- Bangalore Branch of SIRC of ICAI

advertisement

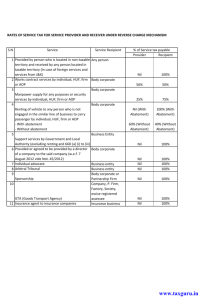

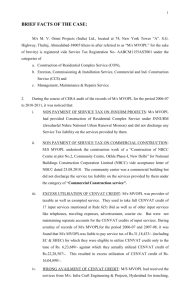

SERVICE TAX MAJOR EXEMPTIONS ABATEMENTS SETTLEMENT COMMISSION ADVANCE RULING APPEALS K.VAITHEESWARAN ADVOCATE & TAX CONSULTANT Mobile: 98400-96876 E-mail : askvaithi@yahoo.co.uk, vaithilegal@yahoo.co.in Flat No.3, First Floor, No.9, Thanikachalam Road, T. Nagar, Chennai - 600 017, India Tel.: 044 + 2433 1029 / 4048 402, Front Wing, House of Lords, 15/16, St. Marks Road, Bangalore – 560 001, India Tel : 080 22244854/ 41120804 Services provided to the United Nations or a specified international organization . Health care services by a clinical establishment, an authorised medical practitioner or a para-medics (i) Authorised medical practitioner means a medical practitioner registered with any of the councils of the recognised system of medicines established or recognized by law in India and includes a medical professional having the requisite qualification to practice in any recognised system of medicines in India as per any law for the time being in force; (ii) Clinical establishment means a hospital, nursing home, clinic, sanatorium or any other institution by, whatever name called, that offers services or facilities requiring diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy in any recognised system of medicines in India, or a place established as an independent entity or a part of an establishment to carry out diagnostic or investigative services of diseases; (iii) Health care services means any service by way of diagnosis or treatment or care for illness, injury, deformity, abnormality or pregnancy in any recognised system of medicines in India and includes services by way of transportation of the patient to and from a clinical establishment, but does not include hair transplant or cosmetic or plastic surgery, except when undertaken to restore or to reconstruct anatomy or functions of body affected due to congenital defects, developmental abnormalities, injury or trauma; Services by a veterinary clinic in relation to health care of animals or birds. Services by an entity registered under section 12AA of the Income tax Act, 1961by way of charitable activities; Charitable activities means activities relating to (i) public health by way of (a) care or counseling of (i) terminally ill persons or persons with severe physical or mental disability, (ii) persons afflicted with HIV or AIDS, or (iii) persons addicted to a dependence-forming substance such as narcotics drugs or alcohol; or (b) public awareness of preventive health, family planning or prevention of HIV infection; (ii) advancement of religion or spirituality; (iii) advancement of educational programmes or skill development relating to,(a) abandoned, orphaned or homeless children; (b) physically or mentally abused and traumatized persons; (c) prisoners; or (d) persons over the age of 65 years residing in a rural area; (iv) preservation of environment including watershed, forests and wildlife; or (v) advancement of any other object of general public utility up to a value of,(a) Rs. 18.75 lakhs for the year 2012-13 subject to the condition that total value of such activities had not exceeded Rs. 25 lakhs during 2011-12; (b) Rs. 25 lakhs in any other financial year subject to the condition that total value of such activities had not exceeded Rs. 25 lakhs during the preceding financial year; Services by a person by way of renting of precincts of a religious place meant for general public; (i) Religious place means a place which is primarily meant for conduct of prayers or worship pertaining to a religion, meditation, or spirituality; (ii) General public means the body of people at large sufficiently defined by some common quality of public or impersonal nature; Services by way of conduct of any religious ceremony; Services provided by an Arbitral Tribunal to (i) any person other than a business entity; or (ii) a business entity with a turnover up to rupees ten lakh in the preceding financial year; Services provided by an individual as an advocate or a partnership firm of advocates by way of legal services to,(i) an advocate or partnership firm of advocates providing legal services (ii) any person other than a business entity; or (iii) a business entity with a turnover up to rupees ten lakh in the preceding financial year; or Legal service means any service provided in relation to advice, consultancy or assistance in any branch of law, in any manner and includes representational services before any court, tribunal or authority. Services provided by a person represented on an arbitral tribunal to an Arbitral Tribunal. Services by way of technical testing or analysis of newly developed drugs, including vaccines and herbal remedies, on human participants by a clinical research organization approved to conduct clinical trials by the Drug Controller General of India. Services by way