Institutional Class Fund Fact sheet

advertisement

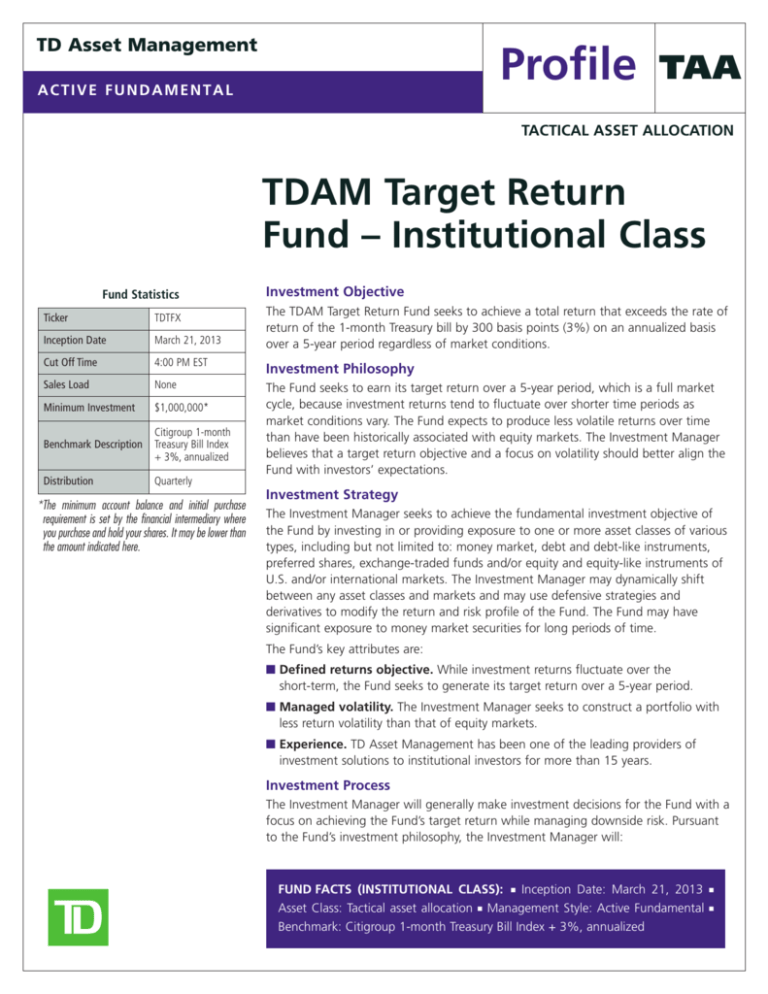

TD Asset Management Profile ACTIVE FUNDAMENTAL TAA TACTICAL ASSET ALLOCATION TDAM Target Return Fund – Institutional Class Fund Statistics Investment Objective The TDAM Target Return Fund seeks to achieve a total return that exceeds the rate of return of the 1-month Treasury bill by 300 basis points (3%) on an annualized basis over a 5-year period regardless of market conditions. Ticker TDTFX Inception Date March 21, 2013 Cut Off Time 4:00 PM EST Investment Philosophy Sales Load None Minimum Investment $1,000,000* Benchmark Description Citigroup 1-month Treasury Bill Index + 3%, annualized Distribution Quarterly The Fund seeks to earn its target return over a 5-year period, which is a full market cycle, because investment returns tend to fluctuate over shorter time periods as market conditions vary. The Fund expects to produce less volatile returns over time than have been historically associated with equity markets. The Investment Manager believes that a target return objective and a focus on volatility should better align the Fund with investors’ expectations. *The minimum account balance and initial purchase requirement is set by the financial intermediary where you purchase and hold your shares. It may be lower than the amount indicated here. Investment Strategy The Investment Manager seeks to achieve the fundamental investment objective of the Fund by investing in or providing exposure to one or more asset classes of various types, including but not limited to: money market, debt and debt-like instruments, preferred shares, exchange-traded funds and/or equity and equity-like instruments of U.S. and/or international markets. The Investment Manager may dynamically shift between any asset classes and markets and may use defensive strategies and derivatives to modify the return and risk profile of the Fund. The Fund may have significant exposure to money market securities for long periods of time. The Fund’s key attributes are: ■ Defined returns objective. While investment returns fluctuate over the short-term, the Fund seeks to generate its target return over a 5-year period. ■ Managed volatility. The Investment Manager seeks to construct a portfolio with less return volatility than that of equity markets. ■ Experience. TD Asset Management has been one of the leading providers of investment solutions to institutional investors for more than 15 years. Investment Process The Investment Manager will generally make investment decisions for the Fund with a focus on achieving the Fund’s target return while managing downside risk. Pursuant to the Fund’s investment philosophy, the Investment Manager will: FUND FACTS (INSTITUTIONAL CLASS): ■ Inception Date: March 21, 2013 Asset Class: Tactical asset allocation ■ Management Style: Active Fundamental Benchmark: Citigroup 1-month Treasury Bill Index + 3%, annualized ■ ■ TD Asset Management Profile ACTIVE FUNDAMENTAL TAA ■ allocate the Fund’s assets across the various asset classes based on an assessment of the associated risk, the investment opportunity presented and the prevailing market conditions within the asset classes in the U.S. and around the world. ■ consider the macro-economic environment. ■ estimate the potential annual return and correlations of various asset classes. ■ attempt to construct the Fund’s portfolio using a combination of asset classes that, in the Investment Manager’s view, have the greatest chance of achieving the targeted return while managing overall portfolio risk. The Investment Manager may adjust the Fund’s portfolio to take advantage of valuation anomalies and changes to the macro-economic environment. Guidelines ■ The Fund may invest in equity securities and fixed income instruments without limit. There are no restrictions on the Fund with regard to geography, currency, market capitalization, credit quality or maturity of individual issues or the portfolio as a whole. ■ The Fund may invest in equity securities of both U.S. and foreign companies including equity securities of emerging market issuers. In addition, the Fund may invest in investment grade and/or below investment grade fixed income instruments without limit. ■ The Fund may also invest in other mutual funds and exchange-traded funds to gain exposure to other asset classes. ■ Securities may be denominated in both U.S. dollars and foreign