Amendment of service tax

advertisement

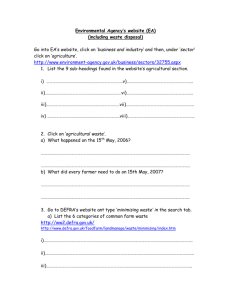

Service Tax Amendments CA Arun Setia Classes Amendment 1 W.e.f. 1-June-2015 Rate of service has been increased to flat 14%. The education Cess & Secondary Higher Education Cess have been Subsumed in new service tax rate. Amendment 2 65B(40) "Process amounting to manufacture or production of goods" means a process on which duties of excise are leviable under section 3 of the Central Excise Act, 1944 [or the Medicinal and Toilet Preparations (Excise Duties) Act,1955” or any process amounting to manufacture of opium, alcoholic liquor (Deleted FA, 2015) Indian hemp and other narcotic drugs and narcotics on which duties of excise are leviable under any State Act for the time being in force; Amendment 3 Section 66F (1) prescribes that unless otherwise specified, reference to a service shall not include reference to any input service used for providing such service. Following illustration has been incorporated in this section vide section 110 of Finance Act, 2015 to exemplify the scope of this provision: The services by the Reserve Bank of India, being the main service within the meaning of clause (b) of section 66D, does not include any agency service provided or agreed to be provided by any bank to the Reserve Bank of India. Such agency service, being input service, used by the Reserve Bank of India for providing the main service, for which the consideration by way of fee or commission or any other amount is received by the agent bank, does not get excluded from the levy of service tax by virtue of inclusion of the main service in clause (b) of the negative list in section 66D and hence, such service is leviable to service tax. Amendment 4 Section 67 prescribes for the valuation of taxable services. It is being prescribed specifically in this section that consideration for service shall include: (i) any amount that is payable for the taxable services provided or to be provided; (ii) any reimbursable expenditure or cost incurred by the service provider and charged, in the course of providing or agreeing to provide a taxable service, except in such circumstances, and subject to such conditions, as may be prescribed; (iii) any amount retained by the lottery distributor or selling agent from gross sale amount of lottery ticket in addition to the fee or commission, if any, or, as the case may be, the 9899259817, 9811059817 Page 1 Service Tax Amendments CA Arun Setia Classes discount received, that is to say, the difference in the face value of lottery ticket and the price at which the distributor or selling agent gets such ticket. Amendment 5 Section 65B - Interpretations. - Chapter V of Finance Act, 1994 (44) "Service" means any activity carried out by a person for another for consideration, and includes a declared service, but shall not include(a) an activity which constitutes merely,-(i) (ii) (iii) a transfer of title in goods or immovable property, by way of sale, gift or in any other manner; or such transfer, delivery or supply of any goods which is deemed to be a sale within the meaning of clause (29A) of Article 366 of the Constitution; or a transaction in money or actionable claim; (b) a provision of service by an employee to the employer in the course of or in relation to his employment; (c) Fees taken in any Court or tribunal established under any law for the time being in force. Explanation 1.- For the removal of doubts, it is hereby declared that nothing contained in this clause shall apply to,-(A) the functions performed by the Members of Parliament, Members of State Legislative, Members of Panchayats, Members of Municipalities and Members of other local authorities who receive any consideration in performing the functions of that office as such member; or (B) the duties performed by any person who holds any post in pursuance of the provisions of the Constitution in that capacity; or (C) the duties performed by any person as a Chairperson or a Member or a Director in a body established by the Central Government or State Governments or local authority and who is not deemed as an employee before the commencement of this section. Explanation 2.-For the purposes of this clause, the expression “transaction in money or actionable claim” shall not include-(i) (ii) any activity relating to use of money or its conversion by cash or by any other mode, from one form, currency or denomination, to another form, currency or denomination for which a separate consideration is charged; any activity carried out, for a consideration, in relation to, or for facilitation of, a transaction in money or actionable claim, including the activity carried out-- 9899259817, 9811059817 Page 2 Service Tax Amendments CA Arun Setia Classes (a) by a LOTTERY distributor or selling agent in relation to promotion, marketing, organizing, selling of lottery or facilitating in organising lottery of any kind, in any other manner; (b) by a foreman of chit fund for conducting or organising a chit in any manner.] (FA, 2015) Explanation 3.-- For the purposes of this Chapter,(a) an unincorporated association or a body of persons, as the case may be, and a member thereof shall be treated as distinct persons; (b) an establishment of a person in the taxable territory and any of his other establishment in a nontaxable territory shall be treated as establishments of distinct persons. Explanation 4.- A person carrying on a business through a branch or agency or representational office in any territory shall be treated as having an establishment in that territory; Amendment 6 AMENDMENTS IN NEGATIVE LIST (1) 66-D (a) Services by Government or a local authority excluding the following services to the extent they are not covered elsewhere. (i) Service by the department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Government; (ii) Services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; (iii) Transport of goods or passengers; or (iv) Support (Deleted FA, 2015 )any services other than covered under clauses (i) to (iii) above provided to business entities (2) 66-D (f) has been amended to exclude ―process amounting to manufacture or production of alcoholic liquor for human consumption‖; Thus, it shall now be read as: ―services by way of carrying out any process amounting to manufacture or production of goods excluding alcoholic liquor for human consumption;" (3) 66-D(j) Admission to entertainment events or access to amusement facilities; (Deleted by FA,2015) 9899259817, 9811059817 Page 3 Service Tax Amendments CA Arun Setia Classes Amendment 7 (Mega Exemptions) Entry -2 . (i) Health care services by a clinical establishment, an authorised medical practitioner or paramedics; (ii) Services provided by way of transportation of a patient in an ambulance, other than those specified in (i) above;] Entry -5A RELIGIOUS PILGRIMAGE BY A SPECIFIED ORGANISATION Service by a specified organization in respect of a religious pilgrimage (facilitated by the Ministry of External affairs of the Government of India, under bilateral arrangement) “Specified organization” shall meana) Kumaon Mandal Vikas Nigam Limited, a Government of Uttarakhand undertaking; or ‘Committee’ or ‘Sate Committee’ as defined in section 2 of the Haj Committee Act, 2002 Entry -12 SERVICE TO GOVT / LOCAL AUTH0RITY / GOVERNMENT AUTH0RITY + SPECIFIED WORKS Services provided to Government, Local Authority or Governmental Authority'* by way of construction, erection, commissioning, installation, completion, fitting out, repair, maintenance, renovation, or alteration of a) A Civil Structure or Any Other Original Works meant predominantly for use other than for commerce, industry, or any other business o, profession (e.g. Parliament construction of building of parliament) (omitted by 1/04/2015) B.G. SHIRKE CONSTRUCTIAN TECHNOLOCY PVT. LTD, - 2O14 – TRI b) A Historical Monument, archaeological site or remains of national importance, archaeological excavation, or Antiquity specified under the Ancient Monuments (structure