of training or coaching in recreational activities relating to arts, culture or sports. Services provided to or by an educational institution in respect of education exempted from service tax, by way of,(a) auxiliary educational services; or (b) renting of immovable property; Auxiliary educational services means any services relating to imparting any skill, knowledge, education or development of course content or any other knowledge – enhancement activity, whether for the students or the faculty, or any other services which educational institutions ordinarily carry out themselves but may obtain as outsourced services from any other person, including services relating to admission to such institution, conduct of examination, catering for the students under any mid-day meals scheme sponsored by Government, or transportation of students, faculty or staff of such institution. Services provided to a recognised sports body by(a) an individual as a player, referee, umpire, coach or team manager for participation in a sporting event organized by a recognized sports body; (b) another recognised sports body; Recognized sports body means – (i) the Indian Olympic Association, (ii) Sports Authority of India, (iii) a national sports federation recognised by the Ministry of Sports and Youth Affairs of the Central Government, and its affiliate federations, (iv) national sports promotion organisations recognised by the Ministry of Sports and Youth Affairs of the Central Government, (v) the International Olympic Association or a federation recognised by the International Olympic Association; or (vi) a federation or a body which regulates a sport at international level and its affiliated federations or bodies regulating a sport in India; Services by way of sponsorship of sporting events organized,(a) by a national sports federation, or its affiliated federations, where the participating teams or individuals represent any district, state or zone; (b) by Association of Indian Universities, Inter-University Sports Board, School Games Federation of India, All India Sports Council for the Deaf, Paralympic Committee of India or Special Olympics Bharat; (c) by Central Civil Services Cultural and Sports Board; (d) as part of national games, by Indian Olympic Association; or (e) under PanchayatYuva Kreeda Aur Khel Abhiyaan (PYKKA) scheme; Services provided to the Government, a local authority or a governmental authority by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of (a) a civil structure or any other original works meant predominantly for use other than for commerce, industry, or any other business or profession; (b) a historical monument, archaeological site or remains of national importance, archaeological excavation, or antiquity specified under the Ancient Monuments and Archaeological Sites and Remains Act, 1958; (c) a structure meant predominantly for use as (i) an educational, (ii) a clinical, or (iii) an art or cultural establishment; (d) canal, dam or other irrigation works; (e) pipeline, conduit or plant for (i) water supply (ii) water treatment, or (iii) sewerage treatment or disposal; or (f) a residential complex predominantly meant for self-use or the use of their employees or other persons specified in the Explanation 1 to clause 44 of section 65 B of the said Act. Original works means (i) all new constructions; (ii) all types of additions and alterations to abandoned or damaged structures on land that are required to make them workable; (iii) erection, commissioning or installation of plant, machinery or equipment or structures, whether pre-fabricated or otherwise; Residential complex means any complex comprising of a building or buildings, having more than one single residential unit. Governmental Authority means a board, or an authority or any other body established with 90% or more participation by way of equity or control by Government and set up by an Act of the Parliament or a State Legislature to carry out any function entrusted to a municipality under article 243W of the Constitution. Services provided by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of,(a) a road, bridge, tunnel, or terminal for road transportation for use by general public; (b) a civil structure or any other original works pertaining to a scheme under Jawaharlal Nehru National Urban Renewal Mission or Rajiv AwaasYojana; (c) a building owned by an entity registered under section 12 AA of the Income tax Act, 1961 and meant predominantly for religious use by general public; (d) a pollution control or effluent treatment plant, except located as a part of a factory; or (e) a structure meant for funeral, burial or cremation of deceased; Services by way of construction, erection, commissioning, or installation of original works pertaining to,(a) an airport, port or railways, including monorail or metro; (b) a single residential unit otherwise than as a part of a residential complex; (c) low- cost