P5–13 Portfolio analysis You have been given the

advertisement

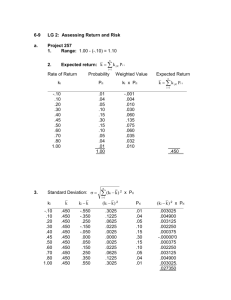

P5–13 Portfolio analysis You have been given the return data shown in the first table on three assets—F, G, and H—over the period 2007–2010. Using these assets, you have isolated the three investment alternatives shown in the following table: a. Calculate the expected return over the 4-year period for each of the three alternatives. b. Calculate the standard deviation of returns over the 4-year period for each of the three alternatives. c. Use your findings in parts a and b to calculate the coefficient of variation for each of the three alternatives. d. On the basis of your findings, which of the three investment alternatives do you recommend? Why? a. Expected portfolio return: Alternative 1: 100% Asset F kp 16% 17% 18% 19% 17.5% 4 Alternative 2: 50% Asset F + 50% Asset G Year Asset F (wF x kF) + Asset G (wG x kG) 2001 2002 2003 2004 (16% x .50 = 8.0%) (17% x .50 = 8.5%) (18% x .50 = 9.0%) (19% x .50 = 9.5%) + + + + (17% x .50 = 8.5%) (16% x .50 = 8.0%) (15% x .50 = 7.5%) (14% x .50 = 7.0%) kp Portfolio Return kp = = = = 16.5% 16.5% 16.5% 16.5% 66 16.5% 4 Alternative 3: 50% Asset F + 50% Asset H Year Asset F (wF x kF) + Asset H (wH x kH) 2001 2002 2003 2004 (16% x .50 = 8.0%) (17% x .50 = 8.5%) (18% x .50 = 9.0%) (19% x .50 = 9.5%) + + + + (14% x .50 = 7.0%) (15% x .50 = 7.5%) (16% x .50 = 8.0%) (17% x .50 = 8.5%) kp 66 16.5% 4 ( ki k ) 2 Standard Deviation: kp i 1 ( n 1) n b. (1) Portfolio Return kp 15.0% 16.0% 17.0% 18.0% F F (16.0% 17.5%) (-1.5%) 2 (17.0% 17.5%) 2 (18.0% 17.5%) 2 (19.0% 17.5%) 2 4 1 2 (0.5%) 2 (0.5%) 2 (1.5%) 2 3 F (2.25% 0.25% 0.25% 2.25%) 3 F 5 1.667 1.291 3 (2) (16.5% 16.5%) FG (0) FG 2 2 (16.5% 16.5%) 2 (16.5% 16.5%) 2 (16.5% 16.5%) 2 4 1 (0) 2 (0) 2 (0) 2 3 FG 0 (3) FH FH FH FH c. (15.0% 16.5%) (1.5%) 2 2 (16.0% 16.5%) 2 (17.0% 16.5%) 2 (18.0% 16.5%) 2 4 1 (0.5%) 2 (0.5%) 2 (1.5%) 2 3 (2.25 .25 .25 2.25) 3 5 1.667 1.291 3 Coefficient of variation: CV CVF 1.291 .0738 17.5% CVFG 0 0 16.5% = k k CVFH d. 1.291 .0782 16.5% Summary: Alternative 1 (F) Alternative 2 (FG) Alternative 3 (FH) kp: Expected Value of Portfolio kp 17.5% 16.5% 16.5% 1.291 -01.291 CVp .0738 .0 .0782 Since the assets have different expected returns, the coefficient of variation should be used to determine the best portfolio. Alternative 3, with positively correlated assets, has the highest coefficient of variation and therefore is the riskiest. Alternative 2 is the best choice; it is perfectly negatively correlated and therefore has the lowest coefficient of variation.