Chapter 16 Notes

advertisement

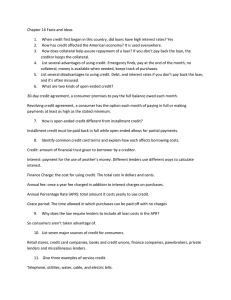

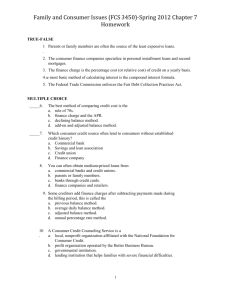

Chapter 16 Credit in America Lesson 16.1 What is Credit? Development of Credit A. Credit—money borrowed to buy something now, with the agreement to pay for it later B. Over 80 percent of all purchases in the U.S. are made with credit rather than cash C. In the Past 1. Need for credit arose when we moved from a bartering and trading society to a currency exchange economy 2. Early form of credit was the account at the general store—pay when received paycheck or harvested the crop 3. Economy grew as credit increased people’s ability to buy goods and services 4. Standard of living rose as people bought luxuries as well as necessities 5. In the 1990s, record numbers of people filed bankruptcy D. Credit Today 1. Credit today is a way of life 2. Credit trouble remains all too common as well II. The Vocabulary of Credit A. Borrower or debtor—person who uses credit B. Creditor—person or company who loans money or extends credit C. Creditors expect you to have capital— property you possess that is worth more than your debts D. Collateral—property pledged to assure repayment of a loan (car). If you do not repay the loan, the collateral can be repossessed— taken by creditor E. Principal—the amount borrowed, plus interest is called the balance due. Payments include both principal and interest. F. Finance charge—the total dollar amount of all interest and fees you pay for the use of credit G. Minimum payment—the least amount you may pay that month under your credit agreement H. All credit payments are due by a specific due date—usually 10 to 20 days from the date of the bill I. Late fee—the amount you are charged if you do not pay within the time allowed J. Installment agreement—for expensive purchases; you agree to make regular payments for a set period of time K. Secured loan—the goods you purchase with the loan serve as collateral III. Advantages and Disadvantages of Consumer Credit A. 1. 2. 3. 4. 5. Advantages of Credit Increases purchasing power Increases standard of living Provides source of emergency funds Is convenient Get better service, preferred status, discounts 6. Have better receipts (proof of purchase), more descriptive 7. Is safer than carrying cash B. Line of Credit—pre-established amount that can be borrowed on demand with no collateral C. Deferred Billing—service available to charge customers where purchases are billed until later (Oct purchase billed in Feb) E. Disadvantages of Credit 1. Costs more than paying cash 2. Ties up future income, can strain budget 3. Can lead to overspending Lesson 16.2 Types and Sources of Credit I. Kinds of Credit A. Open-ended credit (credit cards)— can be used over and over, as long as balance owed does not exceed limit 1. Open 30-day accounts— consumer promised to pay the full balance owed each month (American Express, Diner’s Club) 2. Revolving Credit Accounts—consumer has the option each month of paying in full or making at least the minimum payment (Visa, MasterCard, Discover, also dept store and gas cards (Macy’s, AE, BP) 3. Credit Card Terms a. Annual Percentage Rate (APR)—the cost of credit expressed as a yearly percentage. Truth-in-Lending law requires lenders to include all loan costs in the APR, must be disclosed when you open account and must be noted on each bill you receive. Can shop around. b. Free Period—(grace period) allows you to avoid interest charges by paying your current balance in full before the due date c. Annual fees—many credit card issuers charge an annual fee from $15--$35 or more. Pay it whether or not you use the card. d. Transaction Fees and Late Fees—pay by phone, go over limit, pay late e. Method of calculating the Finance Charge—can vary B. Closed-End Credit 1. 2. 3. A loan for a specific amount that must be repaid, in full, including all finance charges, by a stated due date Also called installment loan Contract tells amount loaned, total finance charge, amount of each payment. Usually a down payment is required. C. Service Credit 1. An agreement to have a service performed now and pay for it later. 2. Telephone, utility services, hospitals, doctors II. Sources of Credit A. Retail Stores—stores that sell directly to consumers (dept stores, restaurants, service businesses. Many offer their own credit cards. Credit customers may receive discounts, advance notice of sales, other privileges. Many also accept major credit cards. B. Credit Card Companies 1. Visa, MasterCard, American Express 2. Affinity Cards—issued by major credit card, sponsored by another organization 3. Cash advance—money borrowed against the credit card limit 4. Access checks—supplied by credit card company, can be used as a check, pay back like a cash advance C. Banks and Credit Unions 1. Make closed-end loans 2. Interest usually lower than credit cards D. Finance Companies 1. Usually charge high interest rates for the use of their money—willing to take risks with consumers with lower credit ratings 2. Consumer finance company—makes mostly consumer loans to customer buying consumer durables (cars, appliances, stereo) Household Finance, Beneficial Finance 3. Sales finance companies—makes loans through representatives (GMAC finances GM car) 4. Loan sharks—unlicensed lenders who charge illegally high interest 5. Usury laws—set maximum interest rates that may be charged for loans E. Pawnbroker—a legal business that makes high-interest loans based on the value of personal possessions pledged as collateral. If you do not pay back the loan and interest by a certain date, the pawnbroker will sell it. F. Private lenders—Parents, relative, friends, may or may not charge interest. G. Other Sources of Consumer Credit 1. Life Insurance Policies—borrow against cash value 2. Borrow against Certificate of Deposit The End!