houses up to a carpet area of 60 square metres per house in a housing project approved by competent authority empowered under the ‘Scheme of Affordable Housing in Partnership’ framed by the Ministry of Housing and Urban Poverty Alleviation, Government of India; (d) post- harvest storage infrastructure for agricultural produce including a cold storages for such purposes; or (e) mechanised food grain handling system, machinery or equipment for units processing agricultural produce as food stuff excluding alcoholic beverages; Single residential unit means a self-contained residential unit which is designed for use, wholly or principally, for residential purposes for one family. Residential complex” means any complex comprising of a building or buildings, having more than one single residential unit. Temporary transfer or permitting the use or enjoyment of a copyright covered under clauses (a) or (b) of sub-section (1) of section 13 of the Indian Copyright Act, 1957, relating to original literary, dramatic, musical, artistic works or cinematograph films. Services by a performing artist in folk or classical art forms of (i) music, or (ii) dance, or (iii) theatre; (services provided by such artist as a brand ambassador are excluded from this exemption notification) Services by way of collecting or providing news by an independent journalist, Press Trust of India or United News of India. Services by way of renting of a hotel, inn, guest house, club, campsite or other commercial places meant for residential or lodging purposes, having declared tariff of a unit of accommodation below Rs.1000 per day or equivalent. ‘Declared tariff’ includes charges for all amenities provided in the unit of accommodation (given on rent for stay) like furniture, air-conditioner, refrigerators or any other amenities, but without excluding any discount offered on the published charges for such unit. Services provided in relation to serving of food or beverages by a restaurant, eating joint or a mess, other than those having (i) the facility of air-conditioning or central air-heating in any part of the establishment, at any time during the year, and (ii) a licence to serve alcoholic beverages; Services by way of transportation by rail or a vessel from one place in India to another of the following goods (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) petroleum and petroleum products falling under Chapter heading 2710 and 2711 of the First Schedule to the Central Excise Tariff Act, 1985; relief materials meant for victims of natural or man-made disasters, calamities, accidents or mishap; defence or military equipments; postal mail or mail bags; household effects; newspaper or magazines registered with the Registrar of Newspapers; railway equipments or materials; agricultural produce; foodstuff including flours, tea, coffee, jaggery, sugar, milk products, salt and edible oil, excluding alcoholic beverages; or chemical fertilizer and oilcakes; Services provided by a goods transport agency by way of transportation of (a) fruits, vegetables, eggs, milk, food grains or pulses in a goods carriage; (b) goods where gross amount charged for the transportation of goods on a consignment transported in a single goods carriage does not exceed Rs.1500; or (c) goods, where gross amount charged for transportation of all such goods for a single consignee in the goods carriage does not exceed Rs.750; Services by way of giving on hire (a) to a state transport undertaking, a motor vehicle meant to carry more than twelve passengers; or (b) to a goods transport agency, a means of transportation of goods; Transport of passengers, with or without accompanied belongings, by (a) air, embarking from or terminating in an airport located in the state of Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, or Tripura or at Bagdogra located in West Bengal; (b) a contract carriage for the transportation of passengers, (tourism, conducted tour, charter or hire are excluded); or (c) ropeway, cable car or aerial tramway; Services by way of vehicle parking to general public (leasing of space to an entity for providing such parking facility is excluded). Services provided to Government, a local authority or a governmental authority by way of (a) carrying out any activity in relation to any function ordinarily entrusted to a municipality in relation to water supply, public health, sanitation conservancy, solid waste management or slum improvement and upgradation; or (b) repair or maintenance of a vessel or an aircraft; Services of general insurance business provided under specified schemes. Service by an unincorporated body or a non- profit entity registered under any law for the time being in force, to its own members by way of reimbursement of charges or share of contribution (a) as a trade union; (b) for the provision of carrying out any activity which is exempt from the levy of service tax; or (c) up to an amount of Rs.5000 