)

(4)

(5)

7,50,000

8,25,000

Fixed

2% of sales

Fixed

Fixed

1,18,250

90,000

12,000

7,500

8,750

1,19,750

90,000

13,500

7,500

8,750

1,21,250

90,000

15,000

7,500

8,750

1,22,750

90,000

16,500

7,500

8,750

8% of sales

2% of sales

1% of sales

1% of sales

48,000

12,000

6,000

6,000

72,000

54,000

13,500

6,750

6,750

81,000

60,000

15,000

7,500

7,500

81,000

66,000

16,500

8,250

8,250

99,000

110%

(`)

(6)

IPCC_34e_Costing_Budgetary Control_Assignment Solutions ____________106

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Wages

Rent 1% of sales

Other expenses

Total Distribution Cost

Total Admn., Selling & Dist.

Costs

Wages

6,000

4% of sales

15,000

6,750

24,000

45,000

2,35,250

15,000

7,500

27,000

48,750

2,49,500

15,000

8,250

30,000

52,500

2,63,750

15,000

33,000

56,250

2,78,000

Note: In the absence of information it has been assumed that office salaries, depreciation, rates and

taxes and wages remain the same at 110% level of activity also. However, in practice some of these

costs may change if present capacity is exceeded.

Problem 9

ABC Ltd.

Budget for 85% capacity level for the period 2013-14

Budgeted production (units)

Direct Material (note 1)

Direct Labour (note 2)

Variable factory overhead (note 3)

Variable selling overhead (note 4)

Variable cost

Fixed factory overhead (note 3)

Fixed selling overhead (note 4)

Administrative overhead

Fixed cost

Total cost

Add : Profit 20% on sales or 25% on total cost

Sales

Contribution (Sales – Variable cost)

Working Notes :

85,000

Amount (`)

18,36,000

8,92,500

1,78,500

3,67,200

32,74,200

2,20,000

1,15,000

1,76,000

5,11,000

37,85,200

9,46,300

47,31,500

14,57,300

Per Unit (`)

21.60

10.50

2.10

4.32

38.52

(1) Direct Materials :

65% Capacity

75% Capacity

` 15,00,000

` 13,00,000

65% Capacity

55%

Capacity

` 13,00,000

` 11,00,000

10% change in capacity

2,00,000

10% change in capacity

2,00,000

For 10% increase in capacity, i.e., for increase by 10,000 units, the total direct material cost regularly changes by `

2,00,000

Direct material cost (variable) = ` 2,00,000 ÷ 10,000 = ` 20

After 8% increase in price, direct material cost per unit = ` 20 × 1.08 = ` 21.60

Direct material cost for 85,000 budgeted units = 85,000 × ` 21.60 = ` 18,36,000

(2) Direct Labour :

75% Capacity

`

7,50,000

65% Capacity

`

6,50,000

IPCC_34e_Costing_Budgetary Control_Assignment Solutions_____________107

Ph:

98851 25025/26

www.mastermindsindia.com

65% Capacity

55% Capacity

` 6,50,000

10% change in capacity

1,00,000

10% change in capacity

For 10% increase in capacity, direct labour cost regularly changes by ` 1,00,000.

Direct labour cost per unit = ` 1,00,000 ÷ 10,000 = ` 10

After 5% increase in price, direct labour cost per unit = ` 10 × 1.05 = ` 10.50

Direct labour for 85,000 units = 85,000 units × ` 10.50 = ` 8,92,500.

(3) Factory overheads are semi-variable overheads:

75% Capacity

65% Capacity

` 3,50,000

65% Capacity

55% Capacity

` 3,30,000

10% change in capacity

20,000

10% change in capacity

Variable factory overhead = ` 20,000 ÷ 10,000 = ` 2

Variable factory overhead for 75,000 units = 75,000 × ` 2 = ` 1,50,000

Fixed factory overhead = ` 3,50,000 – ` 1,50,000 = ` 2,00,000.