more than 100 years old) & Archaeological Sites and Remains Act, 1958; c) A structure meant predominantly for use as (i) An educational, (e.g. Army School) establishment (ii) A Clinic, (e.g. Army Hospital) (iii) An art (omitted w.e.f. 1/04/2015) or culture d) Canal, Dam or Other Irrigation Works; e) Pipeline, Conduit or Plant for (i) water supply (ii) water treatment, or (iii) sewerage treatment or disposal; or 9899259817, 9811059817 Page 4 Service Tax Amendments f) CA Arun Setia Classes A RESIDENTIAL COMPLEX predominantly meant for Self-use or the use of their Employees or OTHER PERSONS Specified in the Explanation 1 to sec 658 (44) (MP, MLA, Judges etc.) (omitted w.e.f. 1/04/2015) Entry No.14 SERVICES RELATING TO SPECIFIED ORIGINAL WORKS Services by way of construction, erection, commissioning, installation, of ORIGINAL WORKS pertaining to (a) Airport, port Railways (including Monorail Or Metro); (Omitted w.e.f. 1/04/2015) (b) A single Residential Unit** otherwise then as a part of a Residential Complex; Single Residential Unit [E/N 25/2012] Residential Complex [E/N 25/2012] Single Residential Unit means a self-contained residential unit which is designed for use, wholly or principally, for residential purposes for one family. Residential Complex means any complex comprising of a building or buildings, having more than one residential unit. (c) LOW- COST HOUSES up to a carpet area of 60 square meters per house in a HOUSING PROJECT approved by competent authority empowered under the 'Scheme of Affordable Housing in Partnership' framed by the Ministry of Housing and Urban Poverty Alleviation, Government of India; (d) Post-Harvest Storage infrastructure for agricultural produce including a cold storages for such purposes; or (e) MECHANIZED FOOD GRAIN HANDLING SYSTEM, machinery or equipment for units processing Agricultural Produce as food stuff excluding Alcoholic Beverages; Entry No.16 PERFORMING ARTIST SERVICES Services by a PERFORMING ARTIST in classical art forms of (i) (ii) (iii) 9899259817, 9811059817 Music; Dance; or Theatre, Page 5 Service Tax Amendments CA Arun Setia Classes If the consideration charged for such performance is not more than Rs 1 lakhs Excluding services provided by such artist as a BRAND AMBASSDOR Note: Other activities by an artist in other forms eg. Western music or dance, modern theaters etc. are taxable Entry No.20 Service by way of TRANSPORTATION BY RAIL OR A VESSEL FROM ONE PORT IN INDIA to another of the following goods. (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) Petroleum and petroleum product Relief materials meant for victims of natural of man-made disasters, calamities, accidents or mishap; Defence or military equipments; Postal mail bags Household effect; newspaper or magazines registered with Registrar of Newspapers; railway equipments or materials agricultural produce; milk, salt and food grain including flours, pulses and rice chemical fertilizer organic manure and oil cakes' cotton, ginned or baled Entry No.21 Services provided by a goods transport agency, by way of transport in a goods carriage of(a) Agricultural produce (b) Goods, where gross amount charged for the transportation of goods on a consignment transported in a single carriage does not exceed Rs'1,500 (c) Goods, where gross amount charged for transportation of all such goods for a single consignee does not exceed Rs.750' (d) milk, salt and food grain including flours, pulses and rice (e) Chemical fertilizer, organic manure and oilcakes; (f) Newspaper or magazines registered with the Registrar of Newspapers (g) Relief materials meant for victims of natural or man-made disasters, calamities, accidents or mishap; or (h) Defence or military equipments. (i) cotton, ginned or baled 9899259817, 9811059817 Page 6 Service Tax Amendments CA Arun Setia Classes Entry No 26. Services of general insurance business provided under following schemes (a) Hut Insurance Scheme; (b) Cattle Insurance under Swarnajaynti Gram Swarozgar Yojna (earlier known as Integrated Rural Development Programme); (c) Scheme for Insurance of Tribals; (d) Janata Personal Accident Policy and Gramin Accident Policy; (e) Group Personal Accident Policy for Self-Employed Women; (f) Agricultural Pumpset and Failed Well Insurance; (g) premia collected on export credit insurance; (h) Weather Based Crop Insurance Scheme or the Modified National Agricultural Insurance Scheme, approved by the Government of India and implemented by the Ministry of Agriculture; (i) Jan Arogya Bima Policy; (j) National Agricultural Insurance Scheme (Rashtriya Krishi Bima Yojana); (k) Pilot Scheme on Seed Crop Insurance; (l) Central Sector Scheme on Cattle Insurance; (m) Universal Health Insurance Scheme; (n) Rashtriya Swasthya Bima Yojana; or (o) Coconut Palm Insurance Scheme; (p) Pradhan Mantri Suraksha Bima Yojna;] (Add by FA, 2015 ) Entry No-26A. Services of life insurance business provided under following schemes (a) Janashree Bima Yojana (JBY); or (b) Aam Aadmi Bima Yojana (AABY);. (c) life micro-insurance product as approved by the Insurance Regulatory and Development Authority, having maximum amount of cover of fifty thousand rupees.] (d) Varishtha Pension Bima Yojana;] (e) Pradhan Mantri Jeevan Jyoti Bima Yojana; Applicable from 30-April-2015 (f) Pradhan Mantri Jan Dhan Yogana;] Entry no 26B: Services by way of collection of contribution under Atal Pension Yojana (APY). Entry No.29 Intermediate service Services by following persons in respective capacities (a) A sub-broker/ an authorized person (b) Authorized person 9899259817, 9811059817 To a stock broker To a member of a commodity exchange Page 7 Service Tax Amendments (c) Mutual fund agent (d) Mutual fund distributor (e) Selling or marketing agent of lottery tickets (f) Sub- contractor providing services by way of works contract CA Arun Setia Classes To a mutual fund or asset management company To a mutual fund or asset management company Deleted w.e.f. 1/04/15 To a distributer or a selling agent To another contractor providing works contract services which are exempt Entry No.30 Service of job work Carrying out intermediate production process as job-work in relation to (Exemption not linked to value of services) a) Agriculture*, Printing or Textile Processing; b) Cut And Polished Diamonds and gemstones; or plain and studded jewellery of gold and other precious metals, falling under Chapter 71 of CETA; c) "any goods excluding alcoholic liquors for human consumption, “ on which appropriate duty is payable by the principal manufacturer; [Bold portion amended with effect from 106-2015] or d) Appropriate Duty [Para 2(b) of Notification No. 25/2012-ST]; Appropriate duty means duty payable on manufacture or production under a Central Act or a state Act, but shall not include ‘Nil’ rate of duty or duty wholly exempt. e) Principal manufacturer [Para 2(z) of Notification No.25/2012-ST]: Principal manufacturer means any person who gets goods manufactured or processed on his account from another person. Entry No.32 Telephone service Deleted w.e.f 1/04/2015 Services by way of making TELEPHONE CALLS from (a) Departmentally run public Telephone; (b) Guaranteed Public telephone operating only for local calls ; or (c) Free telephone at airport and hospital where no bills are being issued. Entry No.43 . Services by operator of Common Effluent Treatment Plant by way of treatment of effluent; Entry No. 44 SERVICES IN RELATION TO FRUITS AND VEGETABLES [Entry 44 of Notification No.25/2012-ST] [inserted w.e.f. 01-04-2015] : Services by way of pre-conditioning pre-cooling, ripening, 9899259817, 9811059817 Page 8 Service Tax Amendments CA Arun Setia Classes waxing, retail packing, labeling of fruits and vegetables which do not change or alter the essential characteristics of the said fruits or vegetables. Entry No.45 . SERVICES BY WAY OF ADMISSION TO MUSEUM NATIONAL PARK ETC. [Entry 45 of Notification No. 25/2012- ST] [inserted w.e.f. 01-04-2015]: Services by way of admission to a museum national park wildlife