View Presentations

advertisement

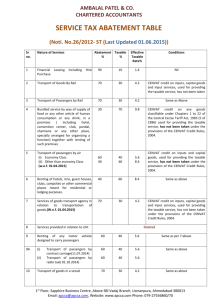

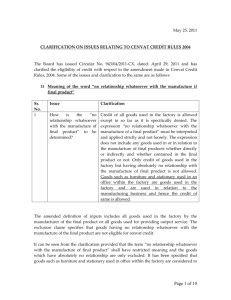

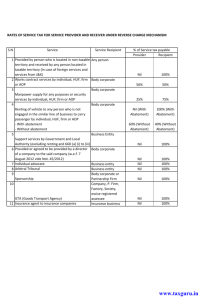

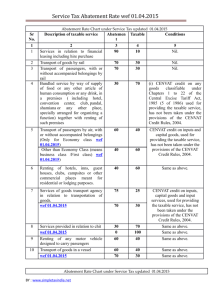

NEGATIVE LIST IMPACT ON TRADE AND INDUSTRY By Mr. Vipin Jain Advocate (CA, LLB) Managing Partner, TLC Legal October, 2012 Valuation, Abatement, CENVAT Credit VALUATION 2 Introduction No fundamental change in the manner of valuation of service, except with regard to works contract (New Rule 2A) Provision in Finance Act 4 As per Section 67 (1) SECTION 67. Valuation of taxable services for charging service tax. — (1) Subject to the provisions of this Chapter, where service tax is chargeable on any taxable service with reference to its value, then such value shall, — (i) in a case where the provision of service is for a consideration in money, be the gross amount charged by the service provider for such service provided or to be provided by him; (ii) in a case where the provision of service is for a consideration not wholly or partly consisting of money, be such amount in money as, with the addition of service tax charged, is equivalent to the consideration; (iii) in a case where the provision of service is for a consideration which is not ascertainable, be the amount as may be determined in the prescribed manner.. 5 (2) Where the gross amount charged by a service provider, for the service provided or to be provided is inclusive of service tax payable, the value of such taxable service shall be such amount as, with the addition of tax payable, is equal to the gross amount charged. (3) The gross amount charged for the taxable service shall include any amount received towards the taxable service before, during or after provision of such service. (4) Subject to the provisions of sub-sections (1), (2) and (3), the value shall be determined in such manner as may be prescribed. Explanation. — For the purposes of this section, — (a) “consideration” includes any amount that is payable for the taxable services provided or to be provided; [(b) * * *] (c) “gross amount charged” includes payment by cheque, credit card, deduction from account and any form of payment by issue of credit notes or debit notes and [book adjustment, and any amount credited or debited, as the case may be, to any account, whether called “Suspense account” or by any other name, in the books of account of a person liable to pay service tax, where the transaction of taxable service is with any associated enterprise].] RULE 2A(i) 6 Subject to the provisions of section 67, the value of service portion in the execution of a works contract, referred to in clause (h) of section 66E of the Act, shall be determined in the following manner, namely :(i) Value of service portion in the execution of a works contract shall be equivalent to the gross amount charged for the works contract less the value of property in goods transferred in the execution of the said works contract. Explanation. - For the purposes of this clause,- 7 (A)Gross amount charged for the works contract shall not include value added tax or sales tax, as the case may be, paid or payable, if any, on transfer of property in goods involved in the execution of the said works contract; (B)Value of works contract service shall include, (i) labour charges for execution of the works; (ii)amount paid to a sub-contractor for labour and services; (iii)charges for planning, designing and architect’s fees; (iv)charges for obtaining on hire or otherwise, machinery and tools used for the execution of the works contract; (v)cost of consumables such as water, electricity, fuel used in the execution of the works contract; 8 (vi) cost of establishment of the contractor relatable to supply of labour and services; vii)other similar expenses relatable to supply of labour and services; and (viii)profit earned by the service provider relatable to supply of labour and services; (C) where value added tax or sales tax has been paid or payable on the actual value of property in goods transferred in the execution of the works contract, then, such value adopted for the purposes of payment of value added tax or sales tax, shall be taken as the value of property in goods transferred in the execution of the said works contract for determination of the value of service portion in the execution of works contract under this clause; RULE 2A(ii) 9 Where the value has not been determined under clause (i), the person liable to pay tax on the service portion involved in the execution of the works contract shall determine the service tax payable in the following manner, namely :(A) in case of works contracts entered into for execution of original works, service tax shall be payable on forty per cent of the total amount charged for the works contract; (B) in case of works contract entered into for maintenance or repair or reconditioning or restoration or servicing of any goods, service tax shall be payable on seventy per cent of the total amount charged for the works contract; 10 (C) in case of other works contracts, not covered under sub-clauses (A) and (B), including maintenance, repair, completion and finishing services such as glazing, plastering, floor and wall tiling, installation of electrical fittings of an immovable property, service tax shall be payable on sixty per cent of the total amount charged for the works contract; Explanation 1. - For the purposes of this rule,(a) “original works” means(i) all new constructions; (ii) all types of additions and alterations to abandoned or damaged structures on land that are required to make them workable; (iii)erection, commissioning or installation of plant, machinery or equipment or structures, whether