Variable factory overhead after 5% increase = ` 2 × 1.05 = ` 2.10

Fixed factory overhead after 10% increase = ` 2,00,000 × 1.10 = ` 2,20,000

(4) Selling overhead is semi-variable overhead :

75% Capacity

65% Capacity

` 4,00,000

65% Capacity

55% Capacity

` 3,60,000

10% change in capacity

40,000

10% change in capacity

Variable selling overhead = ` 40,000 ÷ 10,000 units = ` 4

Variable selling overhead for 75,000 units = 75,000 × ` 4 = ` 3,00,000.

Fixed selling overhead = ` 4,00,000 – ` 3,00,000 = ` 1,00,000

Variable selling overhead after 8% increase = ` 4 × 1.08 = ` 4.32

Fixed selling overhead after 15% increase = ` 1,00,000 × 1.15 = ` 1,15,000

` 5,50,000

1,00,000

3,30,000

` 3,10,000

20,000

`

3,60,000

3,20,000

40,000

`

`

(5) Administrative overhead is fixed :

After 10% increase = ` 1,60,000 × 1.10 = ` 1,76,000

Problem.10

Master Budget for the year ending

Sales :

Toughened Glass

Bent Glass

Total Sales

Less : Cost of

production :

Direct materials (60% of

` 8,00,000)

Direct wages (20

workers × ` 150 × 12

months)

Prime Cost

Fixed Factory

Overhead :

Works manager’s

salary (500 × 12)

Foreman’s salary (400

× 12)

(`)

6,00,000

2,00,000

8,00,000

4,80,000

36,000

5,16,000

6,000

4,800

IPCC_34e_Costing_Budgetary Control_Assignment Solutions ____________108

MASTER MINDS

No.1 for CA/CWA & MEC/CEC

Depreciation

Light and power

(assumed fixed)

Variable Factory

Overhead :

Stores and spares

Repairs and

maintenance

Sundry expenses

Works Cost

12,600

3,000

26,400

20,000

8,000

3,600

31,600

5,74,000

2,26,000

36,000

1,90,000

Gross Profit (Sales – Works cost)

Less: Adm., selling and distribution expenses

Net Profit

Problem 11

Budget Showing Current Position and Position for 2013

Position for 2012

Sales (units)

(A) Sales (` )

Direct Material

Direct wages

Factory

overhead

(variable)

Other variable

Costs

(B) Marginal

Cost

(C)

Contribution

(A-B)

Fixed costs –

Factory

– Others

(D) Total fixed

Cost

Profit

(C – D)

A

B

2,00,000

1,00,000

(`)

(`)

4,00,000

1,00,000

50,000

50,000

3,50,000

75,000

50,000

50,000

50,000

30,000

2,50,000

2,05,000

1,50,000

1,45,000

Position for 2013

Total

(A+B)

–

A

B

C

1,50,000

50,000

2,00,000

(`)

(`)

(`)

3,00,000

75,000

37,500

37,500

1,75,000

37,500

25,000

25,000

3,50,000

80,000

50,000

50,000

8,25,000

1,92,500

1,12,500

1,12,500

37,500

15,000

50,000

1,02,500

4,55,000

1,87,500

1,02,500

2,30,000

5,20,000

2,95,000

1,12,500

72,500

1,20,000

3,05,000

(`)

7,50,000

1,75,000

1,00,000

1,00,000

80,000

Total

(A+B+C)

–

(`)

1,00,000

1,00,000

80,000

1,80,000

80,000

1,80,000

1,15,000

1,25,000

Comments: Introduction of Product C is likely to increase profit by ` 10,000 (i.e. from ` 1,15,000 to ` 1,25,000)

in 2013 as compared to 2012. Therefore, introduction of product C is recommended.

THE END

IPCC_34e_Costing_Budgetary Control_Assignment Solutions_____________109