Financial Capability - Jim Casey Youth Opportunities Initiative

advertisement

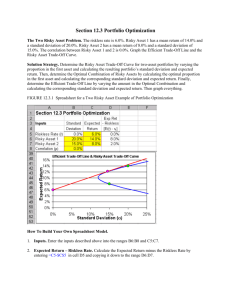

Increasing Financial Capability in Young People: Engaging approaches that build financial, social, and personal assets Developed by: Inger Giuffrida August 5, 2014 from 10:45 a.m. to 12:30 p.m. Opener • Group 1: What experiences do young people have with money or financial issues? • Group 2: What resources do they have? • Group 3: What emotions do they have around money and financial issues? • Group 4: What do they want to get out of financial capability work? • Group 5: Where do we as staff and practitioners serving young people want them to get? 2 Session Objectives • Explain the relationships among financial, social, and personal assets using a balanced portfolio model. • Describe specific strategies and systems for building financial capability that lead to financial, social, and personal asset development. • Use specific tools, information, and techniques to engage and support young people in financial capability. • Describe ways to make financial information contextually relevant using the materials developed by the Jim Casey Youth Opportunities Initiative (Keys to Your Financial Future). • Explain the roles adults can play that can support and provide opportunities for young people to increase their financial capability and develop financial, social, and personal assets. • Use one activity to introduce credit scoring. 3 Financial Capability • What is financial capability? • How is it different from other approaches? 4 Knowledge & Skills Access to Products, Services, and Support Financial Capability Experiences Ability to Use K, S, and E 5 Financial coaching and counseling Experiences— ”normal”, risktaking opportunities with money and consequences Peer-based financial education Involvement of youth in the planning, design and implementation of financial capability Increasing Financial Capability of Youth Ongoing access to information, products, services, and support 6 “Financial Independence” Means . . . • “Being stable with your money” • “Learning; learning is most valuable—learning what brings happiness” • “Being independent and self-sufficient; having an emergency fund” • “Understanding components so you know what you’re working with; having overall knowledge of financial components” 7 Biggest Obstacles • College loans and college debt • Not having a place to “fall back to” as a young person from care • Systems like having to have deposits for things; “we don’t have anything to back us up”; no support • Not having education or a career path—need degrees • Not having money and income to reach goals; having money or income comes first • Not having one-on-one help with a plan 8 Most Important Topics • Finding money to save in my budget—50% • Ways to save and invest—33% • Understanding taxes—why I pay them, how to avoid paying too much, how the money is used, etc.—33% • Reading a credit report and improving credit history—33% 9 Most Important Topics • Understanding lease agreements and rights are a renter –17% • Finding financial aid including loans for postsecondary education and training—17% • Understanding how my beliefs and attitudes about money influence my relationship with money—17% 10 Most Preferred Way to Build Financial Capability • Which approach to building financial capability do youth tend to prefer? 11 Most Preferred Way to Build Financial Capability • One-on-one sessions with a financial coach or mentor—86% • Financial education in a training session with my peers— 14% • Through social media or technological applications (Facebook, MySpace, Blogs, Texts) —0 • Using online financial literacy curriculum (working independently with a computer based curriculum that includes simple games, quizzes, short video clips, etc.) —0 • Playing online or IRL games—0 12 Keys to Your Financial Future: Products Participant’s Workbook Facilitator’s Guide Video Tutorial Online Toolkit Modules 1-7 Modules 1-7 -Facilitator’s Notes & -Visual Aids (PPT) Financial Coaching -Participant Workbook -Facilitator’s Guide -Props (Tools) -Video Tutorial -Evaluations - Curriculum Overview (PPT) -Appendices Keys to Your Financial Future: Modules • Module 1: Asset Building: Unlocking the door to long-term benefits building Core Modules • Module 2: Good Credit: Your score in the game of life Prior to enrollment in Opportunity Passport™ • Module 3: Money Management: Cashing in on financial success 14 Keys to Your Financial Future: Modules • Module 4: Education and Training: The power of knowledge for work and college • Module 5: Housing: Reality in realty • Module 6: Transportation: Enjoy the ride • Module 7: Saving and Investing: Making the change by keeping it About the Module Names The module names were developed by the 2012 Jim Casey Youth Opportunities Initiative Youth Leadership Institute through a collaborative brainstorming session. 15 Keys to Your Financial Future: Repeating Competencies • Competencies addressed contextually in multiple sessions for the purposes of reinforcement. – Setting goals – Building assets – Contingency planning – Protecting assets (including your identity) – Operating as a savvy consumer – Making decisions/evaluating the risks and returns of a product, service or situation – Making and keeping a budget – Managing cash flow – Fixing or improving credit and/or managing and reducing debt 16 Asset-Building Framework • Asset – something that you own that has value. – you must own it, be able to control it, and be able to make decisions about it. 17 Balanced Asset Building Portfolio Physical Assets Financial Assets Productive Assets Social Capital Portfolio = a grouping of assets. Your asset building portfolio is basically the assets you have and are working towards. 18 Why Credit Reports & Scores ARE Important • A bank or credit union may use them to decide whether to give you a loan. • A credit card company may use them to decide whether to give you a credit card. • A landlord may use them to determine whether to rent an apartment to you. • An insurance company may use them to determine whether to give you insurance coverage and the rates you will pay for 19 coverage. Why Credit Reports & Scores ARE Important • A utility company may use them to figure out how much deposit you must pay before they will turn on your electric or gas. • A cell phone provider may use them to determine what plans you may be eligible for and the rates you will pay. • A potential employer may use reports to determine whether you will get a job. • Credit scores are completely based on information in your credit reports. 20 The Credit Reporting Agencies • Equifax • Experian • TransUnion May have different information. Must check all 3. – If over 18, order from website, call them or write to them. – Use www.annualcreditreport.com for annual free report. – May not be useable if you have been the victim of identity theft. 21 Can You Have a Credit Report if You are Under 18? • You cannot have credit report if you are under 18 unless: – You are an emancipated minor – You are an authorized user on someone’s credit card – You have student loans – You live in a state where you can be younger than 18 to enter into a financial contract – Your identity has been stolen and used by someone else to get credit or services 22 Exercise in Pairs • Calculate your final credit score using the 15 cards. • Start with the first card, and go through them in order. • Notice which actions make your score go UP, go DOWN and those that have no affect. 23 FICO Score Distribution Types of Credit Used, 10% New Credit, 15% Payment History, 35% Length of Credit History, 15% Amounts Owed & Credit Utilization Rate, 30% 24 Roles for Adults Role for Youth Access to Products, Services, and Support Knowledge & Skills Financial Capability Experiences Ability to Use K, S, and E 25 Thank you for participating • Inger Giuffrida, Financial Educator and Asset Building Consultant • Email: inger.giuffrida@gmail.com • Phone and text: 405-819-7039 26