per month per member for sourcing of goods or services from a third person for the common use of its members in a housing society or a residential complex; Services by the following persons in respective capacities (a) (b) (c) (d) (e) sub-broker or an authorised person to a stock broker; authorised person to a member of a commodity exchange; mutual fund agent to a mutual fund or asset management company; distributor to a mutual fund or asset management company; selling or marketing agent of lottery tickets to a distributer or a selling agent; (f) selling agent or a distributer of SIM cards or recharge coupon vouchers; (g) business facilitator or a business correspondent to a banking company or an insurance company, in a rural area; or (h) sub-contractor providing services by way of works contract to another contractor providing works contract services which are exempt; “Rural area” means the area comprised in a village as defined in land revenue records, excluding(i) the area under any municipal committee, municipal corporation, town area committee, cantonment board or notified area committee; or (ii) any area that may be notified as an urban area by the Central Government or a State Government; Carrying out an intermediate production process as job work in relation to (a) agriculture, printing or textile processing; (b) cut and polished diamonds and gemstones; or plain and studded jewellery of gold and other precious metals, falling under Chapter 71 of the Central Excise Tariff Act ,1985; (c) any goods on which appropriate duty is payable by the principal manufacturer; or (d) processes of electroplating, zinc plating, anodizing, heat treatment, powder coating, painting including spray painting or auto black, during the course of manufacture of parts of cycles or sewing machines upto an aggregate value of taxable service of the specified processes of Rs. 150 lakhs in a financial year subject to the condition that such aggregate value had not exceeded Rs. 150 lakhs during the preceding financial year; “Appropriate duty” means duty payable on manufacture or production under a Central Act or a State Act, but shall not include ‘Nil’ rate of duty or duty wholly exempt; “Principal manufacturer” means any person who gets goods manufactured or processed on his account from another person; Services by an organizer to any person in respect of a business exhibition held outside India. Services by way of making telephone calls from (a) Departmentally run public telephone; (b) Guaranteed public telephone operating only for local calls; or (c) Free telephone at airport and hospital where no bills are being issued; Services by way of slaughtering of bovine animals. Services received from a provider of service located in a nontaxable territory by (a) Government, a local authority, a governmental authority or an individual in relation to any purpose other than commerce, industry or any other business or profession; (b) an entity registered under section 12AA of the Income tax Act, 1961 for the purposes of providing charitable activities; or (c) a person located in a non-taxable territory; Services of public libraries by way of lending of books, publications or any other knowledge enhancing content or material. Services by Employees’ State Insurance Corporation to persons governed under the Employees’ Insurance Act, 1948. Services by way of transfer of a going concern, as a whole or an independent part thereof. Services by way of public conveniences such as provision of facilities of bathroom, washrooms, lavatories, urinal or toilets. Services by a governmental authority by way of any activity in relation to any function entrusted to a municipality under article 243W of the Constitution. Sl. No. (1) 1 Description of taxable service (2) Services in relation to financial leasing including hire purchase % Conditi ons (3) (4) 10 Nil. Explanation (i)The amount charged shall be an amount, forming or representing as interest, i.e. the difference between the installments paid towards repayment of the lease amount and the principal amount contained in such installments; (ii) the exemption shall not apply to an amount, other than an amount forming or representing as interest, charged by the service provider such as lease management fee, processing fee, documentation charges and administrative fee, which shall be added to the amount calculated in terms of (i) above. Sl. No. Description of taxable service % Conditions (1) (2) (3) (4) 2 3 Transport of goods by rail Transport of passengers, with or without accompanied belongings by rail Bundled service by way of supply of food or any other article of human consumption or any drink, in a premises (including hotel, convention center, club, pandal, shamiana or any other place, specially arranged for organizing a function) together with renting of such premises 30 30 Nil. Nil. 70 (i) CENVAT credit on any goods classifiable under Chapters 1 to 22 of the Central Excise Tariff Act, 1985 (5 of 1986) used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. 