sanctuary, tiger reserve to zoo. National Park [Para 2(xxa) of Notification No. 25/2012-ST]: ”National Park” has the meaning assigned to it in Section 2(21) of The Wild Life (protection) Act, 1972. Tiger Reserve [Para 2(zi) of Notification No. 25/2012-ST]: ”Tiger Reserve” has the meaning assigned to it in Section 38K(e) of The Wild Life (protection) Act, 1972. Wild life sanctuary [Para 2(zk) of Notification No. 25/2012-ST]: ”Wild life sanctuary” has the means sanctuary as defined in the Section 2(26) of The Wild Life (protection) Act, 1972. Zoo [Para 2(zl) of Notification No. 25/2012-ST]: ”Zoo” has the meaning assigned to it in Section 2(39) of The Wild Life (protection) Act, 1972. MOVIE EXHIBITION Entry No.46 MOVIE EXHIBITION [Entry 46 of Notification No.2512012-ST] [Inserted w.e.f.07-04-2015] : Service provided by way of exhibition of movie by an exhibitor to the distributor or an association of persons consisting of the exhibitor as one of its members. ADMISSION TO ENTERTAINMENT EVENT OR AMUSEMENT FACILITY Entry No.47 ADMISSION TO ENTERTAINMENT EVENT OR AMUSEMENT FACILITY [Entry 47 of Notification No. 25/2012-ST] [Inserted w.e.f.07-04-2015] : Services by way of right to admission to:exhibition of cinematographic film, circus, dance, or theatrical performance including drama or ballet; (ii) recognised sporting event; (iii) award function, concert, Pageant, musical performance or any sporting event other than a recognized sporting event, where the consideration for admission is not more than Rs. 500 per person. “Recognized sporting event” [Para 2(zab) of Notification No. 25/2012-ST]: “Recognized sporting event” means any sporting event – (i) (i) (ii) organized by a recognized sports body where the participating team or individual represent any district, state, zone or country; covered under entry 11. 9899259817, 9811059817 Page 9 Service Tax Amendments CA Arun Setia Classes Author's Note: With effect from 01-06-2011 the Negative List entry that covers "admission to entertainment event or access to amusement facility" is being omitted [Section 66D (j)]. Consequently, the definitions of “amusement facility” [Section 65 B (9)] and "entertainment event" [Section 658(24)] are also being omitted. Hence, the aforesaid exemption has been provided w.e.f . 01-06- 2015. Amendment 8 (COMPOSITION SCHEME ) (A) Payment of service tax by an air travel agent for booking of tickets for travel by air [Rules 6(7) of Service Tax Rules, 1994] Service tax in relation to booking of ticket for travel by air can be paid in any of the following alternatives: a) At the rate of 14% of the commission and other charges recovered from the customer or received from the air line; b) (i) At the rate of .7% of Basic Fare in case of Domestic Booking. Explanation:- (ii) At the rate of 1.4% of Basic Fare in case of International Booking. “Basic fare” means that part of the air fare on which commission in normally paid to the air travel agent by the airline. And the option, once exercised Shall apply uniformly in respect of all the bookings of passage for travel by air made by him and Shall not be changed during a Financial Year under any circumstance (B) Payment of service tax by the insurer carrying on life insurance business [Rules 6(7A) of Service Tax Rules, 1994] The insurer can pay service tax in any of the following alternatives: I) Where the entire premium paid by the policy holder is only towards risk cover in life insurance. II) Where the gross premium paid is inclusive of investment amount and the policy holder has been intimated such amount at the time of providing service. III) Where the investment amount in the gross premium has not been separately intimated. (i) Where the entire premium paid by the policy holder is only toward risk cover in life insurance In this case service tax shall be payable @ 14% on the entire premium amount. (ii) Where the gross premium paid is inclusive of investment amount and the policy holder has been intimated such amount at the time of providing service 9899259817, 9811059817 Page 10 Service Tax Amendments CA Arun Setia Classes The insurer shall have the option to pay tax @ 14% on the gross premium charged from a policy holder reduced by the amount allocated for investment, or savings on behalf of policy holder, if such amount is intimated to the policy holder at the time of providing of service (iii) Where the investment amount in the gross premium has not been separately intimated The insurer shall have the option to pay tax at the following rates: 3.5% of the gross premium charged from the policy holder in the first year; And 1.75% of the gross premium charged in the subsequent years (C) Payment of service tax by the authorized agent in case of purchase or sale foreign currency including money changing Service tax in relation to currency exchanged can be paid in any of the following alternatives: Option I :- It can be paid @ 14% on the value of service determined as per rule 2B of Service Tax (Determination of Value) Rules 2006; or Option II:- It can be paid at the rate provided in rule of 6(7B) of Service Tax Rule, 1994. Option I :- Where service tax is to be paid @ 14% on the value of service In this case, the value of service shall be determined as per rule 2B of Service Tax (Determination of Value) Rules 2006 in the following manner: a) Where one of the currency exchanged is Indian Rupees The value of service which pertains to purchase or sale of foreign currency, including money changing shall be determined by the service provider in the following manner: (i) Where Reserve Bank of India reference rate for a currency in available: For a currency, when exchanged from, or to, Indian Rupees (INR), the value shall be equal to the difference in the buying rate or the selling rate, as the case may be, and the Reserve Bank of India (RBI) reference rate for the that currency at that time, multiple by the total units of currency. Example 1: R converted US$1000 from the authorized money changer @ Rs 45 per US$ and received Rs. 45,000. RBI reference rate for US$ is Rs. 45.50 for that day. As per RBI reference rate the amount should have been 1000 45.50 = Rs. 45,500. Thus, the difference due to the selling rate Rs. 45,500 – 45,000 = 500 will be treated as taxable value of the service in relation to exchange of money and the service tax shall be payable by the authorized money changer @ 14% on Rs. 500 amounting to Rs. 70. Example 2: R converted INR70000 into Great Britain Pound (GBP) from the authorized money changer and the exchange rate offered was Rs. 70, and therefore he received GBP 1000. RBI reference rate for that day for GBP is Rs. 69. Thus as per RBI reference rate, he should have paid 9899259817, 9811059817 Page 11 Service Tax Amendments (ii) CA Arun Setia Classes Rs. 69,000 (GBP1000 69).The taxable value of service in this case shall be Rs 70,000 – 69,000 = Rs 1000 and service tax shall be payable @ 14 % on Rs. 1,000 amounting to Rs. 140. Where Reserve Bank of India reference rate for a currency is not available: where the RBI reference rate for a currency in not available, the value shall be 1% of the gross amount of Indian Rupees Provision or received, by the person changing the money. Example: R has converted Rs. 1, 50,000 GPB and received 2000. The RBI reference rate is not available on that day. In this case the value of service shall be taken as 1% of Rs. 1, 50,000 amounting to Rs. 1, 500 and service tax shall be payable by the authorized agent @ 14% on Rs. 1, 500. b) Where neither of the currencies exchanged is Indian Rupees Where neither of the currencies exchanged is Indian Rupees, the value shall be equal to 1% of the lesser of the two amount the person changing the money would have receive by converting any of the two currencies into Indian Rupees on that day at reference rate provided by RBI. Option II:- Where the service tax is to 1994 (i) For currency upto Rs. 1,00,000 exchanged (ii) For amount exceeding Rs. 1,00,000 and upto Rs. 10,00,000 (iii) For an amount exceeding Rs. 10,00,000 be