Service Tax 2011

advertisement

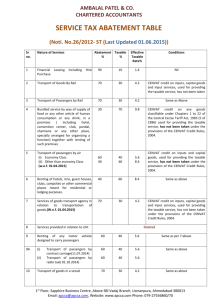

Introduction: • Service Tax was introduced in 1994 vide Finance Act, 1994 with 3 SERVICES namely, Brokerage charged by stockbroker, Telephone services & premium on General Insurance Services. • Applicable to whole of India except Jammu & Kashmir. • Today there are 109 services under section 65(105), which are considered taxable. 2 What is Service Tax? • It is a tax levied on the transaction of certain Specified Services, by the Central Government under the Finance Act, 1994. • It is an Indirect Tax, which means that normally the service provider pays the tax and recovers the amount from the recipient of taxable service. 3 Who is liable to pay Service Tax? (Sec.68 (1) of the Act) says that-the ‘Person’ who provides the taxable service is responsible for paying the Service Tax to the Government. However this rule is subject to exceptions: 4 Reverse Charge 1.INSURER in case of service provided by insurance agent 5.SPECIFIED CONSIGNOR OR CONSIGNEE in case of service provided by goods transport agency 4.ASSET MANAGEMENT COMPANY in case service provided by a distributor to them Persons Liable to Pay Service Tax in Certain Cases 2.INDIAN RESIDENT in case of import of service 3.BODY CORPORATE OR FIRM in case of receipt of sponsorship service General Exemptions Payment received in Foreign Exchange Services provided to UN or an International organization (16/2002-ST dated 2.8.2002) Specified services provided by a non-resident in the course of sailing of a ship (22/2005-ST dated 16.6.2005) Services provided to SEZ and units in SEZ (4/2004-ST dated 31.3.2004) All Services rendered to or by Reserve Bank of India REGISTRATION REQUIREMENTS Section 69 read with Rule 4 • • • • • Every Person who is liable to pay service tax Application shall be filed to Superintendent of Central Excise Application is to be in form No. ST-1 Within 30 days Registration shall be issued within 7 days in form ST-2 REGISTRATION REQUIREMENTS • As per Section 69, every person liable to pay service tax has to get themselves registered with service tax department. • Any provider of taxable services whose aggregate value of taxable service in a financial year exceeds Rs. 9 lacs, has to get themselves registered. 8 Contd… • Application for registration in Form ST-1 to be made to concerned Superintendent of Central Excise. • The application for registration shall be made within 30 days, from the date on which the levy of service tax is brought into force in respect of the relevant services or of the commencement of business where services has already been levied . 9 Contd… • Registration Certificate is granted in Form ST-2 within 7 days from the date of receipt of intimation.In case the registration certificate is not issued within seven days, the registration applied for is deemed to have been granted. (Rule 4(5) of the STR, 1994) • CBEC vide Circular no. 35/3/2003 has made it compulsory for every assessee to obtain the Service Tax Code number which is a 15 digit alphanumeric no. based on the PAN 10 Contd… Assessee providing more than one taxable service should mention in single application, all the taxable services provided by him. Rule 4(4), Service Tax Rule,1994. 11 DocumentS to be Submitted with ST-1 (a) Proof of address of the premises office sought to be registered (b) PAN number of the assessee (c) List of Branches offices or premises of the assessee (d) Brief note on accounting system adopted by the assessee (e) Branch-wise series of invoices maintained along with a sample copy thereof (f) Previous years audited balance sheet along with gross trial balance of different branches (g) Details of records accounts maintained at different branches and Central Office (h) Bank account numbers of the Branches and Central Office through which the receipts are deposited, transacted. I am confused what documents to be filed with ST-1 Provision for Centralized Registration Service providers having centralised accounting or centralised billing system, at their option, can have Centralised registration at one or more places. Commissioner of Central Excise / Service Tax in whose jurisdiction centralised account or billing office of the assesses exists, is empowered to grant centralised registration. 