4 Explanation The amount charged shall be the sum total of the gross amount charged and the fair market value of all goods and services supplied in or in relation to the supply of food or any other article of human consumption or any drink (whether or not intoxicating) and whether or not supplied under the same contract or any other contract, after deducting(i) the amount charged for such goods or services supplied to the service provider, if any; and (ii) the value added tax or sales tax, if any, levied thereon : Provided that the fair market value of goods and services so supplied may be determined in accordance with the generally accepted Sl. No. Description of taxable service % Conditions (1) (2) (3) (4) 5 Transport of passengers by air, with or without accompanied belongings 6 Renting of hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes. Services of goods transport agency in relation to transportation of goods. 7 40 CENVAT credit on inputs and capital goods, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. 60 Same as above. 25 CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. Explanation Sl. No. Description of taxable service % Conditions (1) (2) (3) (4) 70 Same as above. 8 Services provided in relation to chit Explanation Chit means a transaction whether called chit, chit fund, chitty, kuri, or by whatever name by or under which a person enters into an agreement with a specified number of persons that every one of them shall subscribe a certain sum of money (or a certain quantity of grain instead) by way of periodical installments over a definite period and that each subscriber shall, in his turn, as determined by lot or by auction or by tender or in such other manner as may be specified in the chit agreement, be entitled to a prize amount, Sl. No. Description of taxable service % Conditions (1) (2) (3) (4) 9 Renting of any motor vehicle designed to carry passengers Transport of goods in a vessel 40 Same as above. 50 Same as above. Services by a tour operator in relation to,(i) a package tour 25 (i) CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii) The bill issued for this purpose indicates that it is inclusive of charges for such a tour. 10 11 Explanation Package tour means a tour wherein transportation, accommodation for stay, food, tourist guide, entry to monuments and other similar services in relation to tour are provided by the tour operator as part of the package tour to the person undertaking the tour, Sl. No. Description of taxable service % Conditions (1) (2) (3) (4) (ii) a tour, if the tour operator is providing services solely of arranging or booking accommodation for any person in relation to a tour 10 (i)CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii) The invoice, bill or challan issued indicates that it is towards the charges for such accommodation. (iii) This exemption shall not apply in such cases where the invoice, bill or challan issued by the tour operator, in relation to a tour, only includes the service charges for arranging or booking accommodation for any person and does not include the cost of such accommodation. Explanation Sl. No. Description of taxable service % Conditions (1) (2) (3) (4) 10 (i) CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii) a tour, if the tour operator is providing services solely of arranging or booking accommodation for any person in relation to a tour (iii) any services other than specified at (i) and (ii) above. (ii) The invoice, bill or challan issued indicates that it is towards the charges for such accommodation. 40 (iii) This exemption shall not apply in such cases where the invoice, bill or challan issued by the tour operator, in relation to a tour, only includes the service charges for arranging or booking accommodation for any person and does not include the cost of such accommodation. (i) CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii) The bill issued indicates that the amount charged in the bill is the gross amount charged for such a tour. Explanation Sl. No. Description of taxable service % Conditions (1) (2) (3) (4) 12. Construction of a complex, building, civil structure or a part thereof, intended for a sale to a buyer, wholly or partly except where entire consideration is received after issuance of completion certificate by the competent authority. 