Investing in Today`s Volitile Market

advertisement

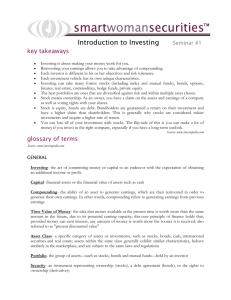

Positioning Your Portfolio for Today’s Volatile Markets and the Coming Recovery By Matthew Lekushoff Financial Advisor Matthew.lekushoff@raymondjames.ca www.matthewlekushoff.com Topics • • • • • How Did We Get Here? The Importance of Multiple-Class Investing Human Nature Financial/Life Planning Were Do We Go From Here? How Did We Get Here How Did We Get Here? Success is simple……..but not easy! Lance Armstrong How Did We Get Here? Roots in the aftermath of 9/11 Lowering interest rates to prevent recession • • • • Housing Bubble Lending Bubble Social Proof Ignoring History How Did We Get Here? • Irrational Exuberance • Tulipmania • The South Sea Bubble • Dot Com Bubble Asset Allocation Asset Allocation Let every man divide his money into three parts, and invest a third in land, a third in business, and a third let him keep in reserve Talmud Circa 1200 B.C. – 500 A.D. Historical Returns S&P Index from 1825 to 2008 – Percentage Total Return Diversification (random returns) 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Highest Return Lowest Return Source: CIBC Asset Management Inc. Objective of an Investor • Rational investor wants to maximize returns with a given amount of risk Basis of “Modern Portfolio Theory” Modern Portfolio Theory Efficient Frontier: Key principle behind portfolio management Optimal Allocation The Efficient Frontier Same Risk with Greater Return The optimal allocation is the combination of stocks, bonds, and cash that maximizes expected return for any level of expected risk Expected Return High Less Risk with Same Return Inefficient Portfolio Low Low Expected Risk High Investment Risks • Event Risk (can’t control) • economic, social and political events • Market Risk (can control) • Security Selection • Concentration • Asset Allocation – Cash, Bonds, Stocks (sector, geography), Real Assets • Inflation (rising prices – can’t control) • Taxes (dependant on source of income) • Human Nature (can control) Variability of Performance Factors Affecting Risk Tolerance • • • • Time horizon Ability to handle market volatility Aggressiveness of goals Different type of goals – Compartmentalizing Types of Assets • Cash – T-Bills/GIC • Fixed Income – Bonds • Equities/Real Assets – – – – – Canadian Equities US Equities International Equities Commodities Real Estate Long Term Diversification • Annual Returns for Decade Ending February 2009 US Stocks (-1%) International Stocks (1%) Real Estate (7%) Natural Resources (7%) • Rebalance on a regular basis Did Diversification Work During the Crisis? What Worked? – Cash/T-bills – Bonds What Kind of Worked? – Gold/Precious Metals – Real Estate What Didn’t Work? – International Diversification Why didn’t it work as well as hoped? In times of crisis only two things matter • Risk and Safety Investors were fleeing risk into safety Asset Allocation Conclusion In times of crisis allocation between cash, bonds and equities is most important Over the long term (5 years+) allocation between and rebalancing of multiple asset classes is very important Human Nature Human Nature We have seen the enemy……..and he is us! The Pogo Papers Human Nature • Morningstar Survey – Looked at all 17 categories of securities they follow – In all 17 the time weighted returns are higher than the dollar weighted returns • Top 10 Internet Funds 1997-2002 – Time Weighted average 1.5%/year – Dollar weighted -72% • Tax Bill was 24% due to turnover Human Nature • Over Confidence – 82% of students consider themselves better than average drivers – Men are more overconfident than women in areas like finance – Overconfidence leads to too much trading and higher fees as well as taking too much risk Human Nature • Pride and Regret (Get-Evenitis) – Selling winners too early and losers too late - Investors are 50% more likely to sell a winner than a loser Would I buy this stock if I didn't own it? Human Nature • Considering the Past – People tend to use a past outcome as a factor in evaluating a current risky situation – People take a larger risk after large gains and less risk after loses – However sometimes after losing money some investors will "double down" to get even Human Nature • Mental Accounting – Viewing investments on an individual basis as opposed to part of the whole. Human Nature • Representativeness and Familiarity – Canadians owning