paid at the rate providing in rule 6(7B) of Service Tax Rule, 0.14 % of the gross amount of currency exchanged or Rs 35 Whichever is higher Rs 140 + .07% of the gross amount of currency exchanged over 1 Lakh Rs 770 + .014% of the gross amount of currency exchange Or Rs 7,000 Whichever is lower However, the person providing the service shall exercise option (2) above for a financial year and such option shall not be withdrawn during the remaining part of that financial year. Illustration: compute the amount of service tax payable by the authorized money changer in the following case: 1. Exchanged US$ 1000 and paid Rs 53,600 2. Exchanged US$ 3000 and paid Rs 1,60,500 3. Exchanged British £ 15000 and paid Rs 12,60,000 Solution: The amount of service tax payable shall be: Case I: Rs. 53,600 × 0.14/100 or Rs. 35 whichever is higher Rs. 75.04 75.04 Service tax rounded Case II: Rs. 1, 60,500 On Rs. 1, 00,000 9899259817, 9811059817 75 140 Page 12 Service Tax Amendments CA Arun Setia Classes Balance Rs. 60,500 × .07/100 42.35 182.35 Service tax rounded Case III: Rs 12, 60,000 Upto Rs 10, 00,000 Balance 2, 60,000 × .014/100 182 770 36.4 806.4 806.4 806 Service tax rounded (D) Payment of service tax by the distributors or selling agent for taxable service or promotion, marketing, organizing or in any other manner assisting lottery [Rules 6(7C) of Service Tax Rules, 1994] Service tax in the case is payable @ 14% of the value of such taxable services. However, he has a option to pay the service tax at rate specified as under: Situation Rate of service tax Where the guaranteed lottery prize payment is 80% or more Rs 8,200 on every Rs 10 lakh (or part of Rs 10 lakh) of aggregate face value of lottery tickets printed by the organizing State for a draw. Where the guaranteed lottery prize payout is less than 80% Rs 12,800 on every Rs 10 lakh (or part of Rs. 10 lakh) of aggregate face value of lottery tickets printed by the organizing State for a draw. In case of online lottery, the aggressive face value of lottery tickets will be the aggregate value of tickets sold and service tax shall be calculated in the manner specified above. Illustration: An organizer of lottery got lottery tickets printed for Rs 10,84,60,000. Compute the service tax payable the organizer under the composition scheme in the following cases: (a) Guaranteed prizes payout is 85% (b) Guaranteed prizes payout is 75% Solution: Case (a) Guaranteed prizes payout is 85% Total value of tickets printed Rs 10,84,60,000. Part less than Rs 10 lakh i.e. Rs. 4,60,000 shall be rounded off to rupees ten lakhs. Hence, total value shall be Rs 10,90,00,000. Rate of service tax on every rupees ten lakh or part thereof = Rs 8200 9899259817, 9811059817 Page 13 Service Tax Amendments CA Arun Setia Classes Total amount of service tax Rs 82,00 × 10,90,00,000/10,00,00 Rs. 893800 Total 893800 Case (b) guaranteed prizes payout is 75% Rate of service tax Rs 12,800 per ten lakhs or part of ten lakh = 12,800 × 109 13,95,200 13,95,200 Amendment 9 Section 75. Interest on delayed payment of service tax Even, person, liab1e to pay the tax in accordance with the provisions of section 68 or rules made thereunder, Who fails to credit the tax or an), part thereof to the account of the Central Government within the period prescribed, Shall pay simple interest at such rate (100% to 36%) as is for the time being fixed by the Central Government, by, notification in the Official Gazette for the period by which such crediting of the tax or any part thereof is delayed. S.No. Period of delay Rate of simple interest 1. Up to six months 18% 2. More than six months 18% for the first six months of delay and and up to one year 24% for the delay beyond six months. More than one year 18% for the first six months of delay; 3. 24% for the period beyond six months up to one year and 30% for any delay beyond one year. Provided that in the case of a service provider, whose value of taxable services provided in a financial year does not exceed 60 lakh rupees During any of the financial years covered by the notice or 9899259817, 9811059817 Page 14 Service Tax Amendments CA Arun Setia Classes During the last preceding financial year, (as the case may be) Such rate of interest, shall be reduced by 3% per annum. Amendment 10 Question: Explain the conditions, safeguards and procedure as specified by CBEC subject to which registration is granted. Answer: The conditions, safeguards and procedure as specified vide order No. 1/2015-ST, dated 28-22015 and Circular No. 997/4/2015-CX, dated 28-02-2015 issued by the CBEC subject to which registration is granted is as under: General procedure: (a) Online Application: Applicants seeking registration for single premises in service tax shall file the application online in the Automation of Central Excise and Service Tax (ACES) website in Form ST-1. (1) (b) PAN mandatory except in case of Government department: Registration shall mandatorily require that the PAN of the proprietor or the legal entity being registered be- quoted in the application with the exception of Government Departments for whom this requirement shall be non-mandatory. Applicants, who are not Government Departments, shall not be granted registration in the absence of PAN. Existing registrants, except Government departments not having PAN shall obtain PAN and apply online for conversion of temporary registration to PAN based registration within 3 months of this order coming into effect failing which the temporary registration shall be cancelled after giving the assessee an opportunity to represent against the proposed cancellation and taking into consideration the reply received, if any. (c) E-mail and mobile number mandatory: The applicant shall quote the email address and mobile number in the requisite column of the application form for communication with the department. Existing registrants who have not submitted this information are required to file an amendment application by 30-4-2015. (d) Online Registration to be granted within 2 working days: Once the completed application form is filed in ACES, registration would be granted online within 2 days. On grant of registration, the applicant would also be enabled to electronically pay service tax. (e) Registration Certificate not to be signed: Further, the applicant would not need a signed copy of-the Registration Certificate as proof of registration. Registration Certificate downloaded from the ACES web site would be accepted as Proof of registration dispensing with the need for a signed copy. 9899259817, 9811059817 Page 15 Service Tax Amendments (2) CA Arun Setia Classes Documentation required: The applicant is required to submit a self attested copy of the following documents by registered post/ Speed Post to the concerned Division, within 7 days of filling the Form ST-1 online, for the purposes of verification:(a) (b) (c) (d) (e) (f) (g) Copy of the PAN card of the proprietor or the Iegal entity registered. Photograph and proof of identity of the person filing the application namely PAN card, passport, voter Identity card, Aadhar voter Identity Card, Driving license, or any other Photo-identity card issued by the central Government, State Government or Public Sector Undertaking. Document to establish possession of the premises to be registered such as proof of ownership, lease or rent agreement, allotment letter from Government, No Objection Certificate from tire legal owner. Details of the main Bank Account. Memorandum/Articles of Association/List of Directors. Authorization by the Board of Directors/ Partners/ Proprietor for the person filling the application. Business transaction numbers obtained from other Government departments or agencies such as Customs Registration No. (BIN No), import Export Code (IEC) number, State Sales Tax Number (VAT) Central sales Tax Number, company Index Number (CIN) which have been issued prior to the filing of the service tax registration application Where the need for the verification of premises arises, the same will