25 (i) CENVAT credit on inputs used for providing the taxable service has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii) The value of land is included in the amount charged from the service receiver. Explanation The amount charged shall be the sum total of the amount charged for the service including the fair market value of all goods and services supplied by the recipient(s) in or in relation to the service, whether or not supplied under the same contract or any other contract, after deducting(i) the amount charged for such goods or services supplied to the service provider, if any; and (ii) the value added tax or sales tax, if any, levied thereon : Provided that the fair market value of goods and services so supplied may be determined in accordance with the generally accepted accounting principles. Notification No.30/2012 dated 20.06.2012 w.e.f. 01.07.2012 as amended has been issued under Section 68(2) specifying the persons liable to pay service tax. The categories of the service and the amount of tax component payable by the service provider and service receiver respectively is given in the following table:Nature of Service Services of Insurance Agent to person carrying on insurance business Goods Transport Agency Status of Service Provider Percentage of Service Tax Payable by Service Provider Service Receiver Any person Nil 100% Any person Nil 100% The earlier provisions linking with categories of persons liable to pay freight such as factory, company, etc. and the 75% abatement have been retained. Nature of Service Sponsorship Services Services provided by an arbitral tribunal Legal Services Support services Status of Service Provider Percentage of Service Tax Payable by Service Provider Service Receiver Nil 100% Nil 100% Individual Advocate or a Firm of Advocates Nil 100% Government or local authority excluding certain specified services. Nil 100% Any person Nature of Service Status of Service Provider Percentage of Service Tax Payable by Service Provider Service Receiver Renting of a Individual / HUF (i) If service provider (i) 100% motor vehicle / follows abated value designed to system and the service is Partnership Firm carry passengers not provided to any person whether engaged in similar line of registered or not, business – Nil including AOP (ii) 40% located in the (ii) If service provider taxable territory to does not follow abated a business entity value system and the registered as a service is not provided to corporate located any person engaged in in the taxable similar line of business – territory. 60% Nature of Service Status of Service Provider Supply of Individual / HUF / manpower for any Partnership Firm whether purpose or registered or not, including security services AOP located in the taxable territory to a business entity registered as a corporate located in the taxable territory. Service portion in Individual / HUF / execution of Partnership Firm whether works contract. registered or not, including AOP located in the taxable territory to a business entity registered as a corporate located in the taxable territory. Percentage of Service Tax Payable by Service Provider Service Receiver 25% 75% 50% 50%* *The service recipient has the option of choosing the valuation method as per choice independent of the valuation method adopted by the provider. Nature of Service Status of Service Provider Services of a person located in a non-taxable territory and received by a person located in the taxable territory. Services provided or Individual agreed to be provided by a director of the company to the company* Percentage of Service Tax Payable by Service Provider Nil Service Receiver 100% Nil 100% Works contract means a contract wherein transfer of property in goods involved in the execution of such contract is leviable to tax as sale of goods and such contract is for the purpose of carrying out construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, alteration of any moveable or immovable property or for carrying out any other similar activity or a part thereof in relation to such property. It is to be noted that the tax liability for the service provider and the service receiver respectively are independent. This is not like a TDS mechanism and would require discharging of the identified percentage of service tax. Case must be pending before the adjudicating authority on the date of making an application before the Settlement Commission. Application Form-SC(ST)-1 along with fee of Rs.1000/-. Full and true disclosure of duty liability which has not been disclosed before the authority. Return must have been filed; show cause is issued; additional amount accepted must be more than Rs.3 lakhs; and additional amount and interest must have been paid. Settlement Commission will not entertain an application where the case is pending in appeal. Within 7 days from receipt of application notice would be issued to the applicant as to why the application should be allowed to be proceeded with. After considering the explanation the Commission will pass an order allowing or rejecting the application. If application is allowed to be proceeded with, report is called for from the Commissioner. Order of the Commission shall provide for terms of settlement including any demand of duty, penalty or interest, manner of payment, etc. Powers to attach the property are also available. Immunity from prosecution can be granted. Case can be sent back to the