treasurer`s training

advertisement

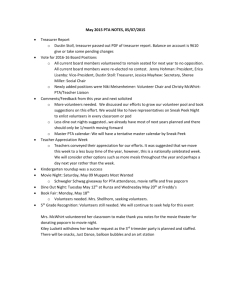

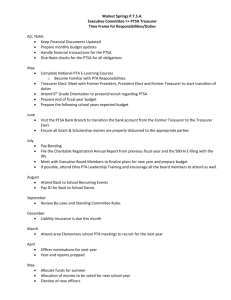

PTA LOCAL UNIT TREASURER DUTIES OF A TREASURER ASSIST IN DEVELOPING A BUDGET MANAGE THE FUNDS OF THE UNIT SUBMIT A BUDGET REPORT AT REGULAR MEETINGS. DEPOSIT ALL MONIES INTO THE PTA BANK ACCOUNT PAY ALL BILLS BY CHECK WITH TWO SIGNATURES KEEP RECORDS & PAY ALL MEMBERSHIP DUES KEEP RECORDS OF ALL TRANSACTIONS MADE IN ACCOUNT (FOR SEVEN YEARS) NEVER KEEP MONEY AT YOUR HOME MONEY/FUNDS SHOULD BE COUNTED BY TWO PEOPLE YOUR TREASURER FILE SHOULD HAVE… A COPY OF PTA BYLAWS & STANDING RULES COPY OF ADOPTED BUDGET PAST RECEIPTS CHECKBOOK FINANCIAL RECORDS FROM PAST TREASURER EIN NUMBER WITH LETTER COPY OF FILED 990 TAX FORMS SALES TAX NUMBER UP TO DATE MEMBERSHIP LIST COPY OF MONEY MATTERS BOOK AUDIT REPORTS 7 YEARS OF RECEIPTS FROM PAST TREASURERS THREE YEARS OF BUDGETS IMPORTANT TREASURER DATES SEPT. 15TH – SUBMIT VOLUNTEER FINANCE SERVICE REPORT FOR PAST YEAR TO PTA STATE OFFICE NOV. 15TH- SUBMIT INSURANCE PREMIUM & MEMBERSHIP DUES (FORMS FOUND IN IRM UNDER TAB #2) MONTHLY- SUBMIT ANY NEW MEMBERSHIP DUES MONTHLY AFTER NOVEMBER NOV. 15TH- 990N TAX FORM FROM PAST YEAR BUDGETING TREASURERS DUTIES ON BUDGETING BUDGETING IS NOT THE TREASURER’S SOLE RESPONSIBILITY. THE TREASURER NEEDS THE INPUT OF THE BOARD AND COMMITTEE ON HOW MUCH INCOME AND EXPENSES ARE EXPECTED IN THE DIFFERENT CATEGORIES FOR THE FISCAL YEAR. THE BUDGET-COMMITTEE, THE BOARD & THE TREASURER SHOULD WORK ON THIS TOGETHER. THE TREASURER WILL FINALIZE THE NUMBERS PRIOR TO DEVELOPING THE BUDGET REVIEW PTA MISSION PREPARE A LIST OF OBJECTIVES AND GOALS FOR THE COMING YEAR – IDENTIFY NEEDS – IDENTIFY WHAT IS TO BE ACCOMPLISHED – HOW WILL IT BE ACCOMPLISHED DEVELOPING THE BUDGET ESTIMATE THE COST OF EACH APPROVED GOAL ESTIMATE THE EXPECTED INCOME COMPARE TOTAL EXPECTED INCOME TO THE EXPENSE OF ACHIEVING THE GOAL. APPROVING THE BUDGET PRESENT TO THE BOARD AND BUDGET COMMITTEE FOR APPROVAL PRESENT TO MEMBERSHIP FOR MAJORITY APPROVAL BUDGET SHOULD BE PRESENTED ITEM BY ITEM MONITORING THE BUDGET BUDGET SHOULD BE COMPARED THROUGHOUT THE YEAR WITH ACTUAL EXPENSES PREPARE TIMELY FINANCIAL REPORTS CORRECT ANY ACTIONS THAT ARE NOT MEETING FINANCIAL NEEDS WITH BOARD AMENDING THE BUDGET BUDGET MAY BE AMENDED (OR CHANGED) BY A VOTE OF THE SAME BODY THAT APPROVED IT BECAUSE THE BUDGET IS ONLY AN ESTIMATE, IT MAY BECOME NECESSARY FROM TIME TO TIME TO AMEND IT. BUDGET EXAMPLES FUNDRAISER CHOICES ESTIMATED EXPENSES ACTUAL EXPENSES Income Budget Estimated Income Actual Income REIMBURSMENT FORM KEEP TRACK OF EVERY PURCHASE OR MONEY PAID OUT RECEIPTS ATTACHED FOR RECORDS SIGNED BY PRESIDENT & TREASURER EXPENSE CATEGORY DEFINED REIMBURSEMENT FORM Event Used For Signature of the President or Treasurer Budget Category SALES TAX ALL IDAHO PTA’S ARE REQUIRED TO PAY SALES TAX – WE ARE NOT TAX EXEMPT BASICALLY, WE PAY TAX ON ANYTHING WE SELL! FOR MORE INFORMATION CHECK YOUR IRM UNDER TREASURERS DUTIES WHAT IS A 990 TAX? THE 990 TAX FORM IS REQUIRED ANNUALLY BY THE IRS FOR ALL NON PROFIT ORGANIZATIONS. WHICH 990? TAKE YOUR LAST THREE YEARS GROSS RECEIPTS AND FIND THE AVERAGE AVERAGE GREATER THAN $100,000 FORM 990 AVERAGE GREATER THAN $25,000 FORM 990EZ ANY OTHERS FORM 990N (e-POSTCARD) 990N FACTS (e-POSTCARD) MUST BE FILED ELECTRONICALLY AT http://epostcard.form990.org/ INFORMATION NEEDED – – – – – – NAME OF PTA MAILING ADDRESS EIN NUMBER TAX PERIOD NAME & ADDRESS OF PRINCIPLE OFFICER CONFIRMATION THE PTA’S RECEIPTS ARE $25,000 OR LESS 990EZ FORM GO TO http://www.irs.gov/pub/irspdf/f990ez.pdf AND PRINT OUT THE FORMS MEMBERSHIP DUES WORK WITH MEMBERSHIP PERSON TO KEEP TRACK OF ALL MEMBERS COUNT MEMBERS & MAIL $7.00 FOR EACH MEMBER TO THE IDAHO STATE PTA OFFICE BY NOVEMBER 15TH AND EVERY MONTH AFTER. “INSTEAD OF WAITING FOR OPPORTUNITY, TAKE HOLD OF YOUR FUTURE AND FACE EACH DAY WITH A SPIRIT OF OPTIMISM AND EXCITEMENT.” BYRON V. GARRETT NATIONAL PTA EXECUTIVE DIRECTOR