have to be authorised by an officer not below the rank of Additional /Joint Commissioner. The registration certificate may be revoked by the Deputy/Assistant Commissioner in any of the following situations, after giving the assessee an opportunity to represent against the proposed revocation and taking into consideration the reply received, if any: (i) the premises are found to be nonexistent or not in possession of the assessee. (ii) no documents are received within 15 days of the date of filing the registration application. (iii) the documents are found to be incomplete or incorrect in any respect. The provisions of sub-rules (5A) and (6) of rule 4 of the Service Tax Rules, 1994 may be referred to regarding change in any information or details furnished by an assessee and transfer of business to another person, respectively. Similarly, sub rule (7) of the Service Tax Rules, 1994 may be referred to in case a registered person ceases to provide the service for which he has been granted registration. Amendment 11 LIABILITY TO PAY SERVICE TAX Sec 68(1) :_-Every person, who provide taxable shall be liable to pay service tax by following the procedure laid down in Rule 6 of STR 1994 Sec 68(2) :- In following cases service tax shall be paid by person who is receiving services i.e. service recipient. 9899259817, 9811059817 Page 16 Service Tax Amendments No. Service provided by – [Alphabetically] CA Arun Setia Classes Recipient of service % of service payable by Service provider 1. 1A. 2 3. 4. 5. 6. tax service receiver Arbitral Tribunal: an arbitral tribunal Any business entity located in the Nil 100% taxable territory In respect of services provided or agreed to To a banking company or a financial Nil 100% be provided by a Recovery Agent institution or a non-banking financial (FA 2014) company; In respect of services provided or agreed to To the said company or the body Nil 100% be provided by a director of a company or corporate a body corporate (FA 2014) Government or Local Authority: Any business entity located in the Nil 100% Government or local authority by way of taxable territory support services excluding – (a) renting of immovable property, and (b) services specified u/s 66d(a)(i), (ii) and (iii) GTA: goods transport agency by way of Where person liable to pay freight is Nil 100% transport of goods by road in a goods – carriage (a) any registered factory; (b) any registered society; (c) any co-operative society established by or under any law; (d) any registered dealer of excisable goods; (e) anybody corporate established by or under any law; or (f) any partnership firm whether registered or not under any law including AOP; and such person is located in taxable territory Reverse charge – Partnership Firm includes LLP [Rule 2(1)(cd) of ST Rules, 1994]: ‘Partnership firm’ includes a limited liability partnership. Hence, for the purpose of rule 2(1)(d) of the Service Tax Rules, 1994 specifying person liable to pay service tax, the word ‘partnership’ shall include ‘LLP’. Author’s Note: The definition of ‘partnership firm’ as including LLP is limited only to Service Tax Rule, 1994 and same is used only for reverse charge and payment of service tax. Therefore, for other purpose, the partnership firm shall not include LLP. Insurance Agent: an insurance agent any person carrying on insurance Nil 100% business Legal services: individual advocate or a firm any business entity located in the Nil 100% of advocates by way of legal services taxable territory Legal Service [Rule 2(1) (cca) of ST Rules, 1994]: Legal Service means – any service provided in relation to advice, consultancy or assistant in any branch of law, in any manner and 9899259817, 9811059817 Page 17 Service Tax Amendments 7. 8. 9. 10. CA Arun Setia Classes includes representational services before any court, tribunal or authority. Person located outside taxable territory: any person located in the taxable any person who is located in a non-taxable territory territory Sponsorship: any person by way of anybody corporate or partnership sponsorship firm (including LLP, as per Rule 2(1)(cd) located in taxable territory A mutual fund agent or distributer to a mutual fund or asset management company, A selling or marketing agent of lottery to a lottery distributer or. Selling tickets agent Nil 100% Nil 100% NIL 100% NIL 100% NIL 100% located in the taxable territory by way of – (a) security services Nil 100% (b) Supply of manpower for any purpose Nil% 100% 11. in respect of any service provided or agreed to be provided by a person involving an aggregator in any manner 12. Partial Reverse Charge – Manpower, a business entity – Security, Renting of motor vehicle and Registered as a body corporate, Works Contract Services: any – and individual, Located in the taxable territory HUF or Partnership firm (including LLP), whether registered or not, Including AOP, (c) service portion in execution of works 50% 50% contract (d) renting of a motor vehicle designed to (service receiver must not be carry passengers – engaged in the similar line of (i) on abated value business Nil 100% (ii) on non-abated value 60% 50% 40% 50% (FA 2014) Terms Defined: (a) Supply of Manpower [Rule 2(1)(g) of ST Rules, 1994]: Supply of Manpower means supply of manpower, temporarily or otherwise, to another person to work under his superintendence or control. Analysis: It must be noted that the word “his” means the person to whom manpower is provided. For example, if a software developer firm employs its staff at clients premises and the staff works under superintendence and control of the software firm, then, it would not amount to “supply of manpower” to client and, thus, reverse charge is not attracted. However, ‘campus recruitment fees’ is consideration for supply of manpower (such manpower works under superintendence and control of client and is, therefore, governed by reverse charge 9899259817, 9811059817 Page 18 Service Tax Amendments CA Arun Setia Classes provisions. Employees sent on deputation basis: In case employees of a concern are sent on deputation basis to another concern against consideration, then, such service would also amount to ‘supply of manpower’.] (b) Security Service [Rule 2(1)(fa) of ST Rules, 1994]: Security Services means – service relating to the security of any property, whether movable or immovable, or of any person, in any manner and includes the service of investigation, detection or verification, of any fact or activity. Analysis: Thus, it would cover detective agencies, security agencies, etc.] (c) Body Corporate – Society/Co-op. Society not covered [Rule 2(1)(be) of ST Rules, 1994]: As per Section 2(7) of the Companies Act, 1956 [corresponding section 2(11) of the Companies. Act, 2013], the word ‘body corporate’ – includes company incorporated outside India but doesn’t include: (i) co-operative society, and (ii) any other notified body corporate (not being a company). Note: A society registered under the Societies Act is also not a body corporate. (d) Aggregator : As per Rule 2(1)(aa) of the Service Tax Rules, 1994 “Aggregator” means a person who(a) Owns and manages a web based software application, and (b) By means the application and a communication device, enable a potential customer to connect with persons providing service of a particular kind under the brand name or trade name of the aggregator. Business entity [Section 65B(17)]: Business Entity means any person ordinarily carrying out any activity relating to industry, commerce or any other business or profession Amendment 12 (ABATEMENT) Table Sl. No. Description of taxable service Taxable Percent- Conditions age (1) (2) (3) (4) 1 Services in relation to FINANCIAL leasing including hire purchase 10 Nil. 2 Transport of goods by rail 30 [CENVAT credit on inputs, capital goods and 9899259817, 9811059817 Page 19 Service Tax Amendments CA Arun Setia Classes input services, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004.] 