authority if there is no cooperation. Chapter V-A of the Finance Act, 1994 provides for advance rulings. Advance Rulings means the determination of the Authority of a question of law or fact specified in the application regarding the liability to pay service tax in relation to a service proposed to be provided by the applicant. An application for advance ruling can be made in respect of a question pertaining to Classification; Valuation of taxable services for charging service tax; Principles for determination of value of taxable service; Applicability of notification; Admissibility of credit; Determination of the liability to pay service tax. A new form has been specified and the application has to be filed before the Authority for Advance Rulings (Central Excise, Customs, and Service Tax), New Delhi. The benefit is available only to: (a) A non-resident setting up a joint venture in India in collaboration with a non-resident or resident. (b) Resident setting up a joint venture in India in collaboration with a non-resident making the application. (c) A wholly owned subsidiary of an Indian Company of which the holding company is a foreign company. who or which as the case may be proposes to undertake any business activity in India. (d) A joint venture in India. (e) A resident falling with such class or category of persons as the Central Government may specify by Notification in the Official Gazette. Government has notified Public Sector Companies under this category. Joint Venture in India means a contractual arrangement whereby two or more persons undertake an economic activity, which is subject to joint control and one or more of the participants or partners or equity holders is a non-resident having substantial interest in such arrangement. The application should be accompanied by a fee of Rs.2,500/-. The application can be withdrawn within 30 days from the date of the application. The Authority may, after examining the application and the records called for, by order, either allow or reject the application. The Authority shall not allow the application where the question raised in the application is (a) already pending in the applicant’s case before any Central Excise Officer, the Appellate Tribunal or any Court; (b) the same as in a matter already decided by the Appellate Tribunal or any Court. However, no application shall be rejected unless an opportunity has been given to the applicant of being heard and the reasons for such rejection shall be given in the order. The advance ruling pronounced by the Authority shall be binding only – (a) on the applicant who had sought it; (b) in respect of any matter referred to (c) on the Commissioner of Central Excise, and the Central Excise authorities subordinate to him, in respect of the applicant. The advance ruling referred to shall be binding as aforesaid unless there is a change in law or facts on the basis of which the advance ruling has been pronounced. Where the Authority finds, on a representation made to it by the Commissioner of Central Excise or otherwise, that an advance ruling pronounced by it has been obtained by the applicant by fraud or misrepresentation of facts, it may, by order, declare such ruling to be void ab initio and thereupon all the provisions of this Act shall apply (after excluding the period beginning with the date of such advance ruling and ending with the date of order under this sub-section) to the applicant as if such advance ruling had never been made. A new form has been specified and the application has to be filed before the Authority for Advance Rulings (Central Excise, Customs, and Service Tax), New Delhi. If the activity is ongoing, Advance Ruling cannot be issued - Arisaig Partners (India) Pvt. Ltd.(2008) 12 STR 245. Order passed by the Assistant Commissioner or Deputy Commissioner – Appeal to CCE(A) within 2 months from the date of receipt of the order. Delay Sufficient cause CCE(A) can condone delay within a further period of one month. Order passed by CCE(A) Order passed by Commissioner Appeal to CESTAT within a period of 3 months from the date of receipt of order. No specified outer limit for condonation of delay. Pre-deposit Waiver of pre-deposit Prima facie case / financial position Circular dated 01.01.2013 and recovery Writs From the CESTAT Order if the issue does not involve rate of tax or value, appeal lies to High Court within a period of 180 days from the date of receipt of order. From the High Court order appeal lies before Supreme Court. If the CESTAT order involves rate of tax or value, appeal directly lies to the Supreme Court. K.VAITHEESWARAN ADVOCATE & TAX CONSULTANT Mobile: 98400-96876 E-mails : askvaithi@yahoo.co.uk vaithilegal@yahoo.co.in Flat No.3, First Floor, No.9, Thanikachalam Road, T. Nagar, Chennai - 600 017, India Tel.: 044 + 2433 1029 / 4048 402, Front Wing, House of Lords, 15/16, St. Marks Road, Bangalore – 560 001, India Tel : 080 + 2224 4854/ 4112 0804