pre-fabricated or otherwise; 11 (b) “total amount” means the sum total of the gross amount charged for the works contract and the fair market value of all goods and services supplied in or in relation to the execution of the works contract, whether or not supplied under the same contract or any other contract, after deducting- (i) the amount charged for such goods or services, if any; and (ii) the value added tax or sales tax, if any, levied thereon : Provided that the fair market value of goods and services so supplied may be determined in accordance with the generally accepted accounting principles. Explanation 2. - For the removal of doubts, it is clarified that the provider of taxable service shall not take CENVAT credit of duties or cess paid on any inputs, used in or in relation to the said works contract, under the provisions of CENVAT Credit Rules, 2004.] Works Contract-Key changes 12 Prior to 30.6.2012 there were two schemes for valuation of works contract services one being under the rule 2A of the Valuation Rules and second under the Works Contract (Composition Scheme for Payment of Service Tax) Rules 2007 Both of these have now been replaced with a unified scheme under the new rule 2A of Service Tax (Determination of Value) Rules, 2006 vide Notification No. 24/2012 ST w.e.f 01/07/2012 Conceptually, the new valuation provisions in respect of works contract service seeks to segregate all works contract, however composite they may be, into the following two portions 13 Work contract Contracts of sale of goods Contract of provision of service Issue 14 When do the valuation rules apply? Are they applicable only when value cannot be determined u/s 67(i), OR Do they prescribe the manner by which the value is determinable u/s 67(i) Issue 15 Rules are invocable in two situations / purposes 1. Where consideration is unascertainable 2. For the purpose of determination of the value under section 67 Issue 16 Is the method of valuation under section 2(a)(ii) an optional one or not- confusion between the TRU Circular dates 16.03.2012 and the Valuation Rules. Para 13 (iii) f the TRU Circular , while dealing with clause (ii) of Rule 2(a) begins with the words “If the value is not deduced, and not merely as an option, the value shall be a specified percentage………” On the other hand sub clause (ii) of Rule 2A begins with the words, “ Where the value has not been determined under clause (i)…………” 17 Where the CENVAT Credit can be availed on inputs(goods) in respect of which property has been transferred by the service providers to the service recipient of the works contract service ? 1. in case value is determined under clause (i) of section 2A 2. in case value is determined under clause (ii) of section 2A Changes in Rule 5 18 1. 2. Exclusions inserted in addition to existing exclusion for reimbursement expenditure messured as Pure Agents w.e.f. 1.07.2012 accidental damage due to unforseen actions not relatable to provision of service Interest charged or paid on delayed payments CENVAT CREDIT June 9, 2012 Major changes in CENVAT Credit Rules 20 i. Calculation of Cenvat Credit Reversal on Capital Gain cleared after used. ii. Service providers are permitted to receive input and CG at any premise iii. Method of calculation of Refund of the unutilized Cenvat credit changedRule 5 iv. Rule framed for providing refund of accumulated Cenvat Credit in the hands of the service provider where the liability is being discharged by the service recipient- Rule 5B v. Manner of distribution of credit by an ISD changed- Rule 7 vi. Manufacturers permitted to transfer unutilized SAD from one unit to another unit- Rule 10B ABATEMENTS IN SERVICES Abatements in Services 22 Powers conferred by sub-section (1) of section 93 of the Finance Act, 1994 Notification No. 26/2012 dated 20.6.2012 issued in supersession of Notification No. 13/2012 dated 17.03.2012 Central Government has exempted a few taxable services from a specified percentage of the taxable value for calculation of service tax leviable thereon subject to the relevant conditions specified. Abatements are granted, subject to the condition of Non- availment of CENVAT Credit on inputs and/or input services and/or Capital Gains. Transfer of passengers by “Rail” 23 Description of taxable service Conditions Deemed to be Value followed Transport of passengers No with or without Condition accompanied belongings by Prescribed rail 30% Old New levy Bundled Services 24 Description of taxable Condition to be service followed Catering in a premises, including hotel, convention center, club, pandal, shamiana or any place specially arranged for organizing a function Deemed Old Value CENVAT credit on any goods classifiable under chapter 1 to 22 70% used for providing the taxable service has not been taken Convention center or mandap catering- 60% pandal or shamiana catering – 70% Transport of passengers by “Air” 25 Description Conditions of taxable to be service followed CENVAT credit on Transport inputs and of capital passengers goods has by air not been taken Deemed Value Old Upto 31.03.2012 Domestic travel-upto Rs.150/- 40% International Travel-upto Rs.750/w.e.f. 01.04.2012 All Class Exemption 60% Levy of ST on 40% Renting of Hotels 26 Description of taxable service Conditions to be followed Deemed Old Rate Value Renting of hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes. CENVAT credit on inputs and capital 60% goods has not been taken 50% Transport of goods in a “vessel” 27 Description of taxable service Conditions to be followed CENVAT credit on Transport of goods in a inputs, capital goods vessel from one port in and input services, India to another has not been taken. Deemed Value 50% Old 75%