Chapter Funds Management - Phi Beta Sigma Fraternity, Inc.

advertisement

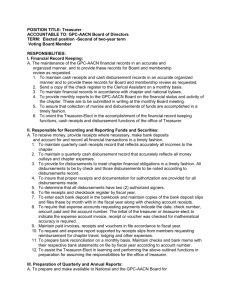

How to handle funds a. The Financial Secretary (Treasurer, if no Financial Secretary) shall kept at duplicate prenumbered receipt books and record all funds received in the name of the chapter, regardless of the source. This includes National and Regional Dues, other fees due National Office, Fund Raising Project receipts, Chapter Budgets, etc. These funds shall be turned over to the Treasurer with a statement indicating the source of the funds. b. The Treasurer shall receive funds from the Financial Secretary and deposit funds, intact, to the account of the Fraternity Chapter. c. In order to withdraw funds which have been properly budgeted, a requisition for payment voucher should be prepared by the Financial Secretary and signed by the President and the Treasurer. A check should then be issued, signed by the Treasurer, the President and the Advisor to the Collegiate chapter. d. If an item does not appear in the Budget, approval for such disbursement from the contingency fund should be secured from the chapter President and any other two chapter Officers or the Finance Committee as agreed upon by the Chapter. What Reports to make a. Bank statements should be reconciled each month by the Treasurer. A monthly statement should be given to the chapter reflecting the beginning balances of cash, cash receipts, cash disbursements, and new cash balance at date of statement. The monthly statement when compared with the budget will give the Officers more guidance on the financial operation of the chapter. b. The Financial Secretary (Treasurer, if none) shall keep a financial record of each Brother. (Individual membership ledger) c. Savings account should be included in the monthly report d. Report on any fund raising projects What Records should be kept a. b. c. d. Duplicate pre-numbered receipt book Cash receipt and Cash disbursement Book Financial record of individual Brothers Bank records-duplicate deposit slips, bank statements and cancelled checks, and debit and credit memoranda. Developing a Budget Who makes the Budget? Each Chapter should have a Finance and/or Budget Committee. One of its duties is the development of a budget. The Treasurer and the Financial Secretary should be members of this committee. The following data should be made available to this Committee: a. b. c. d. Planned program activities Estimated number of financial brothers Planned fund raising projects Other Sources (funds from the graduate chapters, Pan-Hellenic Council, etc.) When should the Budget be made? The Chapter should prepare a budget prior to the beginning of its business year. If this is not possible, the budget should be completed during the first month of the business year and approved by the Chapter in order that the Chapter might begin operating under the budget immediately. It is also necessary to complete the budget so that dues for the year can be determined. How is the Budget made? Essentially there are two parts to a budget: 1) Estimated Receipts, and 2) Estimated Disbursements. These amounts are estimated for the business year. Receipts: The main source of income for the Chapter operation are dues (Chapter budget), initiation fees, assessments, and fund raising projects, etc. Disbursements: The items for which money is to be spent will depend upon the program of activities of the Chapter, during the year, general operating expenses and the amount to be spent on National and Regional activities associated with the Chapters. Often it is necessary to first list the items and amount the Chapter would like to spend, total items and divide by the estimated number of Brothers who will financially support the Chapter in order to determine dues (Chapter budget). If this amount proves too large, then some items of expenses must be eliminated unless special projects are planned to bring in more income. Administration and Control Fund Management The officers of the Chapter have a responsibility to manage funds within the budget in accordance with the following procedures: 1. Money can only be spent for budgeted items if it has been collected and is on hand. Approval of the budget by the Chapter does not necessarily indicate that funds are available because all brothers may not have paid dues (Chapter budget) in full in advance nor will income from special projects be available at the beginning of the budget year. Before each disbursement or commitment the Treasurer should make known the funds which are available. 2. Regular monthly reporting of receipts and disbursements and cash balances by the Treasurer will permit more adequate decisions about disbursements of funds. 3. All disbursements should be made by check, and invoices or supporting evidence to substantiate payment. 4. After the disbursement is approved, vouchers are made and signed by the designated Officers and presented to the Treasurer. The check is prepared and signed by the Treasurer and countersigned by the President and Advisor. 5. If a PETTY CASH fund is used, a check should be made payable to one particular person, receipts showing how the money was spent should be presented periodically. 6. Emergency disbursements should be approved by the Chapter, by the President and one other Officer who reports to the Chapter. The CONTINGENCY FUND is used for this purpose. Handling Money 1. Checking accounts In order to open a bank account, an application has to be made a submitted to the bank. Often a copy of the miniutes or a resolution showing which Officers are authorized to withdraw and/or sign checks is required. Regular accounts, rather than special checking accounts are recommended so as to be entitled to monthly statements. However, it is advisable that you discuss the type of checking account that would best serve the needs of your chapter with the bank officials. 2. Savings Accounts Saving accounts are opened in the same manner as checking accounts. 3. Financial Officers Every chapter should bond its financial officers and advisor who sign checks. Surety Bonds may be secured through a local insurance broker. Bonds should be deposited with the National Office. 4. Auditing The financial records of the chapter should be audited at least once a year, and written report of the financial condition of the chapter made. It is often necessary and desirable to audit (fund raising) project accounts immediately thereafter.