3 Transport of passengers, with or without accompanied belongings by rail 30 [Same as above] 4 Bundled service by way of supply of food or any other article of human consumption or any drink, in a premises ( including hotel, convention center, club, pandal, shamiana or any other place, specially arranged for organizing a function) together with renting of such premises 70 (i) CENVAT credit on any goods classifiable under Chapters 1 to 22 of the Central Excise Tariff Act, 1985 used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. 5 Transport of passengers by air, with or without accompanied belongings in 40 60 (i) economy class 40% (ii) other than economy class 60% CENVAT credit on inputs and capital goods, used for providing the taxable Service, has not been taken under the provisions of the CENVAT Credit Rules, 2004.] 6 Renting of hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes. 60 7 Services of goods transport agency in relation to transportation of goods. [30] Same as above. CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken [by the service provider] under the provisions of the CENVAT Credit Rules, 2004. 8 Omitted] 9 Renting of [motor cab] 40 [(i) CENVAT credit on inputs and capital goods, used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004; (ii) CENVAT credit on input service of renting of motorcab has been taken under the provisions of the CENVAT Credit Rules, 9899259817, 9811059817 Page 20 Service Tax Amendments CA Arun Setia Classes 2004, in the following manner: (a) Full CENVAT credit of such input service received from a person who is paying service tax on forty percent of the value; or (b) Up to forty percent CENVAT credit of such input service received from a person who is paying service tax on full value; (iii) CENVAT credit on input services other than those specified in (ii) above, has not been taken under the provisions of the CENVAT Credit Rules, 2004] 9A [Transport of passengers, with or without accompanied belongings, by- 40 a. a contract carriage other than motorcab. CENVAT credit on inputs, capital goods and input services, used for providing the taxable service, has not been taken under the provisions of theCENVAT Credit Rules, 2004] b. a radio taxi.] 10 Transport of goods in a vessel 11 Services by a tour operator in relation to,- [30] 25 (i) a package tour Same as above. (i) CENVAT credit on inputs, capital goods and [input services other than the input service of a tour operator], used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii) The bill issued for this purpose indicates that it is inclusive of charges for such a tour. (ii) a tour, if the tour operator is providing services solely of arranging or booking accommodation for any person in relation to a tour 10 (i) CENVAT credit on inputs, capital goods and [input services other than the input service of a tour operator], used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii) The invoice, bill or challan issued indicates that it is towards the charges for 9899259817, 9811059817 Page 21 Service Tax Amendments CA Arun Setia Classes such accommodation. (iii) This exemption shall not apply in such cases where the invoice, bill or challan issued by the tour operator, in relation to a tour, only includes the service charges for arranging or booking accommodation for any person and does not include the cost of such accommodation. (iii) any services other than specified at (i) and (ii) above. 40 (i) CENVAT credit on inputs, capital goods and 9[input services other than the input service of a tour operator], used for providing the taxable service, has not been taken under the provisions of the CENVAT Credit Rules, 2004. (ii)The bill issued indicates that the amount charged in the bill is the gross amount charged for such a tour. 12. Construction of a complex, building, civil structure or a part thereof, intended for a sale to a buyer, wholly or partly, except where entire consideration is received after issuance of completion certificate by the competent authority,- 25 (i) CENVAT credit on inputs used for providing the taxable service has not been taken under the provisions of theCENVAT Credit Rules, 2004; (ii) The value of land is included in the amount charged from the service receiver.] (a) for a residential unit satisfying both the following conditions, namely:(i) the carpet area of the unit is less than 2000 square feet; and (ii) the amount charged for the unit is less than rupees one crore; (b) for other than the (a) above. 9899259817, 9811059817 30 Page 22 Service Tax Amendments CA Arun Setia Classes Amendment 13 Section 73.Recovery of service tax not levied or paid or short-levied or short-paid or erroneously refunded (1) Where any service tax has not been levied or paid or has been short-levied or short-paid or erroneously refunded, the 2[Central Excise Officer] may, within 11[eighteen months] from the relevant date, serve notice on the person chargeable with the service tax which has not been levied or paid or which has been short-levied or short-paid or the person to whom such tax refund has erroneously been made, requiring him to show cause why he should not pay the amount specified in the notice: PROVIDED that where any service tax has not been levied or paid or has been short-levied or short-paid or erroneously refunded by reason of(a) fraud; or (b) collusion; or (c) wilful mis-statement; or (d) suppression of facts; or (e) contravention of any of the provisions of this Chapter or of the rules made thereunder with intent to evade payment of service tax, by the person chargeable with the service tax or his agent, the provisions of this sub-section shall have effect, as if, for the words [eighteen months] , the words "five years" had been substituted. Explanation: Where the service of the notice is stayed by an order of a court, the period of such stay shall be excluded in computing the aforesaid period of 11[eighteen months] or five years, as the case may be. [(1A) Notwithstanding anything contained in sub-section (1), (except the period of eighteen months of serving the notice for recovery of service tax) the Central Excise Officer may serve, subsequent to any notice or notices served under that sub-section, a statement, containing the details of service tax not levied or paid or short levied or short paid or erroneously refunded for the subsequent period, on the person chargeable to service tax, then, service of such statement shall be deemed to be service of notice on such person, subject to the condition that the grounds relied upon for the subsequent period are same as are mentioned in the earlier notices. ] [(1B) Notwithstanding anything contained in sub-section (1), in a case where the amount of service tax payable has been self-assessed in the return furnished under sub-section (1) of section 70, but not paid 9899259817, 9811059817 Page 23 Service Tax Amendments CA Arun Setia Classes either in full or in part, the same shall be recovered along with interest thereon in any of the modes specified in section 87, without service of notice under sub-section (1).] (2) The [Central Excise Officer] shall, after considering the representation, if any, made by the person on whom notice is served under sub-section (1), determine the amount of service tax due from, or erroneously refunded to, such person (not being in excess of the amount specified in the notice) and thereupon such person shall pay the amount so determined. [(2A) Where any appellate authority or tribunal or court concludes that the notice issued under the proviso to sub-section (1) is not sustainable for the reason that the charge of,(a) fraud; or (b) collusion; or (c) wilful misstatement; or (d) suppression of facts; or (e) contravention of any of the provisions of this Chapter or the rules made thereunder with intent to evade payment of service tax has not been established against the person chargeable with the service tax, to whom the notice was issued, the Central Excise Officer shall determine the service tax payable by such person for the period of eighteen months, as if the notice