currencies. Lead Managers Anish Chopra, CA, CFA, Portfolio Manager Anish joined TD Asset Management in 1998. He is lead portfolio manager of the Canadian Value and Target Return strategies for both TD Mutual Funds and TD Waterhouse Private Investment Counsel. Anish is also a member of the TD Wealth Asset Allocation Committee. He has over 11 years of experience managing proprietary funds within TDAM, with knowledge of Canadian, U.S. and global equities as well as numerous absolute return strategies. Prior to joining TDAM, Anish worked as a member of TD Securities’ mergers and acquisitions group. Anish holds a Masters of Accounting degree (Gold Medalist) from the University of Waterloo. He is a Chartered Accountant, a CFA charterholder, and he holds the Chartered Alternative Investment Analyst designation. Anish is also a Chartered Business Valuator (Canadian Gold Medalist) and was the inaugural recipient of the Canadian Institute of Chartered Business Valuators “Top Chartered Business Valuator Under 40” award. Jonathan Shui, CFA, Portfolio Manager Jonathan joined TD Asset Management in June 2003. He is currently the co-manager of the Target Return funds for TD Mutual Funds and TD Waterhouse Private Investment Counsel. Previously, Jonathan supported the Target Return, Canadian Value and Hedge Fund mandates through fundamental analysis and 2 TD Asset Management Profile ACTIVE FUNDAMENTAL TAA portfolio management responsibilities. Jonathan was also the primary analyst covering the technology and industrials sectors of the Canadian equities market. Jonathan graduated from the University of Waterloo in 2003 with a B.A. Sc. degree in Mechanical Engineering along with a Minor in Economics. He was awarded the CFA designation in 2006 and completed the Columbia Business School Executive Education Program in Value Investing in 2007. Risk Management Risk management is inherent in the portfolio architecture of this Fund. Investors benefit from: ■ Independent monitoring. An independent 25-plus member Risk Management team oversees and monitors portfolio guidelines and risk controls on a daily basis. ■ A risk management culture. TD Asset Management fosters a risk management culture that increases personal accountability and maintains the integrity of our investment management and product management processes. About TD Asset Management TD Asset Management is a North American investment firm offering progressive investment solutions to institutional and individual investors. For over two decades, we have developed an integrated investment management platform that spans active, quantitative and passive portfolio management as well as customizable services such as currency overlay and hedging, bond overlay, cash equitization, asset mix rebalancing and liability driven investment solutions. Fund Performance Click here for performance information to the most recent month-end or visit us at www.tdamusa.com Before investing you should carefully read the prospectus and/or the summary prospectus and carefully consider the investment objectives, risks, charges and expenses of the Fund. The prospectus and the summary prospectus contain this and other information about the Fund and may be obtained by calling 1-866-416-4031. For performance information current to the most recent month-end, please visit www.tdamusa.com. Bonds and bond funds are subject to interest rate risk and will decline in value as interest rates rise. High yield bonds involve greater risks of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from social, economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Investments in mid-size and smaller companies typically exhibit higher volatility. The Fund may invest in derivatives, which are often more volatile than other investments and may magnify the Fund’s gains or losses. Not FDIC Insured • May Lose Value • No Bank Guarantee. The Fund is a series of TD Asset Management USA Funds Inc. SEI Investments Distribution Co., which is not affiliated with TD Asset Management, acts as distributor of shares of the Fund. TD Asset Management operates in the United States as TDAM USA Inc. and in Canada as TD Asset Management Inc., each a wholly-owned subsidiary of the Toronto-Dominion Bank. All trade-marks are the property of their respective owners. ® The TD logo and other trade-marks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or other countries. PR2337-4_INS.082415 3