Finance 101

advertisement

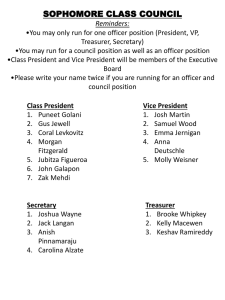

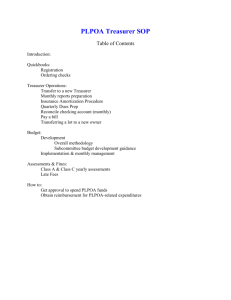

Eastern Area Leadership Forum Money! Money! Money Links Finance Agenda • Presenters Ethelyn S. Bowers, Area Treasurer esbowers@comcast.net 862-926-9333 Valerie Lancaster Beal, Area Financial Secretary vlancaster@mrbeal.com 917-576-8302 Agenda • DUTIES Treasurer & Financial Secretary • BUDGET & FINANCES • BANK ACCOUNTS • ACCOUNTING PRACTICES • LIABILITY & BONDING INSURANCE • FUNDRAISING IN LINKDOM Agenda • 503c(3) vs. 503c(4) – WHY & SO WHAT? • MOVING TOWARD TRANSPARENCY IN THE EASTERN AREA DUTIES • Treasurer Receive monies collected by Financial Sec. Deposit money promptly in all accounts Pay all accounts, approved by chapter (all checks to be co-signed by President) Checks should be documented with a voucher DUTIES • Treasurer Checks should be printed with “Void after 90 days” Reconciles book balances with monthly bank Statements Prepares complete financial report at each chapter meeting DUTIES • Treasurer Presents annual report at May chapter meeting Submits books to internal audit committee with 40 days of April 30th Engages professional external auditor biennially ; when officers and/or treasurer change DUTIES • Financial Secretary Receives all money from whatever source; provides receipts in triplicate (1 for payee, 1 for treasurer and 1 for Financial Secretary) Reconciles funds to total received, purpose of funds and turns over to treasurer Keeps record of individual member obligations BUDGET & FINANCES • Budget is a “plan of action” Budget should be approved by chapter at least 2 months prior to the end of fiscal year Budget should be presented NO LATER than Feb. 1st Financial Officers: Treasurer, Financial Secretary, President, VP BUDGET & FINANCE • Finance Committee is appointed by the Chapter president; chaired by the Treasurer and includes the Financial Secretary ACCOUNTING PRACTICES • Fiscal Year (May 1 through April 30) Payment of chapter & National dues must be submitted through local chapter (exception is Affiliate members) Chapter President or designee, shall sign all contracts Monthly financial report reveals complete financial status of chapter ACCOUNTING PRACTICES • Restricted Funds Funds received or solicited for Program Facets Grant in aid contributions Funds derived from public, individuals/corp. by special events, grants or solicitations ACCOUNTING PRACTICES • Restricted Funds Received for “Benefit –The Links Foundation” and/or grants written by chapters and funded by Links Foundation TAX DEDUCTIBLE for contributors Allowable expenditures (up to 10% of net income; cost of delegate to National/Area meeting ACCOUNTING PRACTICES • Unrestricted Funds Chapter dues, assessments for social events , amount permitted from restricted funds (up to 10%) Chapter Assessments – are due & payable prior to leave of absence being granted Financial obligations & service hours must be met prior to National dues being paid ACCOUNTING PRACTICES • Group Exemption Number is 1520 All chapters must file Form 990, 990EZ or 990N regardless of income level Forms submitted to IRS and National HQ LIABILITY/BONDING • Liability Insurance Has been automated – information is online; coverage is mandatory; chapter shall be covered for all activities/events Chapter is assessed $5/member for umbrella liability insurance Chapter is permitted to secure a rider for additional coverage at a reduced rate BONDING INSURANCE • Process has been automated – forms online Chapter officers who handle funds must have bonding insurance; all signatories on chapter checks must be bonded Payment due September 15th $500 penalty for failure to meet deadline FUNDRAISING • The Links, Incorporated 501c(4) – Exempt from paying Federal Income tax; contributions NOT tax deductible The Links Foundation, Inc 501c(3) – Exempt from paying Federal Income tax; contributions ARE tax deductible Chapter establishes separate account FUNDRAISING • Chapter Fundraiser Establish separate checking account All funds, less expenses, raised from public must be used for charitable purposes Tickets must contain -Contributions to this organization are not tax deductible as charitable contributions for Federal Income tax purposes FUNDRAISING • Fundraising using The Links Foundation 501c(3) tax deduction Ticket must include –For the Benefit of The Links Foundation, Inc. Ticket must state tax deductible portion of price Net balance of funds sent to Foundation with report 501c(3) vs 501c(4) • Tax advantages National vs local fundraising MOVING TOWARD TRANSPARENCY • Standardization of accounting • Use of technology • Skill set of those with fiscal responsibility