was issued for the offences for which limitation of eighteen months applies under sub-section (1).] (3) Where any service tax has not been levied or paid or has been short-levied or short-paid or erroneously refunded, the person chargeable with the service tax, or the person to whom such tax refund has erroneously been made, may pay the amount of such service tax, chargeable or erroneously refunded, on the basis of his own ascertainment thereof, or on the basis of tax ascertained by a Central Excise Officer before service of notice on him under sub-section (1) in respect of such service tax, and inform the Central Excise Officer of such payment in writing, who, on receipt of such information shall not serve any notice under sub-section (1) in respect of the amount so paid: Provided that the 6[Central Excise Officer] may determine the amount of short payment of service tax or erroneously refunded service tax, if any, which in his opinion has not been paid by such person and, then, the [Central Excise Officer] shall proceed to recover such amount in the manner specified in this section, and the period of "11[eighteen months]" referred to in sub-section (1) shall be counted from the date of receipt of such information of payment. Explanation 1: For the removal of doubts, it is hereby declared that the interest under section 75 shall be payable on the amount paid by the person under this sub-section and also on the amount of short 9899259817, 9811059817 Page 24 Service Tax Amendments CA Arun Setia Classes payment of service tax or erroneously refunded service tax, if any, as may be determined by the 8[Central Excise Officer], but for this sub-section. [Explanation 2: For the removal of doubts, it is hereby declared that no penalty under any of the provisions of this Act or the rules made thereunder shall be imposed in respect of payment of servicetax under this sub-section and interest thereon.] (4) Nothing contained in sub-section (3) shall apply to a case where any service tax has not been levied or paid or has been short-levied or short-paid or erroneously refunded by reason ofa. fraud; or b. collusion; or c. wilful mis-statement; or d. suppression of facts; or e. contravention of any of the provisions of this Chapter or of the rules made thereunder with intent to evade payment of service tax. [4A] Omitted [(4B) The Central Excise Officer shall determine the amount of service tax due under sub-section (2)a. within six months from the date of notice where it is possible to do so, in respect of cases whose limitation is specified as eighteen months in sub-section (1); b. within one year from the date of notice, where it is possible to do so, in respect of cases falling under the proviso to sub-section (1) or the proviso to sub-section (4A).] (5) The provisions of sub-section (3) shall not apply to any case where the service tax had become payable or ought to have been paid before the 14th day of May, 2003. (6) For the purposes of this section, "relevant date" means,I. in the case of taxable service in respect of which service tax has not been levied or paid or has been short-levied or short-paid- a. where under the rules made under this Chapter, a periodical return, showing particulars of service tax paid during the period to which the said return relates, is to be filed by an assessee, the date on which such return is so filed; 9899259817, 9811059817 Page 25 Service Tax Amendments CA Arun Setia Classes b. where no periodical return as aforesaid is filed, the last date on which such return is to be filed under the said rules; c. in any other case, the date on which the service tax is to be paid under this Chapter or the rules made thereunder; II. in a case where the service tax is provisionally assessed under this Chapter or the rules made thereunder, the date of adjustment of the service tax after the final assessment thereof; III. in a case where any sum, relating to service tax, has erroneously been refunded, the date of such refund. Amendment 14 Penalty for failure to pay service tax Section 76. (1) Where service tax has not been levied or paid, or has been short-levied or short-paid, or erroneously refunded, for any reason, other than the reason of fraud or collusion or wilful misstatement or suppression of facts or contravention of any of the provisions of this Chapter or of the rules made thereunder with the intent to evade payment of service tax, the person who has been served notice under sub-section (1) of section 73 shall, in addition to the service tax and interest specified in the notice, be also liable to pay a penalty not exceeding ten per cent. of the amount of such service tax: Provided that where service tax and interest is paid within a period of thirty days of-(i) the date of service of notice under sub-section (1) of section 73, no penalty shall be payable and proceedings in respect of such service tax and interest shall be deemed to have been concluded; Amendment 15 [Penalty for failure to pay service tax for reasons of fraud, etc. Section 78. (1) Where any service tax has not been levied or paid, or has been shortlevied or short-paid, or erroneously refunded, by reason of fraud or collusion or wilful mis-statement or suppression of facts or contravention of any of the provisions of this Chapter or of the rules made thereunder with the intent to evade payment of service tax, the person who has been served notice under the proviso to sub9899259817, 9811059817 Page 26 Service Tax Amendments CA Arun Setia Classes section (1) of section 73 shall, in addition to the service tax and interest specified in the notice, be also liable to pay a penalty which shall be equal to hundred per cent. of the amount of such service tax: “Provided that in respect of the cases where the details relating to such transactions are recorded in the specified record for the period beginning with the 8th April, 2011 upto the date on which the Finance Bill, 2015 receives the assent of the President (both Days inclusive), the penalty shall be fifty per cent of the service tax so determined.”. Provided further that where service tax and interest is paid within a period of thirty days of -I. the date of service of notice under the proviso to sub-section (1) of section 73, the penalty payable shall be fifteen per cent. of such service tax and proceedings in respect of such service tax, interest and penalty shall be deemed to be concluded; II. the date of receipt of the order of the Central Excise Officer determining the amount of service tax under sub-section (2) of section 73, the penalty payable shall be twenty-five per cent. of the service tax so determined: Provided also that the benefit of reduced penalty under the second proviso shall be available. only if the amount of such reduced penalty is also paid within such period. “Explanation.-For the purposes of this sub-section, “specified records” means records including computerised date as are required to be maintained by an assesse in accordance with any law for the time being in force or where there is no such requirement, the invoices recorded by the assessee in the books of accounts shall be considered as the specified records.”