FCS3450Chapter7Homework

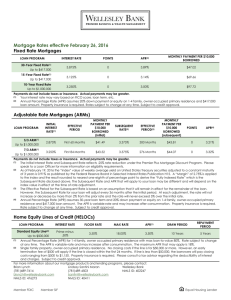

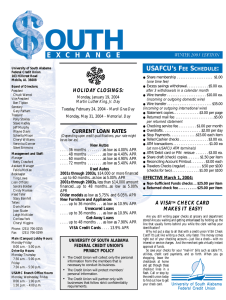

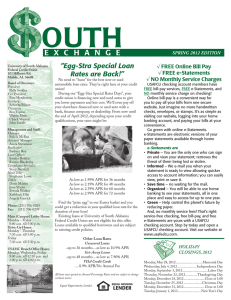

advertisement

Family and Consumer Issues (FCS 3450)-Spring 2012 Chapter 7 Homework TRUE-FALSE 1 Parents or family members are often the source of the least expensive loans. . 2. The consumer finance companies specialize in personal installment loans and second mortgages. 3. The finance charge is the percentage cost (or relative cost) of credit on a yearly basis. The 4. most basic method of calculating interest is the compound interest formula. 5. The Federal Trade Commission enforces the Fair Debt Collection Practices Act. MULTIPLE CHOICE _____6. The best method of comparing credit cost is the a. rule of 78s. b. finance charge and the APR. c. declining balance method. d. add-on and adjusted balance method. _____7. Which consumer credit source often lend to consumers without established credit history? a. Commercial bank b. Savings and loan association c. Credit union d. Finance company 8. You can often obtain medium-priced loans from a. commercial banks and credit unions. b. parents or family members. c. banks through credit cards. d. finance companies and retailers. 9. Some creditors add finance charges after subtracting payments made during the billing period, this is called the a. previous balance method. b. average daily balance method. c. adjusted balance method. d. annual percentage rate method. 10 . A Consumer Credit Counseling Service is a a. local, nonprofit organization affiliated with the National Foundation for Consumer Credit. b. profit organization operated by the Better Business Bureau. c. governmental institution. d. lending institution that helps families with severe financial difficulties. 1 Chapter 07 11. Dave borrowed $500 for one year and paid $50 in interest. The bank charged him a $5 service charge. What is the finance charge on this loan, in dollars? 12. In problem 11, Dave borrowed $500 on January 1, 2006, and paid it all back at once on December 31, 2006. What was the APR? 13. Dorothy lacks cash to pay for a $600 dishwasher. She could buy it from the store on credit by making 12 monthly payments of $52.74 each. The total cost would then be $632.88. Instead, Dorothy decides to deposit $50 a month in the bank until she has saved enough money to pay cash for the dishwasher. One year later, she has saved $642—$600 in deposits plus interest. When she goes back to the store, she finds that the dishwasher now costs $660. Its price has gone up 10 percent—the current rate of inflation. Was postponing her purchase a good trade-off for Dorothy? 14. Calculating Simple Interest on a Loan. Damon convinced his aunt to lend him $2,000 to purchase a plasma digital TV. She has agreed to charge only 6 % simple interest, and he has agreed to repay the loan at the end of one year. How much interest will he pay for the year? 2