13 Payment of Service Tax through G.A.R. 7 Individual/Firm Other than Individual/Firm Quarterly Payment Monthly Payment Quarter Ending on 31st March Upto 31st Other Quarters Month of March 5th of the Month March Upto 31st March following Quarter E – Payment of Service Tax Other Months 5th of the Next Month E – Payment of Service Tax Mandatory E - Payment Optional E - Payment Rs. 50 Lakhs or More (Cash+CENVAT) Less than Rs. 50 Lakhs (Cash+CENVAT) In case of Large Taxpayer Unit Check the Limit Individually for Every Registered Premises Other than LTU Check Cumulative Limit for Every Registered Premises Return of Service Tax Return of Service Tax to be filed Half Yearly – ST-3 For 1st April to 30th September Due Date - 25th October For 1st October to 31st March Due Date - 25th April E-filing of ST-3 return Basic Requirement • PAN Based Service Tax Code (STC) • File return on www.servicetaxefiling.nic.in Condo nation of Delay Only for those using e-filing Facility first time Assessee has faced technical difficulties Delay of 1 month shall be condoned as per Circular No. 71/2004 SSP Exemption Limit Rs. 1000000/- 1500000 Rs. 900000/- 1000000 Have to pay Service tax on crossing the aggregate value of taxable service not exceeding the threshold limit of Rs. 10 lacs 1100000 500000 700000 800000 01.04.06 01.04.07 500000 0 X 01.04.08 Have to get himself registered on crossing the aggregate value of taxable service not exceeding the threshold limit of Rs. 9 lacs. Turnover Aggregate value of taxable service means the sum of first consecutive payments received during a financial year towards taxable service provided or to be provided. Exemption Scheme for Small Service Providers Central Government, provides the basic exemption to the service providers whose aggregate value of taxable services provided in last financial year is less than Rs. 10 Lacs. Assessee should not charge the Service Tax if he/she is claiming the benefit of exemption. If charged by mistake the same should be refunded to the service receiver. 19 Exception • Taxable services provided by a person under Brand Name or Trade Name, whether registered or not, of any other person are not eligible for the threshold limit exemption of Rs. 10 Lacs. [Notification No. 6/2005] 20 Abatement In case of certain services, the benefit of abatement (rebate) is allowed to the service provides. In such cases, the portion of revenue is exepmted (abated) while computing the assessable value. Example: If invoice for servicing is to be raised for Rs. 1000/- and abatement of 75% is available(then service tax will be imposed only on [1000 – 75% of 1000] Rs. 250/- 21 Abatements: Goods transport agency -75% abated. Construction of residential services-67% abated. Banking services- 30% Rent a cab-60% And so on… Service Tax Rate Period From 1.7.1994 to 13.05.2003 From 14.5.2003 to 09.09.2004 From 10.9.2004 to 17.04.2006 From 18.4.2006 to 10.05.2007 From 11.05.2007 to 24.02.2009 From 25.02.2009 Rate 5% 8% 10% 12.24%* 12.36%* 10.3%* *Inclusive of cess 23 Failure to Pay Service Tax • Interest(sec. 75) :- Interest @13% p.a. is payable on the short-fall or unpaid tax for delayed period. • Penalty(sec. 76) :• Rs.200 for every day during which failure continues, or • 2% of tax per month, whichever is higher. 24 Delay in Filing Return Period Up to 15 days 16 to 30 days Beyond 30 days Fine/Penalty Rs.500/Rs.1000/Rs.1000/- plus Rs.100/- per day from the 30th day till date of furnishing return (max Rs 20,000) 25 SERVICE TAX CENVAT CREDIT 26 What is CENVAT Credit Scheme ? The CENVAT Credit Rules, 2004, introduced with effect from 10.9.2004, provides for availment of the credit of the Service Tax paid on the input services / Central Excise Duties paid on inputs / capital goods / Additional Customs Duty leviable under the Customs Tariff Act, equivalent to the duties of excise. Such credit amount can be utilized towards payment of Service Tax by an assessee on their Output Services. (Refer to Rule 3 of CENVAT Credit Rules, 2004). 27 Contd… Duties paid on the inputs, capital goods and the Service Tax paid on the 'input' services can be taken as credit. Education Cess paid on the Excise duty and Service Tax can also be taken as credit only for payment of Education Cess relating to output service. The interest and penalty amounts cannot be taken as credit. 28 New services taxable (introduced in Finance Act, 2010) 1. Games of chance (zzzzn) 2 Health services (zzzzo) 3 Maintenance of medical records (zzzzp) 4 Promotion of a ‘brand’ of goods, services, events, business entity etc. (zzzzq) 5 Commercial use or exploitation of any event organized by a person or organization (zzzzr) 6 Electricity Exchange Service (zzzzs) 7 Copyrights on Cinematographic films and sound recording (zzzzt) 8 Providing of preferential location or external / internal development of complexes (zzzzu)