. “(2) Where the Commissioner (Appeals), the Appellate Tribunal or the court, as the case may be, modifies the amount of service tax determined under sub-section (2) to section 73, then the amount of penalty payable under sub-section (1) and the interest payable thereon under section 75 shall stand modified accordingly, and after taking into account the amount of service tax so modified, the person who is liable to pay such amount of service tax, shall also be liable to pay the amount of penalty and interest so modified. (3) Where the amount of service tax or penalty is increased by the Commissioner (Appeals), the Appellate Tribunal or the court, as the case may be, over and above the amount as determined under sub-section (2) of section 73, the time within which the interest and the reduced penalty is payable under clause (ii) of the second provisio to sub-section (1) in relation to such increased amount of service tax shall be counted from the date of the order of the Commissioner (Appeals), the Appellate Tribunal or the court, as the case may be.] 9899259817, 9811059817 Page 27 Service Tax Amendments CA Arun Setia Classes Amendment 16 Section [78A. Penalty for offences by director, etc., of company. Where a company has committed any of the following contraventions, namely:— (a) evasion of service tax; or (b) issuance of invoice, bill or, as the case may be, a challan without provision of taxable service in violation of the rules made under the provisions of this Chapter; or (c) availment and utilisation of credit of taxes or duty without actual receipt of taxable service or excisable goods either fully or partially in violation of the rules made under the provisions of this Chapter; or (d) failure to pay any amount collected as service tax to the credit of the Central Government beyond a period of six months from the date on which such payment becomes due, then any director, manager, secretary or other officer of such company, who at the time of such contravention was in charge of, and was responsible to, the company for the conduct of business of such company and was knowingly concerned with such contravention, shall be liable to a penalty which may extend to one lakh rupees.] Amendment 17 (Amendment in STR) After Rule 4BRule 4C has been Inserted:- ―4C. Authentication by digital signature- (1) Any invoice, bill or challan issued under rule 4A or consignment note issued under rule 4B may be authenticated by means of a digital signature. (2)The Board may, by notification, specify the conditions, safeguards and procedure to be followed by any person issuing digitally signed invoices.‖; In Rule 5after Sub-Rule (3), following Sub-Rules has been inserted:- ―(4) Records under this rule may be preserved in electronic form and every page of the record so preserved shall be authenticated by means of a digital signature. (5) The Board may, by notification, specify the conditions, safeguards and procedure to be followed by an assessee preserving digitally signed records. Explanation – For the purposes of rule 4C and sub-rule (4) and (5) of this rule,- (i) The expression ―authenticate‖ shall have the same meaning as assigned in the Information Technology Act, 2000 (21 of 2000). (ii) The expression ―digital signature‖ shall have the meaning as defined in the Information Technology Act, 2000 (21 of 2000) and the expression ―digitally signed‖ shall be construed accordingly.‖ 9899259817, 9811059817 Page 28 Service Tax Amendments CA Arun Setia Classes Amendment 18 RULE 5A. ACCESS TO A REGISTERED PREMISES. (1) An officer authorised by the Commissioner in this behalf shall have access to any premises registered under these rules for the purpose of carrying out any scrutiny, verification and checks as may be necessary to safeguard the interest of revenue. (2) Every assessee, shall, on demand make available to the officer empowered under sub-rule (1) or the audit party deputed by the Commissioner or the Comptroller and Auditor General of India, or a cost accountant or chartered accountant nominated under section 72A of the Finance Act, 1994,I. II. III. the records maintained or prepared by him in terms of sub-rule (2) of rule 5; the cost audit reports, if any, under section 148 of the Companies Act, 2013 (18 of 2013); and the income-tax audit report, if any, under section 44AB of the Income-tax Act, 1961 (43 of 1961), for the scrutiny of the officer or the audit party, or the cost accountant or chartered accountant, within the time limit specified by the said officer or the audit party or the cost accountant or chartered accountant, as the case may be. Amendment 19 Notification No -4/2015 The Central Government, being satisfied that it is necessary in the public interest so to do, hereby exempts the taxable service received by an exporter of goods (hereinafter referred to as the exporter) and used for export of goods (hereinafter referred to as the said goods), of the description specified in column (2) of the Table below (hereinafter referred to as the specified service), from the whole of the service tax leviable thereon under section 66B of the said Act, subject to the conditions specified in column (3) of the said Table, namely:Table Sr.No. Description of the taxable service (1) (2) 1. Service provided to an exporter for transport of the said goods by goods transport agency in a goods carriage from any container freight station or inland container depot to the 2[port, airport or land customs station], as the case may be, from where the goods 9899259817, 9811059817 Conditions (3) The exporter shall have to produce the consignment note, by whatever name called, issued in his name. Page 29 Service Tax Amendments CA Arun Setia Classes are exported; or Service provided to an exporter in relation to transport of the said goods by goods transport agency in a goods carriage directly from their place of removal, to an inland container depot, a container freight station, a3[port, airport or land customs station], as the case may be, from where the goods are exported. Amendment 20 APPEALS TO APPELLATE TRIBUNAL Section 86. (1) [Save as otherwise provided herein, an assessee] aggrieved by an order passed by a Principal Commissioner of Central Excise or] Commissioner of Central Excise under [section 73 or section 83A or] or an order passed by a Commissioner of Central Excise (Appeals) under section 85, may appeal to the Appellate Tribunal against such order [within three months of the date of receipt of the order]. [Provided that where an order, relating to a service which is exported, has been passed under section 85 and the matter relates to grant of rebate of service tax on input services, or rebate of duty paid on inputs, used in providing such service, such order shall be dealt with in accordance with the provisions of section 35EE of the Central Excise Act, 1944 (1 of 1944): Provided further that all appeals filed before the Appellate Tribunal in respect of matters covered under the first proviso, after the coming into force of the Finance Act, 2012 (23 of 2012), and pending before it up to the date on which the Finance Bill, 2015 receives the assent of the President, shall be transferred and dealt with in accordance with the provisions of section 35EE of the Central Excise Act, 1944.] Amendment 21 Notification No. 9/2015 - Service Tax, dated 1st March, 2015 In exercise of the powers conferred by sub-clause (iii) of clause (b) of section 96A of the Finance Act, 1994 (32 of 1994), the Central Government specified ―resident firm‖ as class of persons for the purposes of the said sub-clause. Explanation - For the purposes of this notification, firm‖ shall have the meaning assigned to it in section 4 of the Indian Partnership Act, 1932 (9 of 1932) , and includes- I. the limited liability partnership as defined in clause (n) of sub-section (1) of the section 2 of the Limited Liability Partnership Act, 2008 (6 of 2009); or II. limited liability partnership which has no company as its partner; or 9899259817, 9811059817 Page 30 Service Tax Amendments III. CA Arun Setia Classes the sole proprietorship; or (iv) One Person Company. Sole proprietorship‖ means an individual who engages himself in an activity as defined in subclause (a) of section 96A of the Finance Act, 1994. One Person Company‖ means as defined in clause (62) of section 2 of the Companies Act, 2013 (18 of 2013). Resident‖ shall have the meaning assigned to it in clause (42) of section 2 of the Income-tax Act, 1961 (43 of 1961) in so far as it applies to a resident firm. COMPOSITION OF THE GST COUNCIL The GST Council is to consist of the following three members: (i) the Union Finance Minister (as Chairman), (ii) the Union Minister of State in charge of Revenue or Finance, and (iii) the Minister in charge of Finance or Taxation or any other, nominated by each state government 9899259817, 9811059817 Page 31