mostly Canadian stocks – Residents of Atlanta owning lots of Coke – Employees owning a high percentage of their company's stock. – Over 50% of the time an investor becomes interested in a stock because another person mentions it Human Nature • Social Interaction and Investing – Herding or social proof – Buying Nortel because everyone else owns it. • Emotion and Investing – Compared the daily return in 26 stock exchanges around the world to the weather in the 26 exchanges. – When they annualized the difference between the sunniest and worst days the difference was 24.6% Human Nature Conclusion Investors need to work hard to be rational!! Financial/Life Planning Financial/Life Planning I have always thought that one man of tolerable abilities may work great changes, and accomplish great affairs among mankind, if he first forms a good plan! Benjamin Franklin Why do we invest • To reach a goal or objective – – – – – Buy a house Retirement Achieve financial independence Protect family Create a legacy Goal of an Investor • Increase the probability of reaching your goals or • Reduce the probability of not reaching your goals Financial/Life Planning Two biggest risks to achieve your financial goals • • Volatility – Short Term Inflation – Long Term Inflation Order of Returns Reduce Risk of Large Losses • Making mistakes early can hurt you in the long run • Invest $100,000 • Investment drops 20% to $ 80,000 • You need to earn 25% to break even again • $80,000 X 1.25% = $100,000 Probability of Reaching Goals Comfort Assessment Uncertain <75% A confidence level below 75% means that there is too high of a chance you may not achieve your goals. Adjustments need to be made to your goals, your allocation or your investments 100% 95% 90% 85% 80% 75% 70% 65% 60% 55% 50% 45% 40% 35% 30% 25% Sacrifice >90% A confidence level above 90% indicates that you are needlessly sacrificing your financial goals. You could take less investment risk, achieve larger or more goals and still maintain confidence in your financial future. Uncertain Comfort Sacrifice Confidence & Comfort (in “balance”) A confidence level between 75% and 90% should give you confidence that your goals can be met. This reading indicates a set of goals that is manageable and avoids unnecessary investment risk. You may find at some future date minor changes may be suggested, but they are likely to be small, easily manageable and exposed well in advance through ongoing monitoring. This analysis simultaneously evaluates your goals, your investment allocation and your assets to determine how confident you can be that your goals will be met. The Wealthcare process subjects your goals and investment strategy to this sophisticated ‘stress testing’ process which simulates 1000 market environments, both good and bad. Your Confidence or Comfort is the percentage of the 1000 simulations that achieve your goals. For example, if you achieved all of your goals or more in 830 of 1000 tests your Achieving Your Goals $3,000,000 Your Portfolio $1,800,000 $200,000 54 55 56 57 58 Age 59 60 61 Monitoring Your Progress… As financial markets, financial goals and priorities change, we monitor your progress on an ongoing basis. The Wealthcare process identifies in advance the future portfolio values needed to maintain balance between confidence and undue sacrifice. This monitoring process enables us to track where your current portfolio falls so we can alert you of potential problems, or help you achieve additional goals you may have. Additionally, this dynamic process recognizes that throughout your life, goals and priorities change. In such cases we will design new recommendations for you. Financial/Life Planning • • • • • • Estate Planning Risk Planning Tax Planning Business Planning Retirement Planning Life Planning Financial/Life Planning • Conclusion – Having a well thought out plan is essential in order to reach your goals and get the most out of your life – Even the best plans need to be updated on a regular basis Where Do We Go From Here? Questions? By Matthew Lekushoff Financial Advisor Matthew.lekushoff@raymondjames.ca www.matthewlekushoff.com Recommended Readings • Extraordinary Popular Delusions and the Madness of Crowds – Charles Mackay • Influence and the Psychology of Persuasion – Robert Cialdini • Seeking Wisdom – From Darwin to Munger – Peter Bevelin • The Importance of Muliti-Class Investing (White Paper) – Roger Gibson